-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

-

Eurovision 2026 will feature 35 countries: organisers

Eurovision 2026 will feature 35 countries: organisers

-

Cambodia says Thailand bombs province home to Angkor temples

-

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

US-Ukrainian talks resume in Berlin with territorial stakes unresolved

-

Small firms join charge to boost Europe's weapon supplies

-

Driver behind Liverpool football parade 'horror' warned of long jail term

Driver behind Liverpool football parade 'horror' warned of long jail term

-

German shipyard, rescued by the state, gets mega deal

-

Flash flood kills dozens in Morocco town

Flash flood kills dozens in Morocco town

-

'We are angry': Louvre Museum closed as workers strike

-

Australia to toughen gun laws as it mourns deadly Bondi attack

Australia to toughen gun laws as it mourns deadly Bondi attack

-

Stocks diverge ahead of central bank calls, US data

-

Wales captain Morgan to join Gloucester

Wales captain Morgan to join Gloucester

-

UK pop star Cliff Richard reveals prostate cancer treatment

-

Mariah Carey to headline Winter Olympics opening ceremony

Mariah Carey to headline Winter Olympics opening ceremony

-

Indonesia to revoke 22 forestry permits after deadly floods

-

Louvre Museum closed as workers strike

Louvre Museum closed as workers strike

-

Spain fines Airbnb 64 mn euros for posting banned properties

-

Japan's only two pandas to be sent back to China

Japan's only two pandas to be sent back to China

-

Zelensky, US envoys to push on with Ukraine talks in Berlin

-

Australia to toughen gun laws after deadly Bondi shootings

Australia to toughen gun laws after deadly Bondi shootings

-

Lyon poised to bounce back after surprise Brisbane omission

-

Australia defends record on antisemitism after Bondi Beach attack

Australia defends record on antisemitism after Bondi Beach attack

-

US police probe deaths of director Rob Reiner, wife as 'apparent homicide'

-

'Terrified' Sydney man misidentified as Bondi shooter

'Terrified' Sydney man misidentified as Bondi shooter

-

Cambodia says Thai air strikes hit home province of heritage temples

-

EU-Mercosur trade deal faces bumpy ride to finish line

EU-Mercosur trade deal faces bumpy ride to finish line

-

Inside the mind of Tolkien illustrator John Howe

-

Mbeumo faces double Cameroon challenge at AFCON

Mbeumo faces double Cameroon challenge at AFCON

-

Tongue replaces Atkinson in only England change for third Ashes Test

-

England's Brook vows to rein it in after 'shocking' Ashes shots

England's Brook vows to rein it in after 'shocking' Ashes shots

-

Bondi Beach gunmen had possible Islamic State links, says ABC

| SCS | 0.12% | 16.14 | $ | |

| CMSC | -0.04% | 23.291 | $ | |

| RBGPF | -4.49% | 77.68 | $ | |

| RIO | -0.23% | 75.485 | $ | |

| RYCEF | 2.01% | 14.9 | $ | |

| VOD | 1.18% | 12.74 | $ | |

| NGG | 0.93% | 75.63 | $ | |

| BTI | 0.69% | 57.495 | $ | |

| GSK | 0.59% | 49.1 | $ | |

| BCE | 1.07% | 23.6465 | $ | |

| CMSD | 0.21% | 23.3 | $ | |

| RELX | 1.76% | 41.103 | $ | |

| BP | -0.54% | 35.07 | $ | |

| AZN | 1.51% | 91.21 | $ | |

| JRI | 0.1% | 13.58 | $ | |

| BCC | -1.84% | 75.125 | $ |

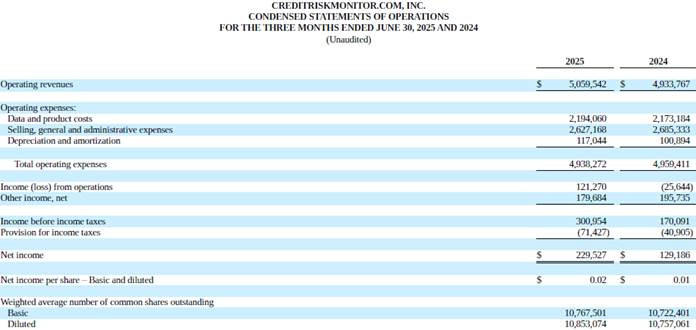

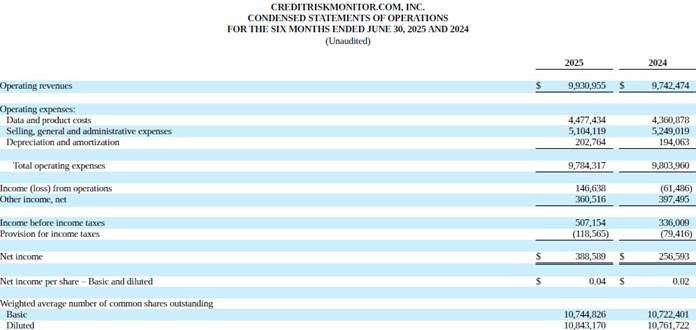

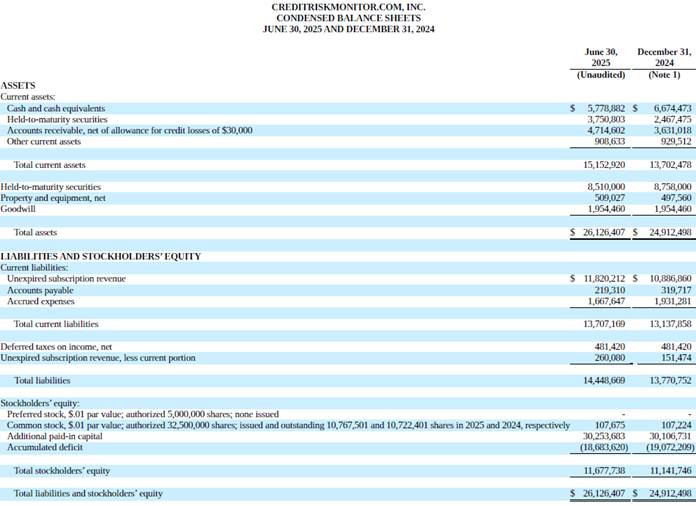

CreditRiskMonitor Announces Second Quarter Results

TARRYTOWN, NY / ACCESS Newswire / August 6, 2025 / CreditRiskMonitor.com, Inc. (OTCQX:CRMZ) reported operating revenues of $5.1 million, an increase of approximately $126 thousand or 3%, for the second quarter of fiscal 2025 compared to the same period of fiscal 2024. The Company reported pre-tax income of approximately $301 thousand, an increase of approximately $131 thousand or 77%, for the second quarter of fiscal 2025 compared to the same period of fiscal 2024. The increase in pre-tax profitability was primarily driven by a decrease in expenses related to employee salaries, employee benefits, and commissions. The Company reported net income of approximately $230 thousand, an increase of approximately $100 thousand or 78%, for the second quarter of fiscal 2025 compared to the same period of fiscal 2024.

Mike Flum, CEO, said, "The second quarter was dynamic for us as we geared up to launch our revamped Client Services model and new Customer Relationship Management ("CRM") platform for Q3. Subscribers now have a support team that includes client success and sales representatives, following more systematic processes with enhanced tracking focused on driving value creation for clients. Customer service is paramount to our success and is consistently mentioned as one of our distinctions when compared to our competition. These changes should improve customer satisfaction while also promoting increases in gross and net revenue retention. The new CRM also unites our marketing and revenue teams on a single platform that should improve transparency and accountability at all levels of the Go-To-Market effort. While these modifications pose some risk to our short-term performance while the teams assimilate to the new systems, they will support far greater efficiency and performance in the long term.

We're also very excited about some upcoming feature releases later this year, including our new Financial Analyst Strength Test or FAST Rating, an update to the FRISK® Score, enhanced industry norms benchmarking, and more. The Company is also working on some interesting conversational AI use cases, which may start rolling out into beta testing as well.

On the macroeconomic front, we continue to see increasing bankruptcy rates across all market size segments, with some notable recent bankruptcies in the over $1 billion liability filers, including Wolfspeed Inc., Del Monte Foods Inc., At Home Group Inc., and Everstream Solutions LLC, to name a few. Recent economic reporting for the U.S. market also points toward increasing recession risks, with nonresidential business investment contributing only 0.27% to Q2 U.S. GDP and the July jobs data calling the labor market's resiliency in the face of tariffs into question. All of these conditions increase demand for our services and we started to see some of our pending deals close in Q2 as businesses moved out of the 'wait & see' strategy that dominated the prior 2 quarters."

A full copy of the financial statements can be found at https://crmz.ir.edgar-online.com/

Overview

CreditRiskMonitor.com, Inc. (creditriskmonitor.com) sells a suite of web-based, SaaS subscription products providing access to comprehensive commercial credit reports, bankruptcy risk analytics, financial and payment information, and curated news on public and private companies worldwide. Our primary SaaS subscription products for analyzing commercial financial risk are CreditRiskMonitor® and SupplyChainMonitor™. These products help corporate credit and procurement professionals stay ahead of and manage financial risk more quickly, accurately, and cost-effectively. Our subscribers include nearly 40% of the Fortune 1000 and well over a thousand other large corporations worldwide.

To help subscribers prioritize and monitor counterparty financial risk, our SaaS platforms offer the proprietary FRISK® and PAYCE® scores, the well-known Altman Z"-score, agency ratings from key Nationally Recognized Statistical Rating Organizations ("NRSROs"), curated news, and detailed financial spreads & ratios. Our FRISK® and PAYCE® scores are financial distress classification models that measure a business's probability of bankruptcy within a year. The FRISK® score also includes a risk signal based on the aggregate research behaviors of our subscribers, who control counterparty access to trade credit at some of the most sophisticated companies in the world. The inclusion of this risk signal boosts the overall accuracy of this bankruptcy analytic by lowering the false positive rate for the riskiest corporations.

Through its Trade Contributor Program, the Company receives monthly confidential accounts receivables data from hundreds of subscribers and non-subscribers, which it parses, processes, aggregates, and reports to summarize the invoice payment behavior of B2B counterparties without disclosing the specific contributors of this information. The size of the Trade Contributor Program's current annualized trade credit transaction data is approximately $3 trillion.

Safe Harbor Statement

Certain statements in this press release, including statements prefaced by the words "anticipates", "estimates", "believes", "expects" or words of similar meaning, constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance, expectations or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements, including, among others, risks associated with the COVID-19 pandemic and those risks, uncertainties and factors referenced from time to time as "risk factors" or otherwise in the Company's Registration Statements or Securities and Exchange Commission Reports. We disclaim any intention or obligation to revise any forward-looking statements, whether as a result of new information, a future event, or otherwise.

CONTACT:

CreditRiskMonitor.com, Inc.

Mike Flum, Chief Executive Officer

(845) 230-3037

[email protected]

SOURCE: CreditRiskMonitor.com, Inc.

View the original press release on ACCESS Newswire

Y.Baker--AT