-

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

'One Battle After Another,' 'Hamnet' triumph at Golden Globes

-

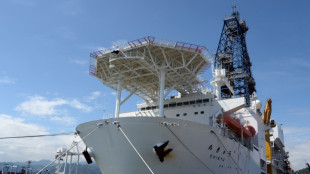

Japan aims to dig deep-sea rare earths to reduce China dependence

-

Top UN court to hear Rohingya genocide case against Myanmar

Top UN court to hear Rohingya genocide case against Myanmar

-

US sends more agents to Minneapolis despite furor over woman's killing

-

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

Trump says Iran 'want to negotiate' after reports of hundreds killed in protests

-

Bangladesh's powerful Islamists prepare for elections

-

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

NBA-best Thunder beat the Heat as T-Wolves edge Spurs

-

Ukraine's Kostyuk defends 'conscious choice' to speak out about war

-

Trump says working well with Venezuela's new leaders, open to meeting

Trump says working well with Venezuela's new leaders, open to meeting

-

Asian equities edge up, dollar slides as US Fed Reserve subpoenaed

-

Hong Kong court hears sentencing arguments for Jimmy Lai

Hong Kong court hears sentencing arguments for Jimmy Lai

-

Powell says Federal Reserve subpoenaed by US Justice Department

-

Chalamet, 'One Battle' among winners at Golden Globes

Chalamet, 'One Battle' among winners at Golden Globes

-

Turning point? Canada's tumultuous relationship with China

-

Eagles stunned by depleted 49ers, Allen leads Bills fightback

Eagles stunned by depleted 49ers, Allen leads Bills fightback

-

Globes red carpet: chic black, naked dresses and a bit of politics

-

Maduro's fall raises Venezuelans' hopes for economic bounty

Maduro's fall raises Venezuelans' hopes for economic bounty

-

Golden Globes kick off with 'One Battle' among favorites

-

Australian Open 'underdog' Medvedev says he will be hard to beat

Australian Open 'underdog' Medvedev says he will be hard to beat

-

In-form Bencic back in top 10 for first time since having baby

-

Swiatek insists 'everything is fine' after back-to-back defeats

Swiatek insists 'everything is fine' after back-to-back defeats

-

Wildfires spread to 15,000 hectares in Argentine Patagonia

-

Napoli stay in touch with leaders Inter thanks to talisman McTominay

Napoli stay in touch with leaders Inter thanks to talisman McTominay

-

Meta urges Australia to change teen social media ban

-

Venezuelans await political prisoners' release after government vow

Venezuelans await political prisoners' release after government vow

-

Lens continue winning streak, Endrick opens Lyon account in French Cup

-

McTominay double gives Napoli precious point at Serie A leaders Inter

McTominay double gives Napoli precious point at Serie A leaders Inter

-

Trump admin sends more agents to Minneapolis despite furor over woman's killing

-

Allen magic leads Bills past Jaguars in playoff thriller

Allen magic leads Bills past Jaguars in playoff thriller

-

Barca edge Real Madrid in thrilling Spanish Super Cup final

-

Malinin spearheads US Olympic figure skating challenge

Malinin spearheads US Olympic figure skating challenge

-

Malinin spearheads US figure Olympic figure skating challenge

-

Iran rights group warns of 'mass killing', govt calls counter-protests

Iran rights group warns of 'mass killing', govt calls counter-protests

-

'Fragile' Man Utd hit new low with FA Cup exit

-

Iran rights group warns of 'mass killing' of protesters

Iran rights group warns of 'mass killing' of protesters

-

Demonstrators in London, Paris, Istanbul back Iran protests

-

Olise sparkles as Bayern fire eight past Wolfsburg

Olise sparkles as Bayern fire eight past Wolfsburg

-

Man Utd knocked out of FA Cup by Brighton, Martinelli hits hat-trick for Arsenal

-

Troubled Man Utd crash out of FA Cup against Brighton

Troubled Man Utd crash out of FA Cup against Brighton

-

Danish PM says Greenland showdown at 'decisive moment' after new Trump threats

-

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

AC Milan snatch late draw at Fiorentina as title rivals Inter face Napoli

-

Venezuelans demand political prisoners' release, Maduro 'doing well'

-

'Avatar: Fire and Ashe' leads in N.America for fourth week

'Avatar: Fire and Ashe' leads in N.America for fourth week

-

Bordeaux-Begles rout Northampton in Champions Cup final rematch

-

NHL players will compete at Olympics, says international ice hockey chief

NHL players will compete at Olympics, says international ice hockey chief

-

Kohli surpasses Sangakkara as second-highest scorer in international cricket

-

Young mother seeks five relatives in Venezuela jail

Young mother seeks five relatives in Venezuela jail

-

Arsenal villain Martinelli turns FA Cup hat-trick hero

-

Syrians in Kurdish area of Aleppo pick up pieces after clashes

Syrians in Kurdish area of Aleppo pick up pieces after clashes

-

Kohli hits 93 as India edge New Zealand in ODI opener

Asian equities edge up, dollar slides as US Fed Reserve subpoenaed

Asian equities posted gains Monday while the dollar dipped as investors digested news that the US Justice Department subpoenaed the Federal Reserve, raising fears over US central bank independence.

Fed Chair Jerome Powell confirmed the unprecedented move late Sunday, which he blasted as part of US President Donald Trump's pressure campaign for another rate cut. The Fed has indicated it would hold rates steady.

"The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President," Powell said in a statement late Sunday.

Powell said the bank received grand jury subpoenas on Friday related to his Senate testimony in June, which had been about a major renovation project of Federal Reserve office buildings.

It came on the heels of Friday's soft US jobs report showing just 50,000 new positions in December and unemployment slipping to 4.4 percent.

The dollar fell about 0.2 percent against major peers, according to Bloomberg, while gold surged 1.5 percent as investors faced with political uncertainty sought safe havens.

Asian markets posted gains in early trade. Hong Kong, Shanghai, Seoul and Taipei climbed, tracking Wall Street's record close Friday.

Bangkok, Manila, Singapore, Kuala Lumpur, and Jakarta were also up.

Most stock markets have enjoyed a solid start to the year, with indices in Frankfurt, London, Paris and Seoul hitting record highs last week, largely on optimism for the tech sector and gains in defence sector shares.

Oil prices saw a slight dip, but largely held after a rally last week, as protests in Iran continued to stoke geopolitical risk and the US seizure of Venezuela's crude supplies added to concerns of a supply glut.

President Trump has warned Tehran of repercussions if demonstrators were harmed, while Iran cautioned against foreign intervention.

On Sunday evening, Trump said he was considering potential military action against Iran following reports of a violent crackdown leading to the deaths of hundreds of people in the country.

"They're starting to, it looks like," Trump said, when asked by reporters aboard Air Force One if Iran had crossed his previously stated red line of protesters being killed.

"We're looking at it very seriously. The military is looking at it, and we're looking at some very strong options. We'll make a determination," he said.

He also said that the Islamic republic's leadership had called seeking "to negotiate" and that a meeting was being set up.

- Key figures at around 0230 GMT -

Hong Kong - Hang Seng Index: UP 0.4 percent at 26,327.33

Shanghai - Composite: UP 0.4 percent at 4,138.32

Tokyo - Nikkei 225: (closed for holiday)

West Texas Intermediate: DOWN 0.1 percent at $59.06 per barrel

Brent North Sea Crude: FLAT at $63.30 per barrel

Euro/dollar: UP at $1.1656 from $1.1635 on Friday

Pound/dollar: UP at $1.3424 from $1.3407

Dollar/yen: FLAT at 157.88 yen from 157.88 yen

Euro/pound: UP at 86.83 pence from 86.78 pence

London - FTSE 100: UP 0.8 percent at 10,124.60 (close)

New York - Dow: UP 0.5 percent at 49,504.07 points (close)

T.Perez--AT