-

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

-

10-year-old girl, Holocaust survivors among Bondi Beach dead

-

Steelers edge towards NFL playoffs as Dolphins eliminated

Steelers edge towards NFL playoffs as Dolphins eliminated

-

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

-

Canada plow-maker can't clear path through Trump tariffs

Canada plow-maker can't clear path through Trump tariffs

-

Bank of Japan expected to hike rates to 30-year high

-

Cunningham leads Pistons past Celtics

Cunningham leads Pistons past Celtics

-

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Australian PM visits Bondi Beach hero in hospital

Australian PM visits Bondi Beach hero in hospital

-

'Easiest scam in the world': Musicians sound alarm over AI impersonators

-

'Waiting to die': the dirty business of recycling in Vietnam

'Waiting to die': the dirty business of recycling in Vietnam

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Security beefed up for Ashes Adelaide Test after Bondi shooting

Security beefed up for Ashes Adelaide Test after Bondi shooting

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

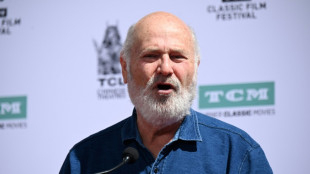

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

MultiSensor AI Announces Fourth Quarter and Full Year 2024 Results

Full Year Revenue Increased 36% to $7.4 million. Software Revenue Increased 30% to $1.0 million

Increased Liquidity Further Strengthens Balance Sheet

HOUSTON, TX / ACCESS Newswire / March 28, 2025 / MultiSensor AI Holdings, Inc. (NASDAQ:MSAI) (the "Company" or "MSAI"), a pioneer in condition-based monitoring and predictive maintenance enabling Industry 4.0, announced results for the fourth quarter and year ended December 31, 2024.

Trip Flavin, Interim CEO, commented: "This was an important quarter for MSAI. We have started to take the necessary steps to reposition the Company for long-term success and navigate our next phase of growth. We refined our strategy to focus on building our position as a SaaS leader in predictive maintenance and strengthened our leadership team to support this new strategy. With our enhanced leadership team and a clear strategic vision, we believe that we are better positioned than ever to drive innovation, expand our commercial reach, and deliver long-term value to our customers and stakeholders."

Robert Nadolny, CFO, continued, "As we close out Q4 2024, we are pleased to report strong revenue growth, a testament to the resilience and strategic execution of our team. We believe the 360% growth in the number of sensors connected to our cloud software, MSAI Connect, and the 400% increase of sites where we are deployed as compared to Q4 2023 illustrates the traction our solutions are getting within the market. We are also pleased to highlight our strengthened balance sheet, which underscores our commitment to financial discipline."

Financial Highlights:

Full year 2024 revenue increased 36% to $7.4 million from $5.4 million in 2023. Software revenue increased 30% to $1.0 million from $0.8 million in 2023.

Net loss per share decreased 70% to $1.07 as of December 31, 2024.

Overall liquidity increased as the Company's cash position grew to $4.4 million as of December 31, 2024, from $1.6 million as of December 31, 2023. Total liabilities decreased to $3.2 million as of December 31, 2024, from $16.6 million as of December 31, 2023.

Strategic Business Highlights:

As of December 31, 2024, the Company has approximately 460 active streaming sensors connected to our MSAI Connect platform as compared to approximately 100 as of December 31, 2023, a 360% increase year over year.

Our sensors are deployed at approximately 50 sites worldwide as of December 31, 2024, as compared to 10 as of December 31, 2023, a 400% increase year over year.

Our platform is deployed in eight countries world-wide and starting in April 2025, we expect our software will be available in multiple languages.

Our largest customer of MSAI Connect is achieving a greater than four times return on investment to date and a payback period of less than one year through minimizing unplanned downtime and reducing process waste through enhanced predictive maintenance.

Organization Transformation:

In the fourth quarter, the Company appointed Trip Flavin as Interim CEO. With a commitment to accelerating MSAI's transformation into a leading SaaS provider in predictive maintenance, Trip brings a wealth of expertise in innovation and operational excellence to spearhead our next growth phase.

To better align the executive team with strategic objectives, the Company in January 2025 appointed Peter Baird as Chief Commercial Officer, tasked with driving commercial growth, and Robert Nadolny as Chief Financial Officer, focused on strengthening financial strategy.

The Company's Annual Report is filed with the SEC, and is available at www.sec.gov as well as in the Investor Relations section of the Company's website (www.multisensorai.com).

About MultiSensor AI

MultiSensor AI builds and deploys intelligent multi-sensing platforms incorporating edge and cloud software solutions that leverage artificial intelligence. MSAI's integrated solutions utilize data generated from an array of sensors and sensor modalities including high-resolution thermal imagers, visible and acoustic imagers, as well as vibration and laser spectroscopy sensors, to protect customers' most critical assets. MSAI's platform combines condition-based monitoring data with proprietary edge and cloud software to generate actionable insights that, we believe, minimize unplanned downtime, reduce maintenance costs, prevent hazards, and extend asset life.

For more information, please visit https://www.multisensorai.com

Forward Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "will," or their negatives or variations of these words, or similar expressions. All statements contained in this press release that do not strictly relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company management's expectations regarding its strategic priorities and objectives, future plans and business prospects. These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including the "Risk Factors" section of the Company's Annual Report on Form 10-K for the year ended December 31, 2024, as such factors may be updated from time to time in the Company's other filings with the SEC. Because forward-looking statements are inherently subject to risks and uncertainties, you should not rely on these forward-looking statements as predictions of future events. Any forward-looking statement made in this press release is based only on information currently available and speaks only as of the date on which it is made. Except as required by applicable law, the Company expressly disclaims any obligations to publicly update any forward-looking statements, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

Media & Investor Contact:

Alpha IR Group

Mike Cummings or Nick Teves

[email protected]

MultiSensor AI Holdings, Inc.

Condensed Consolidated Statements of Operations

(Amounts in thousands of U.S. dollars, except share and per share data)

Year Ended December 31, | ||||||

2024 | 2023 | |||||

Revenue, net | $ | 7,402 | $ | 5,430 | ||

Cost of goods sold (exclusive of depreciation) | 2,582 | 2,297 | ||||

Inventory impairment | 2,272 | 1,689 | ||||

Operating expenses: | ||||||

Selling, general and administrative | 15,655 | 8,044 | ||||

Share-based compensation expense | 3,382 | 14,061 | ||||

Depreciation | 1,140 | 872 | ||||

Loss (gain) on asset disposal | 322 | (56 | ) | |||

Other Loss | 930 | - | ||||

Total operating expenses | 21,429 | 22,921 | ||||

Operating loss | (18,881 | ) | (21,477 | ) | ||

Interest expense | 63 | 94 | ||||

Change in fair value of convertible notes | 475 | (970 | ) | |||

Tariff refund | - | (2,401 | ) | |||

Change in fair value of warrants liabilities | (39 | ) | (195 | ) | ||

Loss on financing transaction | 1,553 | 4,043 | ||||

Other expenses, net | 1,027 | 12 | ||||

Loss before income taxes | (21,960 | ) | (22,060 | ) | ||

Income tax expense (benefit) | (465 | ) | 208 | |||

Net loss | $ | (21,495 | ) | $ | (22,268 | ) |

Weighted-average shares outstanding, basic and diluted | ||||||

Basic | 20,119,161 | 6,257,476 | ||||

Diluted | 20,119,161 | 6,257,476 | ||||

Net loss per share, basic and diluted | ||||||

Basic | (1.07 | ) | (3.56 | ) | ||

Diluted | (1.07 | ) | (3.56 | ) | ||

SOURCE: MultiSensor AI Holdings, Inc.

View the original press release on ACCESS Newswire

M.O.Allen--AT