-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

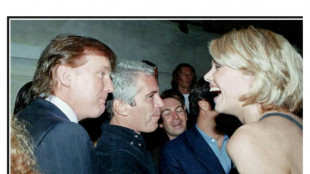

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

-

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

-

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

-

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

-

Dolphin Subsidiary Shore Fire Media's Podcast Clients Recognized as 2025's Best

-

Who Is the Best Plastic Surgery Marketing Company?

Who Is the Best Plastic Surgery Marketing Company?

-

Snaplii Simplifies Holiday Gifting with Smart Cash Gift Cards, Built-In Savings

-

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

-

Flushing Bank Expands Presence in Chinatown with Opening of New Branch

Green Leaf Innovations, Inc. Announces FINRA Approval of Reverse Stock Split and Strategic Reduction of Authorized Share Capital

Historic Corporate Action Positions Company for Institutional Capital Access and Long-Term Shareholder Value

PEMBROKE PINES, FLORIDA / ACCESS Newswire / December 23, 2025 / Green Leaf Innovations, Inc. (OTCPK:GRLF), a leading distributor and manufacturer of premium handmade cigars, today announced that the Financial Industry Regulatory Authority (FINRA) has approved the company's reverse stock split at a ratio of 2,500:1, effective 12-22-2025. Additionally, the company will also be reducing its authorized share capital.

This strategic corporate action marks a transformative moment in the company's capital structure and positions Green Leaf Innovations for enhanced investor accessibility and long-term shareholder value creation.

KEY HIGHLIGHTS OF THE CAPITAL RECAPITALIZATION:

Reverse Stock Split (2,500:1 Ratio)

* Immediately increases stock price on a per-share basis, improving market perception among institutional investors

* Reduces share count from approximately 16.70B shares to approximately 6,680,000 million shares (post-split)

* Eliminates penny stock stigma associated with high share counts, potentially opening doors to broader investment communities

* Enhances trading visibility and liquidity through improved stock price positioning

Authorized Share Reduction (500% to 1000% Reduction)

* Demonstrates management's commitment to capital discipline and shareholder protection

* Reduces potential dilution concerns that have historically deterred institutional capital from current shares to a controlled authorized ceiling

* Creates a clean, manageable capital structure appropriate for a company with the company's market position

* Signals confidence in current market valuation and reduced need for continuous equity financing

STRATEGIC RATIONALE AND INVESTOR BENEFITS:

"This reverse stock split and authorized share reduction represent a pivotal moment for Green Leaf Innovations," said Roberto Mederos, CEO. "We have built a profitable growing business and also with the SOFLO acquisition substantially expanding our revenue and market reach. This corporate action is not about financial engineering - it's about aligning our capital structure with the operational reality of what we have accomplished.

"Our institutional investor outreach has consistently identified share count and authorized shares as barriers to portfolio inclusion. By reducing authorized shares while implementing a 2,500:1 reverse split, we dramatically reduce shareholder dilution risk and create a capital structure that attracts institutional capital. We are now positioned to compete for capital in markets previously inaccessible to us, while simultaneously protecting existing shareholders from the dilution concerns that plagued our previous structure."

BENEFITS TO THE INVESTMENT COMMUNITY:

1. Institutional Accessibility: Many institutional investors maintain minimum stock price thresholds for portfolio inclusion. The reverse split elevates our per-share price into ranges that align with institutional mandates.

2. Analyst Coverage: Higher stock prices and lower share counts typically attract greater analyst attention and coverage from institutional research platforms.

3. Index Eligibility: Improved stock price positioning enhances potential eligibility for inclusion in OTC market indices and other benchmark tracking products.

4. Reduced Dilution Risk: With authorized shares capped the outstanding post-split, shareholders have substantial room for growth while maintaining strong protection against excessive future dilution.

5. Capital Efficiency: The disciplined share structure signals management's commitment to capital stewardship and profitability-focused growth rather than dilutive financing.

SHAREHOLDER IMPACT:

Existing shareholders will experience a proportional adjustment to their holdings. For example, a shareholder holding 2,500 shares will receive one share post-split. No fractional shares will result from this split ratio. The reverse split is automatic and requires no action from shareholders.

The company's CUSIP number will change while the (GRLF) remains. All securities issued in connection with convertible notes, warrants, and preferred stock will be adjusted proportionally.

BOARD CONFIDENCE AND FORWARD STRATEGY:

"The Board's decision to pursue this recapitalization strategy, rather than a buyback program, reflects our confidence that the market will quickly recognize the improved capital structure and competitive positioning," Mederos continued. "As we execute on our retail cigar shop partnership initiative expansion through our distribution network, and continue to drive profitability across our brands, we expect this cleaner capital structure to accelerate institutional investor engagement and support sustainable share price appreciation."

The company anticipates that the improved capital structure will enhance its profile within the broader investment community and support its long-term growth trajectory.

ABOUT GREEN LEAF INNOVATIONS, INC.

Green Leaf Innovations, Inc. is a premier distributor and manufacturer of handmade premium cigars, including renowned brands such as CUBANACAN, MEDEROS, MAL.CRI.AO, TABACALERA SERRANO and others. With operations spanning Nicaragua's premier tobacco-growing regions and distribution reaching over 400 retail locations across the United States, Green Leaf Innovations is committed to delivering exceptional products to cigar enthusiasts while building shareholder value.

For more information, visit www.greenleafinnovation.com or follow @otcgrlf on X.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on management's current expectations and assumptions and are subject to risks and uncertainties that could cause actual results to differ materially. Factors that could cause such differences include, but are not limited to: market acceptance of the recapitalized share structure, competitive conditions in the premium cigar market, regulatory changes, capital availability, and general economic conditions. The company undertakes no obligation to update forward-looking statements except as required by law.

INVESTOR RELATIONS CONTACT

Green Leaf Innovations, Inc.

Email: [email protected]

Contact: Ryan Medico

Phone: (800) 303-6268

Website: www.greenleafinnovation.com

SOURCE: Green Leaf Innovations, Inc.

View the original press release on ACCESS Newswire

A.Ruiz--AT