-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

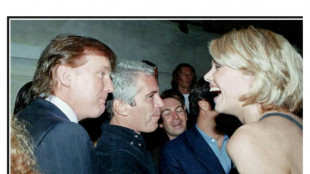

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

-

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

-

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

-

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

-

Dolphin Subsidiary Shore Fire Media's Podcast Clients Recognized as 2025's Best

-

Who Is the Best Plastic Surgery Marketing Company?

Who Is the Best Plastic Surgery Marketing Company?

-

Snaplii Simplifies Holiday Gifting with Smart Cash Gift Cards, Built-In Savings

-

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

-

Flushing Bank Expands Presence in Chinatown with Opening of New Branch

Security First International Holdings, Inc. Forges Groundbreaking Joint Venture with BTCx Developers to Establish Shareholder-Backed, Non-Custodial Bitcoin Treasury Reserve

FORT LAUDERDALE, FL / ACCESS Newswire / August 4, 2025 / Security First International Holdings, Inc. (OTC:SCFR), a diversified holding company with a focus on innovative financial solutions, today announced a strategic joint venture with the BTCx Developer Team, the creators of BTCx, a leading Bitcoin derivative token. This partnership aims to pioneer a revolutionary model for corporate treasury management, allowing Security First to integrate Bitcoin exposure into its balance sheet while empowering its shareholders with a unique non-custodial backing mechanism.

This groundbreaking initiative will enable Security First International Holdings, Inc. to utilize BTCx as a core component of its corporate treasury reserves. What sets this venture apart is the innovative "shareholder-backed derivative reserve" model, designed to align the company's digital asset strategy with the principles of decentralization and individual asset control.

Under this model, participating Security First shareholders will have the unprecedented opportunity to voluntarily contribute their native Bitcoin (BTC) to a highly secure, transparent, and auditable multi-party computation (MPC) vault or a decentralized proof-of-reserve protocol managed by the BTCx developers. Crucially, these shareholders will retain ultimate control over their private keys through advanced cryptographic techniques, ensuring they never relinquish sole custody of their underlying Bitcoin. In return for their participation, these shareholders will receive newly minted BTCx tokens directly to their personal wallets, maintaining a verifiable 1:1 peg with their locked BTC.

Security First's corporate treasury will then acquire BTCx tokens, which are directly backed by this collective, shareholder-controlled Bitcoin reserve. This innovative structure provides Security First with Bitcoin price exposure and the flexibility of a tokenized asset, while offering unparalleled transparency and aligning directly with the self-custody ethos valued by the crypto community.

"This joint venture with the BTCx Developer Team represents a monumental leap forward for corporate treasury management and shareholder empowerment," said Brian Fowler, CEO of Security First International Holdings, Inc. "We are not just adding Bitcoin to our balance sheet; we are doing so in a way that respects the foundational principles of decentralization and individual ownership. By allowing our shareholders to non-custodially back our BTCx reserves, we are building a treasury strategy that is both secure and deeply aligned with our investor base, setting a new standard for public companies embracing digital assets."

The BTCx Developer Team brings robust blockchain infrastructure and expertise in maintaining the integrity and peg of the BTCx token. This collaboration will ensure the highest levels of security, transparency, and auditability for the underlying Bitcoin reserves.

Lead Developer for the BTCx Team, commented, "We are thrilled to partner with Security First International Holdings, Inc. on this visionary project. Their commitment to a non-custodial, shareholder-aligned treasury model perfectly showcases the power and flexibility of BTCx. This initiative will not only bolster Security First's financial strategy but also serve as a powerful testament to the utility and trustworthiness of tokenized Bitcoin in institutional settings."

The joint venture is expected to provide Security First with enhanced liquidity for its digital asset holdings, potential for yield generation through DeFi integrations enabled by BTCx, and a clear, auditable pathway for Bitcoin adoption. For shareholders, it offers a unique opportunity to support the company's growth while maintaining direct control over their Bitcoin.

About Security First International Holdings, Inc.:

Security First International Holdings, Inc. (OTC:SCFR) is a diversified holding company focused on identifying and developing innovative solutions across various sectors. With a commitment to security, transparency, and technological advancement, SCFR seeks to create long-term value for its shareholders through strategic investments and groundbreaking partnerships.

Contact:

Brian Fowler

CEO

[email protected]

https://yieldtether.com

SOURCE: Security First International Holdings, Inc.

View the original press release on ACCESS Newswire

F.Ramirez--AT