-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

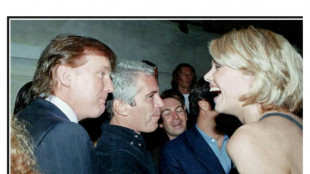

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Kultura Brands Exceeds Original 5.0 Billion Share Retirement Goal, Significantly Reduces Preferred H Overhang

-

EVCS Appoints Eric Danner as Chief Executive Officer; Gustavo Occhiuzzo Named Executive Chairman & Chief Strategy Officer

EVCS Appoints Eric Danner as Chief Executive Officer; Gustavo Occhiuzzo Named Executive Chairman & Chief Strategy Officer

-

BCII Enterprises Appoints Emmy Award-Winning Media Strategist and Former White House Advisor Evan "Thor" Torrens as Strategic Advisor

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

| RIO | 1.05% | 80.95 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| CMSC | 0.25% | 23.195 | $ | |

| NGG | 0.99% | 77.175 | $ | |

| BTI | 0.31% | 56.945 | $ | |

| BCE | -0.08% | 22.711 | $ | |

| RBGPF | 0% | 80.22 | $ | |

| CMSD | -0.35% | 23.12 | $ | |

| RYCEF | 0.19% | 15.53 | $ | |

| GSK | 0.6% | 48.885 | $ | |

| BP | 1.11% | 34.522 | $ | |

| RELX | -0.21% | 40.895 | $ | |

| BCC | -1.23% | 73.33 | $ | |

| AZN | 0.95% | 92.425 | $ | |

| VOD | 1.34% | 13.055 | $ | |

| JRI | 0.35% | 13.417 | $ |

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

BOCA RATON, FL / ACCESS Newswire / December 23, 2025 / For years, growth in ESG and compliance technology was driven by ambition. Platforms expanded feature sets, stacked partnerships, and narrated future potential. That era is closing. Today, the market is rewarding something far less theatrical and far more durable: execution that holds up under scrutiny.

That shift frames the latest strategic update from Diginex Limited (NASDAQ:DGNX). The company outlined progress on its forward-looking acquisition roadmap with a message that is increasingly resonant across capital markets: growth will continue, but not at the expense of balance-sheet integrity or shareholder discipline.

How a company finances its expansion now signals just as much as what it plans to build.

Structuring Growth for the Market That Exists Today

At the center of Diginex's Tuesday update is its continued engagement with Resulticks Global Companies Pte Limited, a global data and analytics platform serving enterprise customers across regulated industries. The parties remain in active and constructive dialogue, with final terms agreed and definitive transaction documents now being updated by counsel.

What stands out is not just the strategic rationale, but the structure. Diginex anticipates that closing the cash consideration component of the transaction will be conditional upon securing a solely debt-based acquisition financing facility, explicitly avoiding additional equity dilution. Discussions with multiple debt providers are ongoing, and the company expects to provide an update on finalized documentation, including the financing facility, within approximately 30 days.

That approach is not accidental. It reflects an understanding of where the market is drawing lines. Investors are no longer rewarding growth at any cost. They are rewarding companies that can expand while preserving ownership integrity and long-term flexibility.

Why This Combination Makes Strategic Sense

Resulticks operates in the arena where data intelligence, customer engagement, and governance increasingly intersect. As regulatory expectations tighten around data use, privacy, and accountability, enterprises are being forced to reconcile performance with compliance. Systems that can do both are becoming core infrastructure.

For Diginex, the potential combination reinforces its broader thesis: compliance platforms are evolving beyond reporting tools. They are becoming embedded operating systems that inform decisions, manage risk, and stand up to regulatory review. The value lies not in presentation, but in defensibility.

At the same time, Diginex has been explicit that while it is hopeful of concluding the transaction, there can be no assurance that a definitive agreement will be executed or that the transaction will ultimately close. That transparency matters. It signals process over pressure and reinforces that selectivity, not speed, is guiding execution.

A Company Acting Like Infrastructure

The larger signal from this update is about posture. Diginex is behaving less like a speculative consolidator and more like infrastructure that expects to be scrutinized, audited, and relied upon. That means disciplined capital decisions, clean integration logic, and restraint when conditions are not aligned.

As ESG and compliance move deeper into enforcement, the market will continue to separate narrative from substance. Companies that build for permanence, not headlines, will occupy the center of that transition.

Diginex is making it clear where it intends to stand.

About Diginex

Diginex is a sustainability data company that helps organizations collect, manage, verify, and report ESG and impact data. Its solutions enable companies to comply with global regulations, improve supply chain transparency, and accelerate decarbonization efforts. Diginex combines technology, data science, and reporting expertise to create tools that make sustainability measurable, verifiable, and actionable.

Forward-Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company's current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can identify these forward-looking statements by words or phrases such as "approximates," "believes," "hopes," "expects," "anticipates," "estimates," "projects," "intends," "plans," "will," "would," "should," "could," "may" or other similar expressions. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results disclosed in the Company's filings with the SEC.

Media contact for this content: [email protected]

SOURCE: Diginex Limited

View the original press release on ACCESS Newswire

M.Robinson--AT