-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

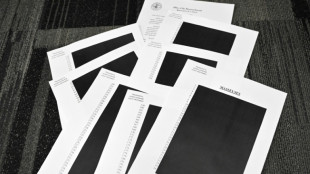

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Laser Photonics Reports Q3 2025 Revenue Growth of 28% Year-Over-Year

-

BeMetals Announces Settlement of All Outstanding Debt

BeMetals Announces Settlement of All Outstanding Debt

-

Who Does the Best Mommy Makeover in Bellevue?

-

Zenwork Joins CERCA to Support IRS Modernization and Strengthen National Information Reporting Infrastructure

Zenwork Joins CERCA to Support IRS Modernization and Strengthen National Information Reporting Infrastructure

-

Cellbxhealth PLC Announces Holding(s) in Company

-

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

Top Gold IRA Companies 2026 Ranked (Augusta Precious Metals, Lear Capital and More Reviewed)

-

Karviva Announces Launch of Energy and ACE Collagen Juices at Gelson's Stores This December

-

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

MindMaze Therapeutics: Consolidating a Global Approach to Reimbursement for Next-Generation Therapeutics

-

Decentralized Masters Announced as the Best Crypto Course of 2025 (Courses on Cryptocurrency Ranked)

-

Trump says would be 'smart' for Venezuela's Maduro to step down

Trump says would be 'smart' for Venezuela's Maduro to step down

-

Steelers' Metcalf suspended two games over fan outburst

-

Salah, Foster take Egypt and South Africa to AFCON Group B summit

Salah, Foster take Egypt and South Africa to AFCON Group B summit

-

Napoli beat Bologna to lift Italian Super Cup

-

Salah snatches added-time winner for Egypt after Zimbabwe scare

Salah snatches added-time winner for Egypt after Zimbabwe scare

-

Penalty king Jimenez strikes for Fulham to sink Forest

Stocks steady as rate cut hopes bring Christmas cheer

Stock markets steadied on Tuesday, while gold and silver hit fresh records as optimism for US rate cuts helped investors ease into the festive break.

Equities have been buoyed in recent weeks by expectations the Federal Reserve would lower borrowing costs further in 2026, with data showing US unemployment rising and inflation easing.

Investors will look to delayed US gross domestic product figures and consumer sentiment data on Tuesday for further Fed signals.

Precious metals pushed higher on the back of expectations for more US rate cuts, which makes them more attractive to investors.

Gold jumped to a high above $4,497 per ounce, while silver was just short of $70 an ounce, with the US blockade against Venezuela and the Ukraine conflict adding support.

London and Frankfurt stock markets edged up, while Paris dipped.

"European stock markets appear to have entered a period of consolidation as we head into the final trading days of 2025," said Joshua Mahony, chief market analyst at Scope Markets.

"With the Santa rally period traditionally taking place over the final five days of the year, investors will be hoping that the bulls are gathering momentum for a final push tomorrow onwards," he added.

Asian markets enjoyed a bright start, although some stuttered as the day wore on.

Shanghai was higher, while Hong Kong dipped and Tokyo closed flat.

With few catalysts to drive gains on Wall Street, tech was again at the forefront of buying on Monday, with chip titan Nvidia and Tesla leading the way.

The tech sector has driven many global markets to all-time highs this year on huge AI investment, though the trade has been questioned in recent months, sparking fears of a bubble.

A blockbuster earnings report from Micron Technologies last week has helped reinvigorate tech firms.

On currency markets, the yen extended gains after Japan's Finance Minister Satsuki Katayama flagged authorities' powers to step in to support the unit, citing speculative moves in markets.

The yen suffered heavy selling after Bank of Japan boss Kazuo Ueda held off signalling another rate hike anytime soon following last week's increase.

Oil prices edged up, having jumped more than two percent Monday on concerns about Washington's measures against Caracas.

The United States has taken control of two oil tankers and is chasing a third, after President Donald Trump last week ordered a blockade of "sanctioned" tankers heading to and leaving Venezuela.

In company news, shares in Danish pharmaceutical giant Novo Nordisk jumped seven percent after the US approved its popular GLP-1 anti-obesity drug Wegovy to be administered in pill form for weight loss.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 0.1 percent at 9,872.23 points

Paris - CAC 40: DOWN 0.2 percent at 8,108.57

Frankfurt - DAX: UP 0.1 percent at 24,315.08

Tokyo - Nikkei 225: FLAT at 50,412.87 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 25,774.14 (close)

Shanghai - Composite: UP 0.1 percent at 3,919.98 (close)

New York - Dow: UP 0.5 percent at 48,362.68 (close)

Dollar/yen: DOWN at 156.00 yen from 156.99 yen on Monday

Euro/dollar: UP at $1.1795 from $1.1756

Pound/dollar: UP at $1.3501 from $1.3458

Euro/pound: UP at 87.36 pence from 87.35 pence

West Texas Intermediate: UP 0.1 percent at $58.06 per barrel

Brent North Sea Crude: UP 0.1 percent at $62.13 per barrel

E.Hall--AT