-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

-

Bad Bunny makes Grammys history with Album of the Year win

Bad Bunny makes Grammys history with Album of the Year win

-

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

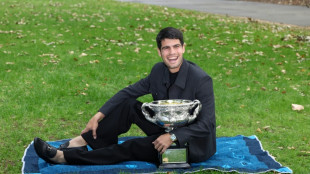

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

ABB Introduces Automation Extended:Eenabling Industrial Innovation with Continuity

ABB Introduces Automation Extended:Eenabling Industrial Innovation with Continuity

-

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

Stock market optimism returns after tech selloff but Wall Street wobbles

European stock markets recovered upward momentum on the back of interest rate optimism Monday following a brief correction affecting mostly the tech sector, but gains were pared as Wall Street ran out of steam by the late morning.

The week is filled with economic data and central bank decisions, keeping investors on their toes.

Wall Street seemed poised in early Monday business to match European gains, but tech worries crept back into the market, causing the key indices to reverse their early upward move.

Gold climbed closer to its all-time high and the dollar dropped as traders bet on further cuts to US interest rates by the Federal Reserve next year.

"The coming week is shaping up to be a significant one for global markets, with a dense calendar of economic releases and major central bank decisions," said Jim Reid, managing director at Deutsche Bank.

The European Central Bank is expected to hold interest rates on Thursday, when the Bank of England is forecast to trim borrowing costs, as policymakers react to cooler inflation in the eurozone and UK.

However the Bank of Japan is expected to hike its main rate on Friday with the yen weak.

Attention turns also to key US data, including reports on jobs for October and November, which were delayed by a government shutdown. Investors will also study a US inflation reading this week.

The data will be pored over for an idea about the Fed's plans for next month's rate decision.

The US central bank has lowered borrowing costs at the past three meetings, citing concerns about a struggling American labour market, though there has been some dissent among policymakers who are concerned about persistently high inflation.

Also in view is the race to take the helm at the Fed after boss Jerome Powell steps down in May, with US President Donald Trump's top economic aide Kevin Hassett and Fed governor Kevin Warsh said to be the front-runners.

Concerns about the AI-fuelled tech rally returned to the spotlight late last week after poorly-received earnings from US giants Oracle and Broadcom revived questions about the vast sums invested in the sector.

After hefty losses on Wall Street on Friday, where the S&P 500 and Nasdaq indices both shed more than one percent, Asia in turn suffered a tech-led retreat Monday.

- Key figures at around 1640 GMT -

New York - Dow: DOWN 0.2 percent at 48,377.96 points

New York - NASDAQ: DOWN 0.4 percent at 23,106.84

New York - S&P 500: DOWN 0.1 percent at 6,817.56

London - FTSE 100: UP 1.1 percent at 9,751.31 (close)

Paris - CAC 40: UP 0.7 percent at 8,124.88 (close)

Frankfurt - DAX: UP 0.2 percent at 24,229.91 (close)

Tokyo - Nikkei 225: DOWN 1.3 percent at 50,168.11 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 25,628.88 (close)

Shanghai - Composite: DOWN 0.6 percent at 3,867.92 (close)

Euro/dollar: UP at $1.1758 from $1.1742 on Friday

Dollar/yen: DOWN at 155.26 yen from 155.83

Pound/dollar: UP at $1.3392 from $1.3368

Euro/pound: UP at 87.87 pence from 87.83

West Texas Intermediate: DOWN 1.3 percent at $56.70 per barrel

Brent North Sea Crude: DOWN 1.1 percent at $60.44 per barrel

burs/jh/rlp

P.Smith--AT