-

Trump says US will take Greenland 'one way or the other'

Trump says US will take Greenland 'one way or the other'

-

Asian equities, precious metals surge as US Justice Dept targets Fed

-

Myanmar pro-military party claims Suu Kyi's seat in junta-run poll

Myanmar pro-military party claims Suu Kyi's seat in junta-run poll

-

Fed chair Powell says targeted by federal probe

-

Trailblazing Milos Raonic retires from tennis

Trailblazing Milos Raonic retires from tennis

-

Australia recalls parliament early to pass hate speech, gun laws

-

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

-

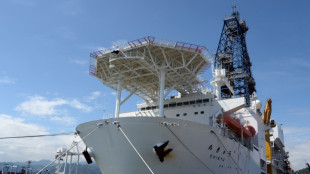

Japan aims to dig deep-sea rare earths to reduce China dependence

-

Top UN court to hear Rohingya genocide case against Myanmar

Top UN court to hear Rohingya genocide case against Myanmar

-

US sends more agents to Minneapolis despite furor over woman's killing

-

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

-

Bangladesh's powerful Islamists prepare for elections

-

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

-

Ukraine's Kostyuk defends 'conscious choice' to speak out about war

-

Trump says working well with Venezuela's new leaders, open to meeting

Trump says working well with Venezuela's new leaders, open to meeting

-

Asian equities edge up, dollar slides as US Fed Reserve subpoenaed

-

Hong Kong court hears sentencing arguments for Jimmy Lai

Hong Kong court hears sentencing arguments for Jimmy Lai

-

Powell says Federal Reserve subpoenaed by US Justice Department

-

Chalamet, 'One Battle' among winners at Golden Globes

Chalamet, 'One Battle' among winners at Golden Globes

-

Turning point? Canada's tumultuous relationship with China

-

Eagles stunned by depleted 49ers, Allen leads Bills fightback

Eagles stunned by depleted 49ers, Allen leads Bills fightback

-

Globes red carpet: chic black, naked dresses and a bit of politics

-

Maduro's fall raises Venezuelans' hopes for economic bounty

Maduro's fall raises Venezuelans' hopes for economic bounty

-

Golden Globes kick off with 'One Battle' among favorites

-

Australian Open 'underdog' Medvedev says he will be hard to beat

Australian Open 'underdog' Medvedev says he will be hard to beat

-

In-form Bencic back in top 10 for first time since having baby

-

Swiatek insists 'everything is fine' after back-to-back defeats

Swiatek insists 'everything is fine' after back-to-back defeats

-

Apex Secures Drill Contractor and Sets Planned Mobilization for Drilling at Rift

-

CelLBxHealth PLC Announces Board Changes

CelLBxHealth PLC Announces Board Changes

-

Following Completion of Expansion Concept Studies HyProMag USA Advances Expansion to Three States Supporting a Path to Triple U.S. Rare Earth Magnet Capacity by 2029

-

Wildfires spread to 15,000 hectares in Argentine Patagonia

Wildfires spread to 15,000 hectares in Argentine Patagonia

-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

Meta urges Australia to change teen social media ban

-

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

-

Trump admin sends more agents to Minneapolis despite furor over woman's killing

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

Following Completion of Expansion Concept Studies HyProMag USA Advances Expansion to Three States Supporting a Path to Triple U.S. Rare Earth Magnet Capacity by 2029

Completed concept studies for expansion of South Carolina and Nevada hubs, increasing total HyProMag USA magnet and alloy production from 1,552 metric tons NdFeB to 4,656 metric tons NdFeB per annum, supporting scalable U.S. manufacturing strategy and reinforcing momentum towards a planned U.S. public listing

Greater than $2 billion post-tax NPV and 38.7% real IRR for expanded developments, based on forecast market pricesi, support commencement of pre-feasibility studies for the expansions

DALLAS-FORT WORTH, TX / ACCESS Newswire / January 12, 2026 / HyProMag USA, LLC ("HyProMag USA" or the "Company"), today announced the completion of expansion concept studies (the "Expansion Concept Study") and will commence pre-feasibility studies for HyProMag USA's Plants located in South Carolina and Nevada, marking a significant step toward tripling its domestic manufacturing capacity by 2029. The studies support HyProMag USA's strategy to build a scalable platform across the U.S. for recycled neodymium-iron-boron (NdFeB) magnets and reinforce the Company's intention to pursue a U.S. public listing.

Julian Treger, CoTec CEO commented: "The Expansion Concept Study demonstrates that HyProMag USA's Texas Hub is not a one-off project, but the foundation of a scalable U.S. manufacturing platform. The modular design allows us to replicate capacity efficiently, optimize products for U.S. customers, and accelerate domestic supply chain resilience. The commissioning of HyProMag plants in the United Kingdom and Germany, along with recent progress on the Texas Hub, materially strengthens HyProMag USA's readiness for the next phase of growth and capital markets engagement."

Will Dawes, Mkango CEO commented: "HyProMag USA continues to develop a strong platform for further growth in the United States, and the recently completed Expansion Concept Study further validates the Company's business model and strategic positioning. In parallel with commissioning of the plants in UK and Germany, HyProMag USA is progressing rapidly towards first production in 2027, making a significant contribution to development of robust rare earth supply chains globally."

The basis of the expansion studies is the recently completed Class 2 AACEii capital cost estimate as part of the Detailed Engineering Design and Value Engineering Phase (the "Detailed Design") of the Company's first facility to be located at the Ironhead Commerce Center, Dallas-Fort Worth, Denton County, Texas (the "Texas Hub" or the "Project").iii

The Texas Hub 2025 Detailed Design base case was based on operating three Hydrogen Processing of Magnet Scrap ("HPMS") vessels, with a post-tax Net Present Value ("NPV") applying a 7% discount rate of $409 million based on current market prices, and a post-tax NPV of $780 million based on forecast prices.

The pre-feasibility studies for each of the South Carolina and Nevada hubs will focus on site selection, saleable products and Project configuration, optimal site layout, permitting, logistics, and technical marketing.

Key Highlights of the Expansion Concept Study

Expansion targets increase magnet and NdFeB Alloy Powder Production capacity by 3x from 1,552 metric tons NdFeB to 4,656 metric tons NdFeB by 2029 across three hubs, in Texas, South Carolina, and Nevada

Concept Study focused on the development of modular production systems and evaluated three investment scenarios based on the following modular configurations:

Case 1 - NdFeB Alloy Powder Production (HPMSiv only) - (Module 1)

Case 2 - NdFeB Alloy Powder Production + Sintered Block Production (Modules 1 & 2)

Case 3 - Fully Integrated Production: NdFeB Alloy Powder Production + Sintered Block + Magnet Finishing and Packaging (Modules 1, 2 and 3)

Each site was envisioned as a brownfield development with no space or utility constraints, enabling optimized layouts and flexible future expansions

The studies included conceptual building layouts, building options, environmental and permitting Roadmaps, Capital Cost Estimate (Class 4 AACE), and the basis of estimate

Project schedule assumes the commissioning of three Plants between 2027 and 2029 and does not include an expansion of the Texas Hub

Conceptual valuation: Concept study results for rare earth magnet recycling and manufacturing operations in the United States with a Texas Hub supported by two additional hubs (Case 3) co-located with Intelligent Lifecycle Solution ("ILS") sites in South Carolina and Nevadav:

$1,143 million post-tax NPVvi and 27.6% real internal rate of return ("IRR") based on current market pricesvii,viii

$2,180 million post-tax NPV and 38.7% real IRR based on forecast market pricesix

Increased magnet production capacity: 2,823 metric tons per annum of recycled sintered neodymium-iron-boron ("NdFeB") magnets and 1,833 metric tons per annum of associated NdFeB co-products (total payable capacity - 4,656 metric tons NdFeB) over a 40-year operating life from 2029.

Pre-feasibility study magnet optimization expected to increase higher value sintered block production

Industrial and workforce impact: The Plants are expected to support revitalization of the U.S. magnet sector and create circa 300 skilled magnet manufacturing jobs

Feedstock security: Plants in South Carolina and Nevada are co-located with ILSx facilities, expansions would be conditional on securing adequate feedstock and offtake

Carbon profile: Independent ISO-compliant study for the Texas Hub 2024 feasibility study confirmed a very low-carbon footprint of 2.35 kg CO2-eq per kg of NdFeB sintered block productxi

Scoping Studies: led by PegasusTSI Inc. (U.S.) and BBA USA Inc. (Canada), with support from HyProMag's international teams and the University of Birmingham

Building Momentum Toward U.S. Commercial Scale

The Expansion Concept Study builds on a series of recent milestones for HyProMag USA, including detailed engineering and feasibility work on the Texas Hub, execution of the site leasexii at the Ironhead Commerce Center, and the Company's intention to pursue a U.S. public listing. Together these developments reflect accelerating momentum as HyProMag USA advances toward commercial operations and a scaled manufacturing footprint across the U.S.

In parallel, HyProMag USA is engaging with large technology and infrastructure operators to support the growing need for secure, domestic recycling solutions for magnet-bearing equipment used in hyperscale data centers and AI infrastructure. The Company's modular, low-carbon, magnet-to-magnet recycling platform is designed to support end-of-life recovery of rare earth materials from servers, storage systems, and related equipment, positioning HyProMag USA as a preferred long-term recycling and manufacturing partner for hyperscale customers as capacity expands in the United States.

About HyProMag USA

HyProMag USA is developing advanced rare earth magnet recycling and manufacturing operations to establish a secure domestic U.S. supply chain for NdFeB magnets, essential components for AI infrastructure, defense systems, robotics, electric vehicles, and advanced electronics. Leveraging the revolutionary HPMS technology, developed over 15 years by the Magnetic Materials Group at the University of Birmingham with more than $100 million in R&D investment, the Company delivers faster magnet-to-magnet short-loop recycling that uses 88% less energy and reduces carbon emissions by 85% compared to conventional methods. HPMS accepts a wide range of magnet-bearing feedstocks - including end-of-life EV motors, data-center, and industrial equipment, consumer electronics, and manufacturing scrap - enabling recovery of magnet-grade material without chemical processing. Selected by the U.S. Department of State as a Minerals Security Partnership project, HyProMag USA is targeting 10% of U.S. domestic magnet supply within five years, ensuring supply chain security and resilience for technologies critical to national defense and economic competitiveness.

Ownership

HyProMag USA LLC is owned 50:50 by CoTec and HyProMag Limited. HyProMag Limited is 100 percent owned by Maginito Limited which is owned on a 79.4/20.6 percent basis by Mkango Resources Ltd. (AIM/TSX-V: MKA) and CoTec.

For more information, please visit www.hypromagusa.com

For further information, please contact:

John Singleton - Director - [email protected]

Will Dawes - Director - [email protected]

Eugene Hercun - Company Communications - +1 604 537 2413

Forward-Looking Information Cautionary Statement

Statements in this press release regarding the Company and its investments which are not historical facts are "forward-looking statements," which involve risks and uncertainties, including statements relating to the Texas Hub, the Feasibility Study, potential future employment and production, the entering of the lease agreement for the Texas Facility, the revised Project valuation, revised capex estimates, revised production numbers, and the benefits to the Company, which may be implied from such statements.

Since forward-looking statements address future events and conditions, by their very nature, they involve inherent risks and uncertainties. Actual results in each case could differ materially from those currently anticipated in such statements due to known and unknown risks and uncertainties affecting the Company, including but not limited to: resource and reserve risks; environmental risks and costs; permitting and regulatory risks; labor costs and shortages; uncertain supply and price fluctuations in materials; increases in energy costs; labor disputes and work stoppages; equipment leasing and availability; heavy equipment demand and availability; contractor and subcontractor performance; worksite safety issues; project delays and cost overruns; extreme weather events; and social, transport, or geopolitical disruptions.

The Company assumes no obligation to update forward-looking statements in this press release except as required by law. Readers should not place undue reliance on the forward-looking statements and information contained in this news release.

__________________________________________

i Forecast market prices ("Forecast Prices") are the prices for all NdFeB products sold in the U.S, excluding residual scrap feed, with the rare earth price component thereof derived from the latest rare earth oxide price forecasts from Q4 (2025) Adamas Intelligence, over the life of the asset

ii Association for the Advancement of Cost Engineering (AACE) - Class 2 Estimate

iv Patented Hydrogen Processing of Magnet Scrap (HPMS) technology developed at University of Birmingham, which liberates NdFeB magnets from end-of-life scrap streams in a cost effective and energy efficient way

vi 7% real discount rates. NPVs are calculated by discounting real US dollar cash flows from 2026

vii Current market prices ("Current Prices") for all NdFeB products sold in the U.S, excluding residual scrap, derived from updated U.S. 2024 price quotes, over the life of the asset

viii NPV does not include the economic benefit of any government or state incentives, carbon pricing

ix Forecast market prices ("Forecast Prices") are the prices for all NdFeB products sold in the U.S, excluding residual scrap feed, with the rare earth price component thereof derived from the latest rare earth oxide price forecasts from Q4 (2025) Adamas Intelligence, over the life of the asset

SOURCE: HyProMag USA, LLC

View the original press release on ACCESS Newswire

F.Wilson--AT