-

UK govt to relax farmers inheritance tax after protests

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

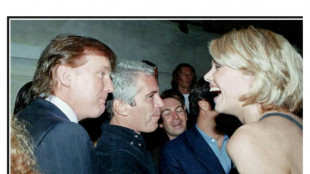

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Kultura Brands Exceeds Original 5.0 Billion Share Retirement Goal, Significantly Reduces Preferred H Overhang

Kultura Brands Exceeds Original 5.0 Billion Share Retirement Goal, Significantly Reduces Preferred H Overhang

-

EVCS Appoints Eric Danner as Chief Executive Officer; Gustavo Occhiuzzo Named Executive Chairman & Chief Strategy Officer

-

BCII Enterprises Appoints Emmy Award-Winning Media Strategist and Former White House Advisor Evan "Thor" Torrens as Strategic Advisor

BCII Enterprises Appoints Emmy Award-Winning Media Strategist and Former White House Advisor Evan "Thor" Torrens as Strategic Advisor

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

-

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

-

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

-

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

NEW YORK, NY / ACCESS Newswire / December 23, 2025 / The digital revolution promised transparency for commodities. Gold proved that the endpoint was more difficult to reach through pure ambition.

The problem was never the ledger. It was the inputs. Since the start of the digital age, the gold industry has experimented with digital traceability systems designed to modernize how provenance and custody are recorded. Distributed ledgers, tokens, and digital certificates were introduced with the promise of immutable truth.

Yet in practice, many of these systems simply preserved uncertainty in a more sophisticated format. When unverifiable material, anonymous handlers, and paper-based custody records feed a digital system, the output is still guesswork, just harder to unwind.

SMX Unites to Create Infrastructure, Not More Paperwork

That failure has forced a deeper architectural rethink. Transparency in gold does not begin with databases or digital ledgers. It begins with identity, both of the material itself and the humans who extract, handle, refine, and move it. Without those anchors, no amount of digitization can produce trust.

This is the context in which SMX (NASDAQ:SMX) is emerging as one of the more aggressive builders of a new identity stack for precious metals.

Following its work with the Dubai Multi Commodities Centre, SMX announced a joint initiative with Bougainville Refinery Ltd and biometric identity provider FinGo. The focus is end-to-end authentication across gold sourcing, refining, and export, not as a theoretical exercise, but inside live supply-chain environments already subject to international scrutiny. The emphasis is not on tokenization or abstract traceability layers. It is on binding reality to record.

Where Identity Gets Verified, Not Presumed

SMX's contribution operates at the material layer, where most digital systems quietly fail. Its molecular authentication technology embeds a persistent, invisible identity directly into gold itself. Once applied, that identity survives refining and downstream processing, allowing the material to be verified repeatedly without altering industrial workflows. This directly addresses one of the gold market's most persistent vulnerabilities: identity loss once material enters the refinery and aggregation stages.

By anchoring identity to the physical metal, SMX removes reliance on external documentation to assert provenance or authenticity. The gold becomes its own proof.

FinGo addresses the other half of the equation, one that has historically been even harder to solve. Gold does not move itself. People do. Across global supply chains, particularly in artisanal and small-scale mining environments, identity is often informal, shared, or paper-based. That creates gaps that regulators, financiers, and counterparties increasingly refuse to overlook.

FinGo's biometric digital identity infrastructure enables the verified attribution of actions and custody changes to real individuals, aligned with KYC and anti-money laundering (AML) expectations. Importantly, it's deployable in environments where traditional identity systems break down, including remote regions with limited infrastructure. This capability transforms compliance records from descriptive narratives into defensible event histories.

A More Valuable Sum of the Parts

When combined, SMX and FinGo create something most digital-based systems never achieved: a direct link between a verified asset and a verified human at a specific moment in time. That linkage fundamentally changes the evidentiary quality of supply-chain data.

Bougainville Refinery Ltd provides the operational framework where these capabilities are tested under real pressure. As a licensed refinery and exporter, BRL sits at the convergence point of sourcing, compliance, and access to international markets. Embedding identity infrastructure at this level moves transparency out of policy documents and into daily operations, where credibility is earned through performance, not intention.

What makes this development notable is momentum. SMX is not positioning itself as a future solution waiting for regulation to mandate adoption. It is inserting identity infrastructure directly into supply chains that already face tightening AML, responsible sourcing, and ESG expectations. The sequencing matters. Framework alignment first. Operational deployment next. Replication thereafter.

The next generation of commodity transparency will not be won by platforms competing for visibility. It will be won by systems that anchor truth at the physical and human layers. Only then do ledgers, analytics, and reporting tools become meaningful. This latest SMX collaboration moves that reality from theory into execution, and it is doing so faster than the market expected.

About SMX

As global businesses face new and complex challenges relating to carbon neutrality and meeting new governmental and regional regulations and standards, SMX is able to offer players along the value chain access to its marking, tracking, measuring and digital platform technology to transition more successfully to a low-carbon economy.

Forward-Looking Statements

This information contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. These statements are based on current expectations, estimates, forecasts, and assumptions regarding future events involving SMX (NASDAQ:SMX), its technologies, its partnership activities, and its development of molecular marking systems for recycled PET and other materials. Forward looking statements are not historical facts. They involve risks, uncertainties, and factors that may cause actual results to differ materially from those expressed or implied.

Forward looking statements in this editorial include, but are not limited to, expectations regarding the integration of SMX's molecular markers into U.S. recycling markets; the potential for FDA-compliant markers to enable recycled PET to enter food-grade and other regulated applications; the scalability of SMX solutions across diverse global supply chains; anticipated adoption of identity-based verification systems by manufacturers, recyclers, regulators, or brand owners; the potential economic impact of turning recycled plastics into tradeable or monetizable assets; the expected performance of SMX's Plastic Cycle Token or other digital verification instruments; and the belief that molecular-level authentication may influence pricing, compliance, sustainability reporting, or financial strategies used within the plastics sector.

These forward looking statements are also subject to assumptions regarding regulatory developments; market demand for authenticated recycled content; the pace of corporate adoption of traceability technology; global economic conditions; supply chain constraints; evolving environmental policies; and general industry behavior relating to sustainability commitments and recycling mandates. Risks include, but are not limited to, changes in FDA or international regulatory standards; technological challenges in large-scale deployment of molecular markers; competitive innovations from other companies; operational disruptions in recycling or plastics manufacturing; fluctuations in pricing for virgin or recycled plastics; and the broader economic conditions that influence capital investment and industrial activity.

Detailed risk factors are described in SMX's filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q. Readers are cautioned not to place undue reliance on forward looking statements. These statements speak only as of the date of publication. SMX undertakes no obligation to update or revise forward looking statements to reflect subsequent events, changes in circumstances, or new information, except as required by applicable law.

EMAIL: [email protected]

SOURCE: SMX (Security Matters) Public Limited

View the original press release on ACCESS Newswire

M.O.Allen--AT