-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

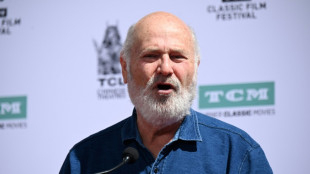

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

-

Athletes to stay in pop-up cabins in the woods at Winter Olympics

Athletes to stay in pop-up cabins in the woods at Winter Olympics

-

England seek their own Bradman in bid for historic Ashes comeback

-

Decades after Bosman, football's transfer war rages on

Decades after Bosman, football's transfer war rages on

-

Ukraine hails 'real progress' in Zelensky's talks with US envoys

-

Nobel winner Machado suffered vertebra fracture leaving Venezuela

Nobel winner Machado suffered vertebra fracture leaving Venezuela

-

Stock market optimism returns after tech sell-off

-

Iran Nobel winner unwell after 'violent' arrest: supporters

Iran Nobel winner unwell after 'violent' arrest: supporters

-

Police suspect murder in deaths of Hollywood giant Rob Reiner and wife

-

'Angry' Louvre workers' strike shuts out thousands of tourists

'Angry' Louvre workers' strike shuts out thousands of tourists

-

EU faces key summit on using Russian assets for Ukraine

-

Maresca committed to Chelsea despite outburst

Maresca committed to Chelsea despite outburst

-

Trapped, starving and afraid in besieged Sudan city

-

Showdown looms as EU-Mercosur deal nears finish line

Showdown looms as EU-Mercosur deal nears finish line

-

Messi mania peaks in India's pollution-hit capital

-

Wales captains Morgan and Lake sign for Gloucester

Wales captains Morgan and Lake sign for Gloucester

-

Serbian minister indicted over Kushner-linked hotel plan

Stock markets diverge ahead of key rate decisions

Wall Street pushed higher but European and Asian stock markets dropped Monday as investors looked ahead to interest rate decisions this week from major central banks including the Federal Reserve.

The dollar traded mixed against its main rivals, while oil prices rebounded following sharp falls last week.

Analysts are forecasting the Fed and the European Central Bank to announce smaller rate hikes at their meetings this week compared with recent decisions.

The Bank of England is meanwhile on course for a ninth increase in a row as policymakers try to bring down inflation from the highest levels in decades.

"Following a softer session in Asia, European markets are on edge, opening the week lower ahead of a critical few days for central bank action," noted Victoria Scholar, head of investment at Interactive Investor.

Wall Street opened higher, however, as bargain hunters moved in following losses at the end of last week.

"The ECB, the Fed and the Bank of England are expected to raise rates by 50 basis points each as the pace of tightening looks set to slow," Scholar added.

The half-point jumps will still be steep rises, however, as central banks struggle to cool the pace of price increases, particularly regarding energy and food.

Ahead of the Fed's policy meeting, investors were set to digest US inflation data due Tuesday.

"It will be a fitting hump day on Wednesday, because the (inflation) data and the Fed decision are big humps the market needs to get over if it wants to make a run at a year-end rally," said market analyst Patrick J. O'Hare at Briefing.com.

"If either, or both, disappoint in a meaningful way, then a year-end rally becomes a more challenging proposition," he added.

Traders were keeping an eye also on developments in China as it moves away from the zero-Covid policy that has hammered its economy, the world's second largest after the United States.

The shift comes after widespread protests against the near three-year strategy, though there is concern about the expected spike in infections.

Uncertainty surrounding the strength of China's demand recovery has hit oil prices hard, with crude futures shedding more than 10 percent last week.

"The gradual easing of Chinese Covid restrictions is... expected to lead to a further upswing in demand," said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

"However, concerns about the rapid spread of the virus remain, and China will have a tough fight on its hands, dealing with an expected explosion of infections while trying to open up the economy."

- Key figures around 1430 GMT -

London - FTSE 100: DOWN 0.4 percent at 7,446.42 points

Frankfurt - DAX: DOWN 0.5 percent at 14,301.97

Paris - CAC 40: DOWN 0.5 percent at 6,644.94

EURO STOXX 50: DOWN 0.6 percent at 3,918.42

New York - Dow: UP 0.4 percent at 33,597.24

Tokyo - Nikkei 225: DOWN 0.2 percent at 27,842.33 (close)

Hong Kong - Hang Seng Index: DOWN 2.2 percent at 19,463.63 (close)

Shanghai - Composite: DOWN 0.9 percent at 3,179.04 (close)

Euro/dollar: UP at $1.0559 from $1.0534 on Friday

Dollar/yen: UP at 137.04 yen from 136.57 yen

Pound/dollar: UP at $1.2284 from $1.2262

Euro/pound: UP at 85.96 pence from 85.90 pence

West Texas Intermediate: UP 1.2 percent at $71.88 per barrel

Brent North Sea crude: UP 0.4 percent at $76.37 per barrel

burs-rl/imm

M.King--AT