-

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

-

10-year-old girl, Holocaust survivors among Bondi Beach dead

-

Steelers edge towards NFL playoffs as Dolphins eliminated

Steelers edge towards NFL playoffs as Dolphins eliminated

-

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

-

Canada plow-maker can't clear path through Trump tariffs

Canada plow-maker can't clear path through Trump tariffs

-

Bank of Japan expected to hike rates to 30-year high

-

Cunningham leads Pistons past Celtics

Cunningham leads Pistons past Celtics

-

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Australian PM visits Bondi Beach hero in hospital

Australian PM visits Bondi Beach hero in hospital

-

'Easiest scam in the world': Musicians sound alarm over AI impersonators

-

'Waiting to die': the dirty business of recycling in Vietnam

'Waiting to die': the dirty business of recycling in Vietnam

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Security beefed up for Ashes Adelaide Test after Bondi shooting

Security beefed up for Ashes Adelaide Test after Bondi shooting

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

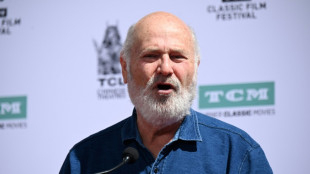

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

International Stem Cell Corporation Announces 2024 Fourth Quarter and Year-End Results

SAN DIEGO, CA / ACCESS Newswire / March 31, 2025 / International Stem Cell Corporation (OTCQB:ISCO) (www.internationalstemcell.com) ("ISCO" or "the Company"), a California-based clinical stage biotechnology company developing novel stem cell-based therapies and biomedical products, today provided a business update and announced fourth quarter and year-end financial results for the period ending on December 31, 2024.

FY 2024 Financial Highlights:

Revenues increased to $9.09 million in 2024, an increase of 17% compared to $7.79 million in 2023.

Combined operating income for the year ended December 31, 2024, from our two wholly owned subsidiaries, Lifeline Cell Technology and Lifeline Skin Care, increased to $2.39 million, an increase of 29%, compared to $1.85 million in 2023.

Loss from operations decreased to $68,000 for the year ended December 31, 2024, a decrease of 90%, compared to $663,000 in 2023.

"2024 has been a successful year for International Stem Cell Corporation, marked by both strong financial performance and continued progress in our clinical trial. Our revenue growth, coupled with a significant reduction in operational losses, underscores the strength of our business model and the demand for our biomedical products. At the same time, we remain committed to advancing our pioneering ISC-hpNSC® program, building upon the promising interim results observed in our Phase 1 clinical trial. Looking ahead, we are focused on leveraging these achievements to drive further growth, accelerate our research, and enhance value for our shareholders," stated Andrey Semechkin, Ph.D., CEO and Co-Chairman of ISCO.

About International Stem Cell Corporation

International Stem Cell Corporation is focused on the therapeutic applications of human parthenogenetic stem cells (hpSCs) and the development and commercialization of cell-based research and cosmetic products. ISCO's core technology, parthenogenesis, results in the creation of pluripotent human stem cells from unfertilized oocytes (eggs). hpSCs avoid ethical issues associated with the use or destruction of viable human embryos. ISCO scientists have created the first parthenogenetic, homozygous stem cell line that can be a source of therapeutic cells for hundreds of millions of individuals of differing genders, ages and racial background with minimal immune rejection after transplantation. hpSCs offer the potential to create the first true stem cell bank, UniStemCell™. ISCO also produces and markets specialized cells and growth media for therapeutic research worldwide through its subsidiary Lifeline Cell Technology (www.lifelinecelltech.com), and stem cell-based skin care products through its subsidiary Lifeline Skin Care (www.lifelineskincare.com).

For more information, please visit http://internationalstemcell.com/ or contact: [email protected]

To subscribe to receive ongoing corporate communications, please click on the following link: http://www.b2i.us/irpass.asp?BzID=1468&to=ea&s=0

To like our Facebook page or follow us on Twitter for company updates and industry related news, visit: www.facebook.com/InternationalStemCellCorporation and www.twitter.com/intlstemcell

Safe harbor statement

Statements pertaining to anticipated developments and company achievements, expected clinical studies (including results and ongoing evaluation of the phase 1 clinical trial), and other opportunities for the company and its subsidiaries, along with other statements about the future expectations, beliefs, goals, plans, or prospects expressed by management constitute forward-looking statements. Any statements that are not historical fact (including, but not limited to statements that contain words such as "will," "believes," "plans," "anticipates," "expects," "estimates,") should also be considered to be forward-looking statements. Forward-looking statements involve risks and uncertainties, including, without limitation, risks inherent in the development and/or commercialization of potential products, regulatory approvals, need and ability to obtain capital, application of capital resources among competing uses, and maintenance of intellectual property rights. Actual results may differ materially from the results anticipated in these forward-looking statements and as such should be evaluated together with the many uncertainties that affect the Company's business, particularly those mentioned in the cautionary statements found in the Company's Securities and Exchange Commission filings. The Company disclaims any intent or obligation to update forward-looking statements.

International Stem Cell Corporation and Subsidiaries

Consolidated Balance Sheets

(In thousands, except share and par value data)

December 31, | ||||||

2024 | 2023 | |||||

Assets | ||||||

Current assets: | ||||||

Cash | $ | 1,230 | $ | 1,588 | ||

Accounts receivable, net | 1,058 | 574 | ||||

Inventories | 1,149 | 1,263 | ||||

Prepaid expenses and other current assets | 123 | 96 | ||||

Total current assets | 3,560 | 3,521 | ||||

Non-current inventories | 252 | 266 | ||||

Property and equipment, net | 257 | 215 | ||||

Intangible assets, net | 721 | 800 | ||||

Right-of-use assets | 352 | 557 | ||||

Deposits and other assets | 31 | 31 | ||||

Total assets | $ | 5,173 | $ | 5,390 | ||

Liabilities, Redeemable Convertible Preferred Stock and Stockholders' Deficit | ||||||

Current liabilities: | ||||||

Accounts payable | $ | 186 | $ | 364 | ||

Accrued liabilities | 527 | 485 | ||||

Operating lease liabilities, current | 330 | 276 | ||||

Advances | 250 | 250 | ||||

Related party note payable | 3,395 | 3,457 | ||||

Total current liabilities | 4,688 | 4,832 | ||||

Operating lease liabilities, net of current portion | 115 | 445 | ||||

Total liabilities | 4,803 | 5,277 | ||||

Commitments and contingencies (Note 11) | ||||||

Series D redeemable convertible preferred stock, $0.001 par value; 50 shares authorized; 43 shares issued and outstanding; liquidation preference of $4,300 at December 31, 2024 and 2023 | 4,300 | 4,300 | ||||

Stockholders' Deficit: | ||||||

Non-redeemable convertible preferred stock, $0.001 par value; 10,004,310 and 10,004,310 shares authorized; 5,254,310 and 5,254,310 shares issued and outstanding; liquidation preference of $9,811 and $9,796 at December 31, 2024 and 2023, respectively | 5 | 5 | ||||

Common stock, $0.001 par value; 120,000,000 shares authorized; 8,004,389 shares issued and outstanding at December 31, 2024 and 2023 | 8 | 8 | ||||

Additional paid-in capital | 106,742 | 106,276 | ||||

Accumulated deficit | (110,685 | ) | (110,476 | ) | ||

Total stockholders' deficit | (3,930 | ) | (4,187 | ) | ||

Total liabilities, redeemable convertible preferred stock and stockholders' deficit | $ | 5,173 | $ | 5,390 | ||

International Stem Cell Corporation and Subsidiaries

Consolidated Statements of Operations

(In thousands, except share and per share data)

Year Ended December 31, | ||||||

2024 | 2023 | |||||

Product sales | $ | 9,085 | $ | 7,789 | ||

Operating expenses: | ||||||

Cost of sales | 3,764 | 3,181 | ||||

General and administrative | 3,516 | 3,514 | ||||

Selling and marketing | 1,216 | 1,246 | ||||

Research and development | 657 | 511 | ||||

Total operating expenses | 9,153 | 8,452 | ||||

Loss from operations | (68 | ) | (663 | ) | ||

Other income (expense): | ||||||

Employee retention credit | - | 663 | ||||

Interest expense | (145 | ) | (139 | ) | ||

Other income, net | 4 | 8 | ||||

Total other (expense) income, net | (141 | ) | 532 | |||

Net loss | (209 | ) | (131 | ) | ||

Net loss per common share, basic and diluted | $ | (0.03 | ) | $ | (0.02 | ) |

Weighted-average common shares used to compute net loss per share, basic and diluted | 8,004,389 | 8,004,389 | ||||

Contacts:

International Stem Cell Corporation

Russell A. Kern, PhD, Executive VP

Phone: 760-940-6383

Email: [email protected]

SOURCE: International Stem Cell Corporation

View the original press release on ACCESS Newswire

J.Gomez--AT