-

L'Oreal shares sink as sales miss forecasts

L'Oreal shares sink as sales miss forecasts

-

Bangladesh nationalists celebrate landslide win, Islamists cry foul

-

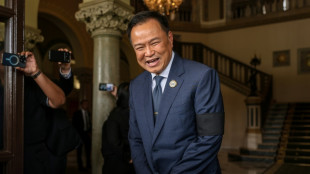

Thai PM agrees coalition with Thaksin-backed party

Thai PM agrees coalition with Thaksin-backed party

-

Zimbabwe pull off shock win over Australia at T20 World Cup

-

Merz, Macron to address first day of Munich security meet

Merz, Macron to address first day of Munich security meet

-

Three dead, many without power after storm lashes France and Spain

-

Bennett half-century as Zimbabwe make 169-2 against Australia

Bennett half-century as Zimbabwe make 169-2 against Australia

-

Asian stocks track Wall St down as traders rethink tech bets

-

'Weak by design' African Union gathers for summit

'Weak by design' African Union gathers for summit

-

Nigerian conservative city turns to online matchmaking for love

-

Serb-zero: the 'iceman' seeking solace in extreme cold

Serb-zero: the 'iceman' seeking solace in extreme cold

-

LeBron James nabs another NBA milestone with triple-double in Lakers win

-

Hundreds of thousands without power after storm lashes France

Hundreds of thousands without power after storm lashes France

-

US Congress impasse over migrant crackdown set to trigger partial shutdown

-

AI's bitter rivalry heads to Washington

AI's bitter rivalry heads to Washington

-

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

-

England seek statement Six Nations win away to Scotland

England seek statement Six Nations win away to Scotland

-

Trent return can help Arbeloa's Real Madrid move forward

-

Battling Bremen braced for Bayern onslaught

Battling Bremen braced for Bayern onslaught

-

Bangladesh nationalists claim big election win, Islamists cry foul

-

Tourists empty out of Cuba as US fuel blockade bites

Tourists empty out of Cuba as US fuel blockade bites

-

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

-

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

-

Oscars museum dives into world of Miyazaki's 'Ponyo'

-

Dieng powers Bucks over NBA champion Thunder

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

Bangladesh political heir Tarique Rahman poised for PM

-

Asian stocks track Wall St down but AI shift tempers losses

-

Bangladesh's BNP claim 'sweeping' election win

Bangladesh's BNP claim 'sweeping' election win

-

Drones, sirens, army posters: How four years of war changed a Russian city

-

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

Crowds flock to Istanbul's Museum of Innocence before TV adaptation

-

North Korea warns of 'terrible response' if South sends more drones

-

NASA crew set for flight to ISS

NASA crew set for flight to ISS

-

'Punk wellness': China's stressed youth mix traditional medicine and cocktails

-

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

Diplomacy, nukes and parades: what to watch at North Korea's next party congress

-

Arsenal, Man City eye trophy haul, Macclesfield more FA Cup 'miracles'

-

Dreaming of glory at Rio's carnival, far from elite parades

Dreaming of glory at Rio's carnival, far from elite parades

-

Bangladesh's BNP heading for 'sweeping' election win

-

Hisatsune grabs Pebble Beach lead with sparkling 62

Hisatsune grabs Pebble Beach lead with sparkling 62

-

Darrell Kelley and Business Partners to Visit Ghana for Humanitarian Engagement and Exploratory Discussions

-

The New Ariane 64 with 4 P120C Boosters Successfully Launches Amazon Leo Satellites

The New Ariane 64 with 4 P120C Boosters Successfully Launches Amazon Leo Satellites

-

What is IRA Eligible Gold? Complete Guide to IRA Approved Metals and Gold IRA Investing Released

-

CelLBxHealth PLC - Aligning Regulatory Approach with Commercial Needs

CelLBxHealth PLC - Aligning Regulatory Approach with Commercial Needs

-

Venezuela amnesty bill postponed amid row over application

-

Barca taught 'lesson' in Atletico drubbing: Flick

Barca taught 'lesson' in Atletico drubbing: Flick

-

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

N. Korea warns of 'terrible response' if more drone incursions from South

-

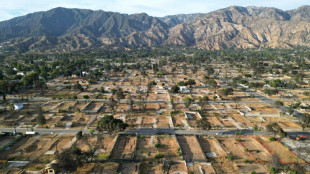

LA fires: California probes late warnings in Black neighborhoods

What is IRA Eligible Gold? Complete Guide to IRA Approved Metals and Gold IRA Investing Released

Seeing the rise in popularity of precious metals investments, IRAEmpire has published a new guide on IRA eligible gold to help consumers avoid confusions when it comes to buying gold in an IRA.

LOS ANGELES, CALIFORNIA / ACCESS Newswire / February 13, 2026 / Investing in gold through an Individual Retirement Account (IRA) has become one of the most popular ways to protect retirement savings from inflation, market volatility, and economic uncertainty. However, many new investors are surprised to learn that not all gold can be held inside a Gold IRA.

Overview of Best IRA Eligible Gold Providers 2026:

Michael Hunt, Senior Writer at IRAEmpire says, "The Internal Revenue Service (IRS) has strict rules about what types of precious metals are allowed in retirement accounts. Only specific coins, bars, and bullion products that meet exact purity and certification standards qualify as IRA eligible gold. Buying the wrong type of gold-even by mistake-can lead to tax penalties and disqualification of your IRA.

This is why understanding IRA eligibility rules is critical before making any precious metals purchase."

>>Find The Best Gold Investment Company of Your State Here.

What Does "IRA Eligible Gold" Mean?

The term IRA eligible gold refers to specific gold products that meet the legal requirements set by the IRS to be held inside a self-directed Individual Retirement Account.

Not every gold coin or bar qualifies. To be considered IRA eligible, a precious metal must satisfy strict rules related to purity, manufacturing standards, and storage.

The Role of the IRS in Gold IRAs

Gold IRAs are governed by federal tax law, specifically Internal Revenue Code Section 408(m). This section outlines which types of precious metals are allowed in retirement accounts and which are classified as prohibited "collectibles."

The IRS created these rules to ensure that:

Only high-quality bullion is used for retirement investing

Precious metals are standardized and easily valued

Investors don't misuse IRAs for personal collectibles

Assets are securely stored and properly tracked

As a result, only certain forms of gold can legally be purchased within an IRA.

Check Out the Best Gold Dealer in the US

IRA Eligible Gold vs Regular Gold Ownership

It's important to understand the difference between owning gold personally and owning gold inside an IRA.

You can personally buy almost any type of gold-jewelry, rare coins, collectibles, etc.

Inside an IRA, you can only hold gold that meets specific IRS criteria

For example:

A rare collectible gold coin may be valuable-but it is not IRA eligible

A 24-karat gold bar from an approved refiner may be IRA eligible

The same metal can be perfectly fine for personal investment yet completely ineligible for an IRA.

Why Eligibility Matters

If you purchase non-eligible gold inside an IRA-either intentionally or by accident-the IRS can treat it as a prohibited transaction.

This can result in:

Taxes on the entire IRA balance

Early withdrawal penalties

Disqualification of the account's tax-advantaged status

Understanding eligibility rules upfront helps you avoid these costly mistakes.

Core Requirements for IRA Eligible Gold

To qualify as IRA eligible, gold must generally meet three main conditions:

Purity standards set by the IRS

Production by an approved mint or refiner

Storage in an IRS-approved depository

If a gold product fails any one of these requirements, it cannot be legally held in a Gold IRA.

See the Top-Rated Companies that Sell IRA Eligible Gold

IRS Requirements for IRA Eligible Gold

To hold gold inside a retirement account, investors must follow strict guidelines established by the IRS. These rules determine exactly which precious metals qualify and how they must be handled.

Understanding these requirements is essential to keeping your Gold IRA fully compliant.

Minimum Purity Standards

The IRS sets clear purity thresholds that all precious metals must meet in order to be IRA eligible.

For gold to qualify, it must have a minimum fineness of:

99.5% pure gold (0.995 fineness)

This means that most modern bullion products are acceptable, while older, lower-purity coins and collectibles are not.

The IRS also defines purity standards for other metals commonly held in IRAs:

Silver: 99.9% purity (0.999)

Platinum: 99.95% purity (0.9995)

Palladium: 99.95% purity (0.9995)

If a coin or bar does not meet these purity levels, it cannot legally be included in a Gold IRA-no matter how valuable or popular it may be.

Approved Refiners and Mints

Purity alone is not enough. The IRS also requires that IRA eligible gold must be produced by an approved and accredited source.

Eligible products generally must come from:

Government mints (such as the U.S. Mint or Royal Canadian Mint)

Refineries accredited by recognized organizations

Manufacturers approved by COMEX or LBMA standards

This requirement ensures that all IRA metals are:

Properly authenticated

Professionally refined

Universally recognized

Easy to value and liquidate

Gold bars or coins from unknown, private, or uncertified sources are typically not eligible for IRA use.

Storage Requirements - No Home Storage Allowed

One of the most misunderstood IRS rules is the storage requirement.

Even if your gold meets all purity and mint standards, it must also be stored correctly.

The IRS mandates that:

IRA gold must be held by an approved custodian

Metals must be stored in an IRS-approved depository

Investors cannot personally hold or store IRA metals

This means you cannot keep IRA gold:

In your home

In a personal safe

In a bank safety deposit box

Under your direct possession

Attempting to store IRA metals yourself is considered a prohibited transaction and can invalidate your account's tax benefits.

Custodian Oversight Is Required

A self-directed IRA that holds precious metals must be managed by a qualified custodian or trustee.

The custodian is responsible for:

Purchasing metals on your behalf

Verifying eligibility

Arranging secure storage

Maintaining IRS-compliant records

This structure ensures that IRA metals remain separate from personal assets and fully compliant with federal law.

New Metals Only - No Personal Gold Allowed

Another key rule is that you cannot contribute gold you already own into an IRA.

All IRA metals must be:

Newly purchased through the IRA

Bought via an approved dealer

Delivered directly to the depository

Trying to move personal gold into an IRA is not permitted under IRS guidelines.

Work with the Top Gold IRA Company in the US

What Types of Gold Are IRA Eligible?

In general, IRA eligible gold falls into two main categories:

Approved gold coins

Approved gold bars and bullion

Only products that meet IRS purity and certification standards can be included.

Learn How to Consult a Gold IRA Expert

IRA Approved Gold Coins

Hunt shares, "Certain government-minted gold coins are specifically approved for use in self-directed IRAs. These coins are widely recognized, highly liquid, and fully compliant with IRS standards."

Some of the most popular IRA eligible gold coins include:

American Gold Buffalo coins - 24-karat gold, 99.99% pure

Canadian Gold Maple Leaf coins - 99.99% pure

Australian Gold Kangaroo/Nugget coins - 99.99% pure

Austrian Gold Philharmonic coins - 99.99% pure

British Gold Britannia coins - 99.99% pure

These coins meet all IRS requirements for purity, minting, and authenticity.

Special Case: American Gold Eagle Coins

The American Gold Eagle is a unique exception to the normal IRS purity rule.

Although Gold Eagles are only 91.67% pure (22-karat), the IRS specifically allows them in Gold IRAs due to their:

Government backing

Widespread recognition

Historical status

Established market value

This makes the American Gold Eagle one of the most commonly used coins in precious metals IRAs.

IRA Approved Gold Bars

In addition to coins, many gold bars and bullion products are also IRA eligible.

To qualify, gold bars must:

Be at least 99.5% pure

Be produced by an approved refiner

Include proper hallmarks and serial numbers

Be professionally assayed and certified

Common IRA eligible gold bar options include products from well-known refiners such as:

PAMP Suisse

Credit Suisse

Valcambi

Royal Canadian Mint

Perth Mint

Johnson Matthey

Common Gold Bar Sizes

IRA investors can choose from a variety of bar sizes depending on budget and investment strategy, including:

1 oz gold bars

10 oz gold bars

100 gram bars

1 kilo gold bars

All sizes are acceptable as long as they meet IRS purity and sourcing requirements.

Coins vs Bars - Which Is Better for an IRA?

Both coins and bars are fully acceptable for Gold IRAs, but they serve slightly different purposes.

Coins tend to be more liquid and easier to sell

Bars often carry lower premiums over spot price

Larger bars can be more cost-efficient

Coins provide more flexibility for partial liquidation

Most IRA investors choose a mix of both to balance liquidity and cost efficiency.

What Gold is NOT IRA Eligible?

While there are many types of gold that qualify for a self-directed IRA, an even larger number of gold products do not meet IRS requirements.

Hunt points out, "Understanding what is not allowed is just as important as knowing what is allowed. Many investors accidentally purchase ineligible metals because they assume "all gold is the same." For IRA purposes, that is not true."

Here are the main categories of gold that cannot be held in a Gold IRA.

Collectible and Numismatic Coins

One of the most common mistakes investors make is trying to place collectible or rare coins into an IRA.

The IRS specifically prohibits:

Rare coins

Graded coins

Limited edition coins

Proof coins (in most cases)

Historical or commemorative coins

Even if these coins contain a high percentage of gold, they are considered collectibles rather than investment-grade bullion-and collectibles are not allowed in IRAs.

For example:

A rare pre-1933 U.S. gold coin may be valuable

But it is not IRA eligible

Because it is classified as a collectible asset

Gold Jewelry

Gold jewelry, no matter how valuable, can never be placed inside a Gold IRA.

This includes:

Necklaces

Rings

Bracelets

Watches

Decorative gold items

Jewelry does not meet purity, certification, or standardization requirements and is always considered a prohibited asset for IRA purposes.

Gold That Does Not Meet Purity Standards

Any gold product that fails to meet the IRS minimum purity threshold of 99.5% (0.995 fineness) is automatically disqualified.

This rules out:

Many older gold coins

Low-karat bullion products

Non-standard gold bars

Certain foreign coins

The only major exception is the American Gold Eagle, which is specifically allowed despite lower purity.

Privately Minted or Uncertified Gold Bars

Gold bars that come from unknown, unaccredited, or private sources are typically not IRA eligible.

Ineligible examples include:

Unbranded gold bars

Homemade or custom-minted bars

Products without proper hallmarks

Metals lacking recognized certification

To qualify for an IRA, gold bars must be produced by approved refiners and come with verifiable authenticity.

Previously Owned Personal Gold

Many investors assume they can simply transfer gold they already own into a new IRA. Unfortunately, this is not allowed.

You cannot place into an IRA:

Gold coins you already purchased personally

Bars stored at home

Metals held in a personal safe

Family heirloom gold

All IRA metals must be newly purchased through the IRA custodian and delivered directly to an approved depository.

Home Storage Gold

Even if your gold meets every purity and mint requirement, it becomes ineligible the moment you attempt to store it yourself.

The IRS prohibits:

Keeping IRA gold at home

Storing it in a personal safe

Using a personal bank deposit box

Any attempt at "home storage IRA gold" is considered a prohibited transaction and can invalidate your account.

Why These Restrictions Exist

The IRS created these rules to ensure that IRA precious metals are:

Standardized

Easily valued

Highly liquid

Properly secured

Used strictly for investment purposes

Allowing collectibles, jewelry, or personal storage would undermine these goals and create tax loopholes.

IRA Eligible Silver, Platinum, and Palladium

Although Gold IRAs are the most popular type of precious metals IRA, the IRS also allows investors to hold silver, platinum, and palladium inside a self-directed retirement account.

Each of these metals has its own eligibility standards, but the rules follow the same basic principles as gold: strict purity requirements, approved mints, and proper custodial storage.

Check Out the Top Gold and Silver IRA Companies of the US

IRA Eligible Silver

Silver is the second most commonly held metal in precious metals IRAs.

To qualify as IRA eligible, silver must meet the following requirement:

Minimum purity of 99.9% (0.999 fineness)

Only high-quality bullion products that meet this standard can be included.

Common IRA approved silver options include:

American Silver Eagle coins

Canadian Silver Maple Leaf coins

Australian Silver Kangaroo coins

Austrian Silver Philharmonic coins

Silver bars from approved refiners such as PAMP Suisse, Royal Canadian Mint, and Perth Mint

Just like with gold, collectible silver coins, jewelry, and uncertified products are not allowed.

IRA Eligible Platinum

Platinum is another IRS-approved precious metal that can add diversification to a retirement portfolio.

The eligibility requirements for platinum are stricter than gold and silver:

Minimum purity of 99.95% (0.9995 fineness)

Approved platinum products include:

American Platinum Eagle coins

Canadian Platinum Maple Leaf coins

Platinum bars from recognized refiners

Platinum IRAs are popular with investors who want exposure to industrial metals in addition to precious metals.

IRA Eligible Palladium

Palladium is less common but fully permitted in precious metals IRAs.

To qualify, palladium must meet the same purity standard as platinum:

99.95% purity (0.9995 fineness)

IRA eligible palladium products typically include:

Canadian Palladium Maple Leaf coins

Bars from LBMA or COMEX approved refiners

Because palladium markets are smaller, not all custodians offer palladium IRA options-but it remains a fully legitimate choice.

The Same Rules Apply to All Metals

Whether you invest in gold, silver, platinum, or palladium, the IRS requirements remain consistent:

The metal must meet minimum purity standards

It must come from an approved source

It must be held by an IRS-approved custodian

It must be stored in an approved depository

Personal possession is never allowed

Failing any of these conditions makes the metal ineligible for IRA ownership.

Benefits of Holding Multiple Metals

Many investors choose to hold a mix of metals inside their IRA for diversification, such as:

Gold for stability and wealth preservation

Silver for affordability and growth potential

Platinum and palladium for industrial demand exposure

A properly diversified precious metals IRA can help reduce risk and provide broader protection against economic uncertainty.

How to Buy IRA Eligible Gold - Step by Step

Knowing which metals are IRA eligible is only half the process. The next important step is understanding how to actually purchase IRA approved gold the right way.

Buying precious metals for an IRA is different from buying gold for personal ownership. To stay compliant with IRS rules, you must follow a specific procedure.

Here is the correct, step-by-step process.

Step 1: Open a Self-Directed Gold IRA

A traditional IRA cannot hold physical precious metals. To invest in IRA eligible gold, you must first open a self-directed IRA with a qualified custodian.

This specialized account allows you to hold alternative assets such as:

Physical gold

Silver

Platinum

Palladium

Without a self-directed IRA, you cannot legally purchase precious metals for retirement purposes.

Learn About the Best Gold IRA Company of USA

Step 2: Choose an IRS-Approved Custodian

The IRS requires that all precious metals IRAs be managed by an approved custodian or trustee.

Your custodian will handle:

Account setup

Paperwork and compliance

Purchasing metals on your behalf

Arranging secure storage

You cannot buy IRA metals directly yourself-the custodian must facilitate the transaction.

Step 3: Fund Your Gold IRA

Once your account is open, you need to add money to it. There are three main ways to do this:

Transfer funds from an existing IRA

Roll over a 401(k) or other retirement account

Make a direct cash contribution

Most investors choose a rollover or transfer so they can move existing retirement savings into gold without taxes or penalties.

Step 4: Select an Approved Precious Metals Dealer

Next, you will choose a reputable precious metals dealer that works with Gold IRAs.

A good dealer will help you:

Understand which products are IRA eligible

Compare coins and bars

Lock in pricing

Coordinate directly with your custodian

It's important to work only with established dealers who specialize in IRA-approved metals.

Step 5: Purchase IRA Eligible Metals

After selecting your products, the purchase is completed through your custodian.

The process works like this:

You choose the metals

The dealer sends an invoice to your custodian

The custodian pays the dealer using IRA funds

The metals are shipped directly to an approved depository

At no point do you personally take possession of the gold.

Step 6: Store Metals in an Approved Depository

IRS rules require that all IRA precious metals be stored in a secure, approved storage facility.

Your custodian will arrange:

Fully insured storage

Segregated or non-segregated vault options

Ongoing account statements

Compliance reporting

This storage requirement is essential for maintaining the tax-advantaged status of your IRA.

Step 7: Manage and Monitor Your Investment

After the purchase is complete, you can:

Buy additional metals over time

Sell metals within the IRA

Take distributions in retirement

Continue to diversify your holdings

Your custodian and dealer can assist with ongoing account management.

Find the Best Gold IRA Company of Your State

Common Mistakes to Avoid When Buying IRA Eligible Gold

Investing in a Gold IRA can be a powerful way to protect your retirement savings-but only if it's done correctly. Many first-time investors make avoidable mistakes that can lead to penalties, higher costs, or even disqualification of their IRA.

Understanding these common pitfalls will help you stay compliant and make smarter decisions.

Buying Non-Eligible Coins or Collectibles

One of the most frequent errors is purchasing gold that does not meet IRS eligibility standards.

Examples include:

Rare or collectible coins

Proof coins

Graded coins

Numismatic products

Even if these items are valuable, they are classified as collectibles and cannot be held in an IRA. Always confirm that any coin or bar is specifically labeled as IRA eligible before purchasing.

Attempting Home Storage

Some investors believe they can store IRA gold at home in a safe or safety deposit box. This is not allowed.

Home storage of IRA metals is considered a prohibited transaction and can result in:

Immediate taxes on the entire account

Early withdrawal penalties

Loss of IRA tax advantages

All IRA gold must be stored in an IRS-approved depository through a qualified custodian.

Using the Wrong Dealer

Not all precious metals dealers understand IRA rules. Buying from an inexperienced or untrustworthy dealer can lead to:

Purchase of ineligible metals

Overpriced products

Improper documentation

Delays in funding and storage

Always work with established dealers who specialize in Gold IRAs and coordinate directly with custodians.

Trying to Add Gold You Already Own

Another common misconception is that you can transfer personal gold into a new IRA.

This is not permitted. The IRS requires that:

All IRA metals be newly purchased

Transactions occur through the custodian

Metals be shipped directly to an approved depository

Personal gold holdings cannot be "contributed" to an IRA under any circumstances.

Ignoring Purity Requirements

Some investors assume that any gold bar or coin is acceptable. In reality, most products must meet a minimum purity of 99.5% to qualify.

Buying lower-purity items-even accidentally-can create serious compliance problems.

Choosing High-Premium Products

Even when a product is IRA eligible, it may not be a smart investment.

Many first-time buyers pay excessive premiums for:

Limited edition coins

Specialty products

Heavily marketed items

High premiums reduce potential returns. It's usually better to focus on widely recognized bullion coins and bars with reasonable markups.

Mixing Personal and IRA Metals

Your IRA metals must remain completely separate from any personal precious metals you own.

Never:

Store them together

Move them between accounts

Treat IRA metals as personal property

Clear separation is essential for IRS compliance.

Overlooking Fees and Costs

A Gold IRA involves more than just the price of the metal. Investors sometimes forget to account for:

Custodian fees

Storage fees

Dealer markups

Transaction costs

Understanding the full cost structure helps you avoid unpleasant surprises.

Skipping Professional Guidance

Trying to navigate Gold IRA rules alone can be confusing. Many mistakes happen because investors don't seek proper help.

Working with experienced:

Custodians

Precious metals dealers

Financial advisors

can save you time, money, and compliance headaches.

About IRAEmpire.com

IRAEmpire.com provides unbiased research, rankings, and educational resources to help Americans make informed decisions about Gold IRAs, precious metals, and retirement planning. Our mission is to offer transparent, data-driven guidance so investors can confidently protect and diversify their wealth with trusted gold investment companies across the United States.

CONTACT:

Ryan Paulson

[email protected]

SOURCE: IRAEmpire LLC

View the original press release on ACCESS Newswire

Th.Gonzalez--AT