-

Ghostwriters, polo shirts, and the fall of a landmark pesticide study

Ghostwriters, polo shirts, and the fall of a landmark pesticide study

-

Mixed day for global stocks as market digest huge Netflix deal

-

Fighting erupts in DR Congo a day after peace deal signed

Fighting erupts in DR Congo a day after peace deal signed

-

England boss Tuchel wary of 'surprise' in World Cup draw

-

10 university students die in Peru restaurant fire

10 university students die in Peru restaurant fire

-

'Sinners' tops Critics Choice nominations

-

Netflix's Warner Bros. acquisition sparks backlash

Netflix's Warner Bros. acquisition sparks backlash

-

France probes mystery drone flight over nuclear sub base

-

Frank Gehry: five key works

Frank Gehry: five key works

-

US Supreme Court to weigh Trump bid to end birthright citizenship

-

Frank Gehry, master architect with a flair for drama, dead at 96

Frank Gehry, master architect with a flair for drama, dead at 96

-

'It doesn't make sense': Trump wants to rename American football

-

A day after peace accord signed, shelling forces DRC locals to flee

A day after peace accord signed, shelling forces DRC locals to flee

-

Draw for 2026 World Cup kind to favorites as Trump takes center stage

-

Netflix to buy Warner Bros. in deal of the decade

Netflix to buy Warner Bros. in deal of the decade

-

US sanctions equate us with drug traffickers: ICC dep. prosecutor

-

Migration and crime fears loom over Chile's presidential runoff

Migration and crime fears loom over Chile's presidential runoff

-

French officer charged after police fracture woman's skull

-

Fresh data show US consumers still strained by inflation

Fresh data show US consumers still strained by inflation

-

Eurovision reels from boycotts over Israel

-

Trump takes centre stage as 2026 World Cup draw takes place

Trump takes centre stage as 2026 World Cup draw takes place

-

Trump all smiles as he wins FIFA's new peace prize

-

US panel votes to end recommending all newborns receive hepatitis B vaccine

US panel votes to end recommending all newborns receive hepatitis B vaccine

-

Title favourite Norris reflects on 'positive' Abu Dhabi practice

-

Stocks consolidate as US inflation worries undermine Fed rate hopes

Stocks consolidate as US inflation worries undermine Fed rate hopes

-

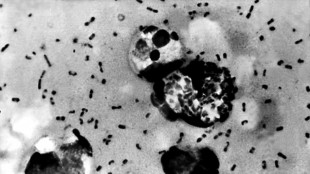

Volcanic eruptions may have brought Black Death to Europe

-

Arsenal the ultimate test for in-form Villa, says Emery

Arsenal the ultimate test for in-form Villa, says Emery

-

Emotions high, hope alive after Nigerian school abduction

-

Another original Hermes Birkin bag sells for $2.86 mn

Another original Hermes Birkin bag sells for $2.86 mn

-

11 million flock to Notre-Dame in year since rising from devastating fire

-

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

Gymnast Nemour lifts lid on 'humiliation, tears' on way to Olympic gold

-

Lebanon president says country does not want war with Israel

-

France takes anti-drone measures after flight over nuclear sub base

France takes anti-drone measures after flight over nuclear sub base

-

Signing up to DR Congo peace is one thing, delivery another

-

'Amazing' figurines find in Egyptian tomb solves mystery

'Amazing' figurines find in Egyptian tomb solves mystery

-

Palestinians say Israeli army killed man in occupied West Bank

-

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

McLaren will make 'practical' call on team orders in Abu Dhabi, says boss Brown

-

Stocks rise as investors look to more Fed rate cuts

-

Norris completes Abu Dhabi practice 'double top' to boost title bid

Norris completes Abu Dhabi practice 'double top' to boost title bid

-

Chiba leads Liu at skating's Grand Prix Final

-

Meta partners with news outlets to expand AI content

Meta partners with news outlets to expand AI content

-

Mainoo 'being ruined' at Man Utd: Scholes

-

Guardiola says broadcasters owe him wine after nine-goal thriller

Guardiola says broadcasters owe him wine after nine-goal thriller

-

Netflix to buy Warner Bros. Discovery in deal of the decade

-

French stars Moefana and Atonio return for Champions Cup

French stars Moefana and Atonio return for Champions Cup

-

Penguins queue in Paris zoo for their bird flu jabs

-

Netflix to buy Warner Bros. Discovery for nearly $83 billion

Netflix to buy Warner Bros. Discovery for nearly $83 billion

-

Sri Lanka issues fresh landslide warnings as toll nears 500

-

Root says England still 'well and truly' in second Ashes Test

Root says England still 'well and truly' in second Ashes Test

-

Chelsea's Maresca says rotation unavoidable

IMF warns China's property stress poses spillover risk

A funding crisis battering China's big property developers could start to shake the wider economy and global markets, the IMF warned on Friday, saying deeper reforms were needed to fully curb the threat.

The International Monetary Fund's report comes as property firms in the world's second-biggest economy struggle with liquidity problems as Beijing looks to curb excessive debt and rampant consumer speculation in the sector.

Among those embroiled in the crisis is Evergrande, one of the country's largest developers, which is involved in restructuring negotiations after racking up $300 billion in liabilities.

Multiple other Chinese developers have also defaulted on bond payments in recent months, piling pressure on the wider economy and rattling investors.

"Property plays a large role in both China's economy and financial system, accounting for about a quarter of both total fixed investment and bank lending over the past five years before the pandemic," the IMF said in a report released on Friday.

It warned that with developers beyond Evergrande also facing funding problems, there were "concerns of negative spillovers to the broader economy and global markets".

A sharper-than-expected slowdown in real estate "could trigger a wide range of adverse effects on aggregate demand, with feedback loops to the financial sector," the IMF said.

Should there be a sudden slowdown in China's growth, this would also create spillovers via trade and commodity prices, the fund added.

The institution this week lowered its 2022 growth forecast for China to 4.8 percent, down 0.8 points from earlier estimates.

Although China's recovery is "well advanced", it lacks balance and momentum has slowed -- partly due to lagging recovery in consumption amid recurrent virus outbreaks -- the IMF said.

China, where the coronavirus first emerged, remains one of the few places left in the world pursuing zero-Covid infections.

Its strategy of rapid lockdowns and mass testing is facing challenges with new virus variants becoming more transmissible, while repeated local outbreaks have weighed on a full resumption of pre-Covid activity.

The IMF noted that the pandemic will likely continue hampering China's consumption recovery before easing in 2023, but this likely requires "more efficacious vaccines and relaxation in the zero-tolerance strategy".

Earlier this week a senior IMF official called for China to begin to "recalibrate" its aggressive anti-Covid policy to ease the negative impact the pandemic continues to have on global supply chains and economic growth.

But Beijing responded by saying its coronavirus approach has achieved "significant results" and that the country remains a key driver of global growth.

A.Moore--AT