-

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

-

10-year-old girl, Holocaust survivors among Bondi Beach dead

-

Steelers edge towards NFL playoffs as Dolphins eliminated

Steelers edge towards NFL playoffs as Dolphins eliminated

-

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

-

Canada plow-maker can't clear path through Trump tariffs

Canada plow-maker can't clear path through Trump tariffs

-

Bank of Japan expected to hike rates to 30-year high

-

Cunningham leads Pistons past Celtics

Cunningham leads Pistons past Celtics

-

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Australian PM visits Bondi Beach hero in hospital

Australian PM visits Bondi Beach hero in hospital

-

'Easiest scam in the world': Musicians sound alarm over AI impersonators

-

'Waiting to die': the dirty business of recycling in Vietnam

'Waiting to die': the dirty business of recycling in Vietnam

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Security beefed up for Ashes Adelaide Test after Bondi shooting

Security beefed up for Ashes Adelaide Test after Bondi shooting

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

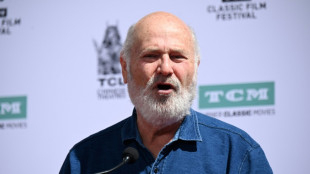

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

A2Z Cust2Mate Solutions Corp. Announces Pricing of US$30 Million Public Offering and Concurrent Registered Direct Offering

TEL AVIV, IL / ACCESS Newswire / January 27, 2025 / A2Z Cust2Mate Solutions Corp. (NASDAQ:AZ)(FRA - WKN: A3CSQ) (the "Company" or "A2Z"), today announced the pricing of an underwritten public offering of 3,281,250 common shares at a public offering price of $6.40 per share. A2Z is concurrently announcing the pricing of a registered direct offering of 1,406,250 common shares at a purchase price of $6.40 per share. All securities to be sold in the offering are being sold by A2Z. The offerings are expected to close on or about January 29, 2025, subject to the satisfaction of customary closing conditions.

The total gross proceeds to the Company from the offerings are expected to be $30 million, before deducting underwriting discounts and commissions related to the public offering and other estimated offering expenses.

A2Z intends to use the net proceeds from the offerings for continued development and expansion of existing business, including fulfilment of contracted smart cart backlog orders and acceleration of the onboarding process for new clients, and for working capital purposes.

Titan Partners Group, a division of American Capital Partners, is acting as sole bookrunner for the underwritten public offering.

The securities in the underwritten public offering are being offered pursuant to a prospectus supplement and an accompanying base prospectus forming part of a shelf registration statement on Form F-3 (File No. 333-271226), which was previously filed with the Securities and Exchange Commission (the "SEC") and became effective on April 21, 2023. A preliminary prospectus supplement and accompanying base prospectus relating to the offering was filed with the SEC and is available on the SEC's website at www.sec.gov. A final prospectus supplement relating to the offering will be filed with the SEC and will be available on the SEC's website located at www.sec.gov. Electronic copies of the final prospectus supplement and the accompanying base prospectus relating to the underwritten public offering may be obtained, when available, by contacting Titan Partners Group LLC, a division of American Capital Partners, LLC, 4 World Trade Center, 29th Floor, New York, NY 10007, by phone at (929) 833-1246 or by email at [email protected]. These securities are not being offered in Canada and may not be sold in Canada or to residents of Canada.

The securities in the registered direct offering are being offered pursuant to a prospectus supplement and an accompanying base prospectus forming part of a shelf registration statement on Form F-3 (File No. 333-271226), which was previously filed with the Securities and Exchange Commission (the "SEC") and became effective on April 21, 2023. A final prospectus supplement relating to the offering will be filed with the SEC and will be available on the SEC's website located at www.sec.gov. Electronic copies of the final prospectus supplement and the accompanying prospectus relating to the registered direct offering may be obtained, when available, at the SEC's website at http://www.sec.gov. These securities are not being offered in Canada and may not be sold in Canada or to residents of Canada.

This press release does not constitute an offer to sell or the solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction. Any offer, if at all, will be made only by means of the prospectus supplement and accompanying prospectus forming a part of the effective registration statement.

About A2Z Cust2Mate Solutions Corp.

A2Z Cust2Mate Solutions Corp. creates innovative solutions for complex challenges. A2Z's flagship product is the world's first proven-in-use mobile self-checkout shopping cart. With its user-friendly smart algorithm, touch screen, and other technologies, Cust2Mate streamlines the retail shopping experience by scanning purchased products and enabling in-cart payment so that customers can simply "pick & go", and bypass long cashier checkout lines. This results in a more efficient shopping experience for customers, less unused shelf-space and manpower requirements, and advanced command and control capabilities for store managers.

Forward Looking Statements

Matters discussed in this press release contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words "anticipate," "believe," "estimate," "may," "intend," "expect" and similar expressions identify such forward-looking statements. Actual results, performance or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained herein. These statements include, without limitation, statements related to our ability to close the offerings, the satisfaction of customary closing conditions and the timing of the offerings,, the gross proceeds, and the use of proceeds. These forward-looking statements are based largely on the expectations of the Company and are subject to a number of risks and uncertainties. These include, but are not limited to, risks and uncertainties associated with: the market and other conditions, the impact of geopolitical, economic, competitive and other factors affecting the Company and its operations, and other factors detailed in reports filed by the Company with the SEC.

Contact Information:

John Gildea

VP corporate communication

[email protected]

00353 86 8238177

SOURCE: A2Z Cust2Mate Solutions Corp.

View the original press release on ACCESS Newswire

W.Nelson--AT