-

Koepka leaves LIV Golf: official

Koepka leaves LIV Golf: official

-

US slams China policies on chips but will delay tariffs to 2027

-

Arsenal reach League Cup semis with shoot-out win over Palace

Arsenal reach League Cup semis with shoot-out win over Palace

-

Contenders Senegal, Nigeria start Cup of Nations campaigns with wins

-

Tunisia ease past Uganda to win Cup of Nations opener

Tunisia ease past Uganda to win Cup of Nations opener

-

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

-

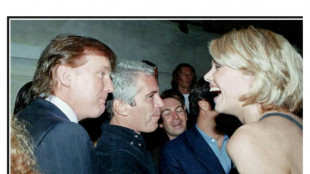

Trump in Epstein files: five takeaways from latest release

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

S&P 500 surges to record after strong US economic report

The S&P 500 powered to a fresh record Tuesday following data showing surprisingly robust third-quarter US economic growth as markets hope for a year-end "Santa Claus Rally."

All three major Wall Street indices advanced, shaking off early choppiness after the strong US gross domestic product report sparked talk that the Federal Reserve could refrain from further interest rate cuts.

"The GDP number was unambiguously good and eventually markets come around to the realization that good news is good news," said Art Hogan of B. Riley Wealth Management.

"Unfortunately, the knee-jerk reaction was: 'If the economy is that strong, does the Fed need to cut anymore?'" said Hogan. "Luckily today, we shed that thought process."

US GDP came in at 4.3 percent, the highest reading in two years, easily topping expectations for 3.2 percent growth.

Heather Long, chief economist at the Navy Federal Credit Union, wrote that the report shows the resiliency of US consumers, boding "well for 2026."

"If the economy can avoid widespread layoffs, most American consumers can keep spending," she said.

The S&P 500 finished up 0.5 percent at 6,909.79, narrowly topping a record set earlier this month.

Separate data showed US consumer confidence fell in December, as a slowing job market offset better sentiment after the government shutdown ended, according to a Conference Board survey.

eToro investment analyst Bret Kenwell noted the headline figure has now declined for five straight months, and the component showing the confidence of consumers in their present situation is at its lowest since February 2021.

"Simply put, despite solid GDP figures and a stock market at record highs, consumers are feeling some anxiety," he said.

Gold jumped to a high above $4,497 per ounce, while silver surged above $70 an ounce, with the US blockade against Venezuela and the Ukraine conflict adding support.

Copper, which is used in electric vehicle batteries and solar panels, hit a record price of $12,159.50 per ton.

"Silver and above all copper are benefitting from structural support from the energy transition, electrification the colossal needs for digital infrastructure and artificial intelligence," said John Plassard, an analyst at Cite Gestion Private Bank.

Europe's main stock markets ended mixed.

"European stock markets appear to have entered a period of consolidation as we head into the final trading days of 2025," said Joshua Mahony, chief market analyst at Scope Markets.

"With the Santa rally period traditionally taking place over the final five days of the year, investors will be hoping that the bulls are gathering momentum for a final push tomorrow onwards," he added.

Asian markets enjoyed a bright start, although some stuttered as the day wore on.

On currency markets, the yen extended gains after Japan's Finance Minister Satsuki Katayama flagged authorities' powers to step in to support the unit, citing speculative moves in markets.

The yen suffered heavy selling after Bank of Japan boss Kazuo Ueda held off signaling another rate hike anytime soon following last week's increase.

In company news, shares in Danish pharmaceutical giant Novo Nordisk jumped more than eight percent after the US approved its popular GLP-1 anti-obesity drug Wegovy to be administered in pill form for weight loss.

- Key figures at around 2115 GMT -

New York - Dow: UP 0.2 percent at 48,442.41 (close)

New York - S&P 500: UP 0.5 percent at 6,909.79 (close)

New York - Nasdaq Composite: UP 0.6 percent at 23,561.84 (close)

London - FTSE 100: UP 0.2 at 9,889.22 (close)

Paris - CAC 40: DOWN 0.2 percent at 8,103.85 (close)

Frankfurt - DAX: UP 0.2 percent at 24,340.06 (close)

Tokyo - Nikkei 225: FLAT at 50,412.87 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 25,774.14 (close)

Shanghai - Composite: UP 0.1 percent at 3,919.98 (close)

Dollar/yen: DOWN at 156.27 yen from 157.05 yen on Monday

Euro/dollar: UP $1.1791 from $1.1762

Pound/dollar: UP at $1.3499 from $1.3461

Euro/pound: DOWN at 87.34 pence from 87.37 pence

West Texas Intermediate: UP 0.6 percent at $58.38 per barrel

Brent North Sea Crude: UP 0.5 percent at $62.38 per barrel

burs-rl/rmb/jgc

T.Perez--AT