-

Arsenal's Merino has earned striking role: Arteta

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

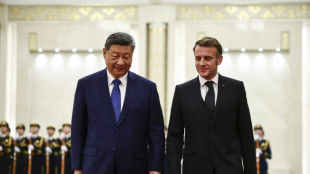

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Rains hamper Sri Lanka cleanup after deadly floods

-

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

Early Warning Press Release - Sumarria Inc. Announces Completion of Acquisition of Securities of Forward Water Technologies Corp.

TORONTO, ON / ACCESS Newswire / November 19, 2025 / Forward Water Technologies Corp. ("FWTC" or, the "Issuer") (TXXV:FWTC): This press release is being disseminated by Sumarria Inc. ("Sumarria") pursuant to the requirements of National Instrument 62-103 - The Early Warning System and Related Take-Over Bid and Insider Reporting Issues to announce the completion of an acquisition by Sumarria of 100 debenture units ("Units") issued by FWTC on October 29, 2025 for total consideration of $100,000 pursuant to its recently completed non-brokered private placement of 1,025 Units. The head office of Sumarria is located at 22 St Clair Ave E, Suite 2001, Toronto, ON M4T 2S5 and the Issuer's head office is located at 1086 Modeland Road, Sarnia, Ontario N7S 6L2.

Each Unit was issued at a price at $1,000 and was comprised of a $1,000 principal amount of 14% per annum unsecured convertible debenture (a "Debenture") and (ii) 5,000 common share purchase warrants (each a "Warrant"). The Debentures bear interest at a rate of 14% per annum from the date of issuance, payable annually in arrears on the last Business Day of each year. The Debentures mature on October 29, 2028 (the "Maturity Date"). At the option of a holder of Debentures, the Issuer covenanted to apply to the TSX Venture Exchange to convert accrued interest into common shares of the Issuer ("Common Shares") at the then prevailing market price, pursuant to the policies of the TSX Venture Exchange.

Each $1,000 principal amount Debenture is convertible into Common Shares ("Debenture Shares") at a conversion price of $0.07 per Debenture Share until the first anniversary of issuance of the Debentures and at a conversion price of $0.10 per Debenture Share thereafter at the option of the holder at any time on or before the Maturity Date.

Each Warrant entitles the holder to acquire one Common Share (a "Warrant Share") at any time on or before October 29, 2028 at an exercise price of $0.07 per Warrant Share until October 29, 2026 and at an exercise price of $0.10 per Warrant Share thereafter.

Prior to (and following) the private placement, Sumarria had ownership and control over an aggregate of 8,879,003 Common Shares representing approximately 17.8% of the issued and outstanding Common Shares as well as 5,327,601 Common Share purchase warrants. Assuming the exercise of all of the 5,327,601 Common Share purchase warrants held by Sumarria prior to the closing of the private placement Sumarria would hold 14,206,604 Common Shares on a partially diluted basis representing approximately 25.7% of the Common Shares as calculated in accordance with National Instrument 62-104 Take-Over Bids and Insider Bids ("NI 62-104").

Following the closing and assuming (i) the exercise of all of the 5,827,601 Common Share purchase warrants held by Sumarria (inclusive of the 5,327,601 Common Share purchase warrants held prior to the private placement), and (ii) conversion of the $100,000 principal amount of Debentures at a conversion price of $0.07 per Common Share, Sumarria would have ownership and control over 16,135,175 Common Shares representing approximately 28.2% of the issued and outstanding Common Shares on a partially diluted basis as calculated in accordance with NI 62-104.

In addition, to the foregoing purchase, Sumarria now also acts jointly with Max Graham, a director of the Issuer, in respect of their holdings of Common Shares. Mr. Graham holds 443,926 Common Shares, 346,963 Common Share purchase warrants (125,000 of which are Warrants issued in the private placement) and $25,000 principal amount of Debentures. Following the completion of the private placement Sumarria and Mr. Graham together hold 9,322,929 Common Shares, 6,174,564 Common Share purchase warrants and $125,000 principal amount of Debentures. On an undiluted basis Sumarria and Mr. Graham hold approximately 18.7% of the issued and outstanding Common Shares and on a partially diluted basis they hold 17,285,206 Common Shares representing approximately 29.9% of the Common Shares outstanding.

The Acquiror and the joint actor hold the Issuer's securities for investment purposes. The Acquiror and the joint actor do not have any current intentions to increase or decrease their beneficial ownership or control or direction over any additional securities of the Issuer. The Acquiror and/or the joint actor may, from time to time and depending on market and other conditions, otherwise acquire additional Common Shares and/or other equity, debt or other securities or instruments of the Issuer in the open market or otherwise, and reserve the right to dispose of any or all of the securities in the open market or otherwise at any time and from time to time, and to engage in similar transactions with respect to the securities, the whole depending on market conditions, the business and prospects of the Issuer and other relevant factors.

An early warning report will be filed pursuant to applicable Canadian securities laws. Copies of the early warning report filed will be available on the Issuer's SEDAR+ (www.sedarplus.ca) profile.

For further information, or to obtain a copy of the Early Warning Report filed under applicable securities laws, please contact:

Anthony R. Graham

Telephone: 416.219.7620

Email: [email protected]

This early warning news release is issued under the early warning provisions of Canadian securities legislation, including National Instrument 62-104 - Take-Over Bids and Issuer Bids and National Instrument 62-103 - The Early Warning System and Related Take-Over Bid and Insider Reporting Issues

SOURCE: Sumarria Inc.

View the original press release on ACCESS Newswire

W.Morales--AT