-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Trump attorney general orders arrest of ex-CNN anchor covering protests

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

Eurozone growth beats 2025 forecasts despite Trump woes

-

Israel to partially reopen Gaza's Rafah crossing on Sunday

-

Dutch PM-elect Jetten says not yet time to talk to Putin

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

-

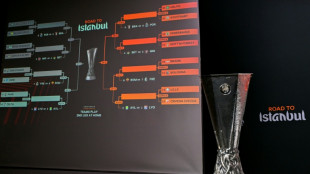

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Alcaraz defends controversial timeout after beaten Zverev fumes

-

New Dutch government pledges ongoing Ukraine support

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

Chad, France eye economic cooperation as they reset strained ties

-

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

-

Everton winger Grealish set to miss rest of season in World Cup blow

Everton winger Grealish set to miss rest of season in World Cup blow

-

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

-

Arteta focuses on the positives despite Arsenal stumble

Arteta focuses on the positives despite Arsenal stumble

-

Fijian Drua sign France international back Vakatawa

-

Kevin Warsh, a former Fed 'hawk' now in tune with Trump

Kevin Warsh, a former Fed 'hawk' now in tune with Trump

-

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

-

Turkey leads Iran diplomatic push as Trump softens strike threat

Turkey leads Iran diplomatic push as Trump softens strike threat

-

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

-

'Superman' Li Ka-shing, Hong Kong billionaire behind Panama ports deal

'Superman' Li Ka-shing, Hong Kong billionaire behind Panama ports deal

-

Skiing great Lindsey Vonn crashes at Crans-Montana, one week before Olympics

| SCS | 0.12% | 16.14 | $ | |

| RBGPF | 1.65% | 83.78 | $ | |

| CMSC | -0.02% | 23.69 | $ | |

| GSK | 1.22% | 51.28 | $ | |

| BCC | -1.19% | 79.23 | $ | |

| BP | -0.52% | 37.845 | $ | |

| AZN | 0.74% | 93.28 | $ | |

| RIO | -3.85% | 91.6 | $ | |

| NGG | -0.72% | 84.445 | $ | |

| CMSD | 0.06% | 24.075 | $ | |

| JRI | 0.19% | 12.98 | $ | |

| BCE | -0.02% | 25.48 | $ | |

| RELX | -1.16% | 35.75 | $ | |

| BTI | -0.1% | 60.15 | $ | |

| RYCEF | -2.69% | 16 | $ | |

| VOD | -0.41% | 14.65 | $ |

Trump's attack on the Dollar

An unprecedented conflict between the US President and the Federal Reserve is causing unrest on the financial markets. In mid-January 2026, it was announced that the US Department of Justice had issued grand jury subpoenas to the Federal Reserve System. Officially, the investigation concerns allegedly overpriced renovation work on historic administrative buildings, but the chairman of the Federal Reserve, Jerome Powell, stated in a video message that these investigations were being used as a pretext. The threat of punishment was aimed solely at subjugating the Federal Reserve's independent interest rate policy. Powell emphasised that the Federal Reserve fully complies with Congress's statutory oversight rights and called the investigation an unprecedented political interference. He fears that the issue at stake is whether monetary policy is based on data or controlled by political pressure.

Since his return to the White House in January 2025, the US President has repeatedly insulted Powell in a completely questionable manner and urged him to resign. Because the Federal Reserve only lowered interest rates gradually in 2025 and attributed the high inflation largely to the US government's protectionist course, the President increased the pressure. He called the central bank chief a ‘moron’ and a “bonehead” and threatened to sue him for ‘incompetence’. Behind the investigation is the prosecutor he appointed in Washington, who used the renovation costs as a reason to initiate criminal proceedings. According to reports, neither the Attorney General nor her deputy were informed in advance.

Reactions from politicians and experts

The legal offensive sparked sharp criticism across party lines. Several Republican senators made it clear that they would not confirm any nominations to the Federal Reserve Board while the investigation was ongoing. Democratic lawmakers described the move as an attack on the rule of law and a step towards autocracy. They warned that the President wanted to ‘lock up’ the Fed chairman simply because he did not align his interest rate policy with the White House's ideas. Former Fed chairmen and leading economists also warn that this is reminiscent of countries with weak institutions where the government controls the central bank – often with fatal consequences for price stability and the economy. Even market liberals warned that the misuse of criminal prosecution could drive away investors and undermine confidence in the United States.

Internationally, numerous central bankers expressed solidarity with Powell. They pointed out that an independent monetary policy is essential to ensure long-term price stability and a functioning economy. Some observers compared the current developments with authoritarian practices in Turkey or Venezuela, where populist governments attempted to control monetary policy, triggering hyperinflation.

Impact on the financial market

The markets reacted sensitively to the escalation. After the threat of sanctions became known, the US dollar fell significantly against major currencies. The dollar index, which measures the strength of the US currency against a basket of other major currencies, slipped by almost half a percent. The euro rose above 1.16 US dollars, the Swiss franc reached a ten-year high against the US currency, and investors fled to safe havens such as gold and silver. Analysts explained that the threat of losing central bank independence and the prospect of even higher US debt in the future are deterring investors. Gold rose to over $4,600 per troy ounce, and silver prices also reached record highs.

Uncertainty about future interest rate policy caused yields on long-term US government bonds to rise as investors demanded higher risk premiums. At the same time, the stock market initially recorded losses, but technology stocks later supported prices. Some analysts warn that sustained political pressure on the Federal Reserve could lead to higher inflation, capital flight and a depreciation of the dollar. Nomura currency strategists also pointed out that, in addition to geopolitical risks, it is above all the loss of confidence in US monetary policy that is weighing on the dollar.

Possible consequences for the dollar

The president's attacks on the Federal Reserve are not a new phenomenon. Back in 2025, the US currency had already lost significant value following repeated public insults directed at the head of the central bank. Analysts noted that the dollar index posted double-digit losses over the course of the year and that the extreme volatility on the currency markets was linked in particular to attempts to exert political influence on monetary policy. Then, as now, protectionist tariff policies and efforts to force interest rate cuts are driving up inflation. Investors fear that a politically compliant central bank will cut interest rates too sharply, triggering a spiral of inflation.

In addition to domestic political tensions, international factors are also weighing on the US dollar's status as the world's reserve currency. The global community is watching closely to see whether the US will continue to pursue a predictable monetary policy or whether political interests will weaken the reserve currency. If investors withdraw from the dollar on a large scale, alternative reserve currencies such as the euro or the Chinese yuan could gain in importance. Digital central bank currencies could also benefit from this.

Looking ahead ‘for the time being’

Jerome Powell is expected to remain Chairman of the Federal Reserve until the end of his term in May 2026, even though the White House is already sounding out potential successors. If the President appoints a loyal candidate, the Senate could delay the appointment due to ongoing investigations. Some observers believe that Powell – whose term as governor does not end until 2028 – could remain on the board despite the threat of sanctions in order to defend the independence of the central bank.

The coming months will show whether the United States can maintain its traditionally strong central bank independence. The conflict between the president and the Federal Reserve chief is already having a noticeable economic impact and is calling into question confidence in the US dollar as a global reserve currency. Economists warn that an independent monetary policy is a cornerstone of economic stability and must not be sacrificed to day-to-day politics.

Azerbaijan is in control: Armenians flee Nagorno-Karabakh

EU countries agree on watered-down car emissions proposal

Hungary-Dictator PM Orban claims EU 'deceived' Hungary

Ruble at the end: Russia's currency on the brink of collapse

Russia in Ukraine: murder, torture, looting, rape!

That's how terror Russians end up in Ukraine!

Spain: Sánchez's aim of a left coalition will fail!

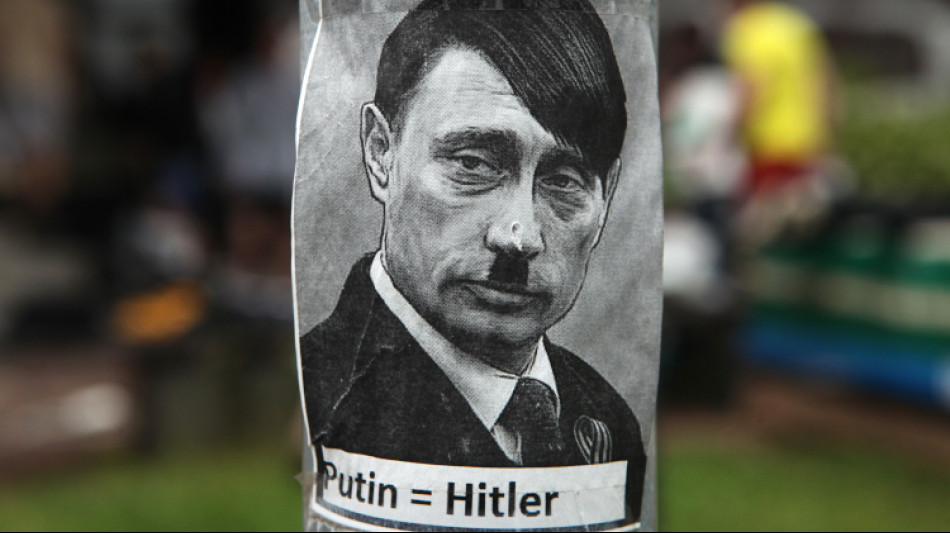

Russland, der Terror-Staat / Russia, the terrorist state!

Ukraine in the fight against the russian terror State

The Russian criminals will never own Ukraine!

ATTENTION, ATENCIÓN, УВАГА, ВНИМАНИЕ, 注意事项, DİKKAT, 주의, ATENÇÃO