-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

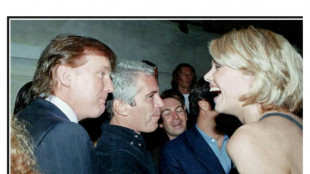

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Ondas Holdings Inc. Announces Proposed Public Offering of Common Stock

BOSTON, MA / ACCESS Newswire / August 12, 2025 / Ondas Holdings Inc. (NASDAQ:ONDS) ("Ondas" or the "Company"), a leading provider of private industrial wireless networks and commercial drone and automated data solutions through its Ondas Networks and Ondas Autonomous Systems business units, today announced that it intends to offer and sell shares of its common stock. Ondas also expects to grant the underwriters a 30-day option to purchase additional shares of common stock offered in the public offering. All of the shares in the proposed offering are to be sold by Ondas. The offering is subject to market conditions, and there can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering. Ondas intends to use the net proceeds from the proposed offering for working capital, general corporate purposes and potential strategic transactions, including acquisitions of businesses or assets, joint ventures or investments in businesses, products or technologies.

Oppenheimer & Co. Inc. is acting as the sole book-running manager. Northland Capital Markets is acting as the lead manager for the offering. Ladenburg Thalmann & Co. Inc. and Lake Street Capital Markets, LLC are acting as co-managers for the offering.

A shelf registration statement on Form S-3 (File No. 333-286642) relating to the shares to be issued in the proposed offering was filed with the Securities and Exchange Commission ("SEC") on April 18, 2025, and was declared effective on April 25, 2025. A preliminary prospectus supplement and accompanying prospectus describing the terms of the proposed offering will be filed with the SEC. The shares may be offered only by means of a prospectus, including a prospectus supplement, forming a part of the effective registration statement. Copies of the preliminary prospectus supplement and the accompanying prospectus relating to the shares being offered may also be obtained from Oppenheimer & Co. Inc. Attention: Syndicate Prospectus Department, 85 Broad Street, 26th Floor, New York, NY 10004, or by telephone at (212) 667-8055, or by email at [email protected]. Electronic copies of the preliminary prospectus supplement and accompanying prospectus will also be available on the SEC's website at http://www.sec.gov. The final terms of the offering will be disclosed in a final prospectus supplement to be filed with the SEC.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy, the shares, nor will there be any sale of the shares in any state or other jurisdiction in which such offer, solicitation or sale is not permitted.

Forward-Looking Statements

Statements made in this release that are not statements of historical or current facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the completion and anticipated use of proceeds of the proposed offering. We caution readers that forward-looking statements are predictions based on our current expectations about future events. These forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. These risks and uncertainties relate, among other things, to fluctuations in our stock price, changes in market conditions and satisfaction of customary closing conditions related to the proposed public offering. Our actual results, performance, or achievements, including our ability to conduct and complete a public offering of our common stock on terms acceptable to us or at all, could differ materially from those expressed or implied by the forward-looking statements as a result of a number of factors, including the risks discussed under the heading "Risk Factors" discussed under the caption "Item 1A. Risk Factors" in Part I of our most recent Annual Report on Form 10-K or any updates discussed under the caption "Item 1A. Risk Factors" in Part II of our Quarterly Reports on Form 10-Q and in our other filings with the SEC. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise that occur after that date, except as required by law.

Contacts

IR Contact for Ondas Holdings Inc.

888.350.9994

[email protected]

Media Contact for Ondas

Escalate PR

[email protected]

Preston Grimes

Marketing Manager, Ondas Holdings Inc.

[email protected]

SOURCE: Ondas Holdings Inc.

View the original press release on ACCESS Newswire

F.Ramirez--AT