-

Trump to attend White House Correspondents' dinner

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

-

Trump warns of longer Iran war as violence spreads

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

Fire-damaged Six nations trophy to be replaced

-

Trump mulls ground troops: latest developments in US-Iran war

-

Middle East war puts shipping firms in tight insurance spot

Middle East war puts shipping firms in tight insurance spot

-

Qatar downs Iran jets as Tehran targets oil and gas in spiralling Gulf crisis

-

UK PM says US will not use British bases in Cyprus

UK PM says US will not use British bases in Cyprus

-

Can Anthropic survive taking on Trump's Pentagon?

-

Real Madrid superstar Mbappe in Paris for treatment on knee injury

Real Madrid superstar Mbappe in Paris for treatment on knee injury

-

Mideast war risks sending global economy into stagflation

-

Stranded tourists shelter from missile fire in Dubai

Stranded tourists shelter from missile fire in Dubai

-

Iran war spells danger for global airlines

-

Trump doesn't rule out sending US troops into Iran

Trump doesn't rule out sending US troops into Iran

-

'No aborts. Good luck': Key moments in the US war on Iran

-

Chelsea boss Rosenior warns players over discipline

Chelsea boss Rosenior warns players over discipline

-

Energy prices soar on Iran war fallout, stocks slide

-

Pentagon chief refuses to rule out 'boots on ground' in Iran

Pentagon chief refuses to rule out 'boots on ground' in Iran

-

Saudi military raises readiness levels after attacks

-

Iran war spreads with strikes across Middle East and beyond

Iran war spreads with strikes across Middle East and beyond

-

Barca must 'make the impossible possible': coach Flick on Atletico cup challenge

-

Furry, frayed & freezing on Milan catwalks: the fashion trends

Furry, frayed & freezing on Milan catwalks: the fashion trends

-

Amsterdam's Rijksmuseum discovers new Rembrandt

-

Olympic comeback queen Brignone ends ski season

Olympic comeback queen Brignone ends ski season

-

Key Gulf air hubs caught up in Iran conflict

-

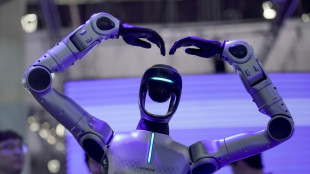

Middle East fighting overshadows world telecom show

Middle East fighting overshadows world telecom show

-

South Korea outclass Iran in Asian Women's Cup opener

-

Liverpool's Slot says his 'football heart' does not like set-piece trend

Liverpool's Slot says his 'football heart' does not like set-piece trend

-

Israel aims fresh attack at Tehran: latest developments in US-Iran war

-

At least 25 killed at Pakistan's weekend pro-Iran protests

At least 25 killed at Pakistan's weekend pro-Iran protests

-

Energy prices soar, stock markets slide on Iran war fallout

-

'No indication' Iran nuclear installations hit: IAEA

'No indication' Iran nuclear installations hit: IAEA

-

Showdown looms between Tesla and German union

-

Israel vows intensified attacks: latest developments in US-Iran war

Israel vows intensified attacks: latest developments in US-Iran war

-

France arrests activists blocking ship over alleged Russia uranium links

-

Tech sovereignty and AI networks set to dominate mobile meet

Tech sovereignty and AI networks set to dominate mobile meet

-

Indian police clash with pro-Khamenei protesters in Kashmir

Stock markets downbeat on eve of Fed rate call

European and Asian stock markets were largely downbeat Tuesday on uncertainty over the US Federal Reserve's plans for interest rates next year.

With traders fully confident of a US rate reduction Wednesday, observers said they would be keeping a close eye on the central bank's so-called "dot plot" of projections for monetary policy into 2026.

They will pore over its post-meeting statement and Fed boss Jerome Powell's news conference, looking for clues about the debate taking place among decision-makers.

Wall Street closed lower Monday, while the dollar traded mixed Tuesday.

"We expect solid growth, above-target inflation, and a slowing labour market to increase internal divisions at the (Fed policy board) and make 2026 a particularly challenging year for policymakers," noted Xiao Cui, senior US economist at Pictet Wealth Management.

"Downside risks to the labour market should lead the Committee to cut once more in December, before shifting to a quarterly pace of cuts in March and June."

She pointed also to "risks that Fed cuts are delayed into the second half of 2026".

Bets on a third successive cut -- and more in 2026 -- had surged on data pointing to a weakening jobs market, which has offset concerns about stubbornly high inflation.

That optimism was boosted last month by reports that President Donald Trump's top economic aide Kevin Hassett -- a proponent of more cuts -- was the frontrunner to take the Fed's helm when Powell's term ends.

However, the excitement has calmed in recent days following slightly higher-than-expected US inflation.

Bloomberg reported that markets are pricing two more rate reductions next year, down from the three expected last week.

On the corporate front Tuesday, chipmakers traded mixed after Trump said he had reached an agreement with Chinese counterpart Xi Jinping to allow Nvidia to export advanced artificial intelligence chips to China.

The announcement marks a significant shift in US export policy for advanced AI chips, which Trump's predecessor Joe Biden had heavily restricted over national security concerns.

Biden's administration required chip companies to create modified, less powerful versions specifically for the Chinese market.

Investors kept a close watch also over the bidding war for Warner Bros. Discovery after Paramount on Monday launched an all-cash tender offer for the Hollywood giant, in a challenge to Netflix's offer.

Paramount's bid of $108.4 billion trumps Netflix's offer of nearly $83 billion which targets, however, a smaller part of the company.

Ahead of Wall Street reopening, Google meanwhile hit out at a European Union antitrust probe launched Tuesday into the tech giant's use of online content to train and provide AI services.

The aviation sector was in focus after a trade association for airlines said carriers expect to transport a record 5.2 billion passengers in 2026 despite global headwinds affecting the sector.

Carriers are also now expecting higher profits than previously forecast for 2025, and predict earnings to come in at a comparable level next year, the International Air Transport Association (IATA) added.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 0.1 percent at 9,657.41 points

Paris - CAC 40: DOWN 0.3 percent at 8,083.12

Frankfurt - DAX: UP 0.4 percent at 24,148.76

Tokyo - Nikkei 225: UP 0.1 percent at 50,655.10 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 25,434.23 (close)

Shanghai - Composite: DOWN 0.4 percent at 3,909.52 (close)

New York - Dow: DOWN 0.5 percent at 47,739.32 (close)

Euro/dollar: UP at $1.1642 from $1.1640 on Monday

Pound/dollar: UP at $1.3332 from $1.3328

Dollar/yen: UP at 156.09 yen from 155.86 yen

Euro/pound: UP at 87.35 pence from 87.34 pence

Brent North Sea Crude: UP 0.3 percent at $62.68 per barrel

West Texas Intermediate: UP 0.3 percent at $59.05 per barrel

burs-bcp/jh

D.Johnson--AT