-

Arsenal's Merino has earned striking role: Arteta

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

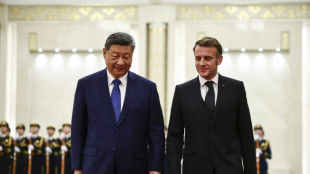

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Rains hamper Sri Lanka cleanup after deadly floods

-

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

Critical Elements Announces Bought Deal Life Private Placement for Gross Proceeds of C$6.0 Million

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES.

MONTRÉAL, QC / ACCESS Newswire / November 17, 2025 / Critical Elements Lithium Corporation (TSXV:CRE)(FSE:F12) ("Critical Elements" or the "Corporation") is pleased to announce that it has entered into an agreement with Red Cloud Securities Inc. ("Red Cloud"), as lead underwriter and sole bookrunner on behalf of a syndicate of underwriters (collectively, the "Underwriters"), pursuant to which the Underwriters have agreed to purchase for resale (i) 5,000,000 common shares of the Corporation (the "HD Shares") at a price of C$0.40 per HD Share and (ii) 6,666,667 common shares of the Corporation to be sold and issued as "flow-through shares" within the meaning of subsection 66(15) of the Income Tax Act (Canada) (the "FT Shares", and collectively with the HD Shares, the "Offered Shares") at a price of C$0.60 per FT Share on a "bought deal" basis in a private placement for aggregate gross proceeds of approximately C$6,000,000 (the "Base Offering").

The Corporation will grant to the Underwriters an option, exercisable up to 48 hours prior to the Closing Date, to purchase for resale up to an additional C$1,000,000 in any combination of HD Shares and FT Shares at their respective offering prices (the "Underwriters' Option"). The Base Offering and the shares issuable upon exercise of the Underwriters' Option shall be collectively referred to as the "Offering".

The Corporation will have the right to include a list of subscribers to purchase Offered Shares reflecting gross proceeds of up to $500,000 under the Offering (the "President's List").

The Corporation intends to use the net proceeds of the Offering to fund exploration programs at the Corporation's Rose West block forming part of the Rose Lithium-Tantalum Property and Nemaska Belt properties in Québec, as well as for general working capital and corporate purposes.

The gross proceeds from the sale of FT Shares will be used by the Corporation to incur eligible "Canadian exploration expenses" that qualify as "flow-through critical mineral mining expenditures" as both terms are defined in the Income Tax Act (Canada) (the "Qualifying Expenditures") related to the Corporation's Rose West block forming part of the Rose Lithium-Tantalum Property and Nemaska Belt properties in Québec on or before December 31, 2026. All Qualifying Expenditures will be renounced in favour of the subscribers of FT Shares effective December 31, 2025.

Subject to compliance with applicable regulatory requirements and in accordance with National Instrument 45-106 - Prospectus Exemptions ("NI 45-106"), the Offered Shares will be offered for sale to purchasers resident in all of the provinces of Canada pursuant to the listed issuer financing exemption under Part 5A of NI 45-106, as amended by Coordinated Blanket Order 45-935 - Exemptions from Certain Conditions of the Listed Issuer Financing Exemption (the "Listed Issuer Financing Exemption"). The Offered Shares are expected to be immediately freely tradeable in accordance with applicable Canadian securities legislation if sold to purchasers resident in Canada. The HD Shares may also be sold in offshore jurisdictions and/or in the United States on a private placement basis pursuant to one or more exemptions or exclusions from the registration requirements of the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), and all applicable U.S. state securities laws.

There is an offering document (the "Offering Document") related to the Offering that can be accessed under the Corporation's profile at www.sedarplus.ca and on the Corporation's website at www.cecorp.ca. Prospective investors should read this Offering Document before making an investment decision.

The Offering is scheduled to close on December 5, 2025 (the "Closing Date"), or such other date as the Corporation and Red Cloud may agree. Completion of the Offering is subject to certain conditions including, but not limited to the receipt of all necessary approvals, including the approval of the TSX Venture Exchange.

The securities offered in the Offering have not been, and will not be, registered under the U.S. Securities Act or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, "U.S. persons" (as defined in Regulation S under the U.S. Securities Act) except pursuant to an exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About Critical Elements Lithium Corporation

Critical Elements aspires to become a large, responsible supplier of lithium to the flourishing electric vehicle and energy storage system industries. To this end, Critical Elements is advancing the wholly-owned, high-purity Rose Lithium-Tantalum project in Québec, the Corporation's first lithium project to be advanced within a land portfolio of over 1,016 km2. On August 29, 2023, the Corporation announced results of a new Feasibility Study on Rose for the production of spodumene concentrate. The after-tax internal rate of return for the Project is estimated at 65.7%, with an estimated after-tax net present value of US$2.2B at an 8% discount rate. In the Corporation's view, Québec is strategically well-positioned for US and EU markets and boasts good infrastructure including a low-cost, low-carbon power grid featuring 94% hydroelectricity. The project has received approval from the Federal Minister of Environment and Climate Change on the recommendation of the Joint Assessment Committee, comprised of representatives from the Impact Assessment Agency of Canada and the Cree Nation Government, received the Certificate of Authorization under the Environment Quality Act from the Québec Minister of the Environment, the Fight against Climate Change, Wildlife and Parks, and the project mining lease from the Québec Minister of Natural Resources and Forests under the Québec Mining Act .

For further information, please contact: Jean-Sébastien Lavallée, P. Géo. Chief Executive Officer 819-354-5146 [email protected]www.cecorp.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is described in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary statement concerning forward-looking information

This news release contains "forward-looking information" and "forward-looking statements" within the meaning of Canadian and United States securities legislation (collectively,

"forward-looking information"). Generally, forward-looking information can be identified by the use of forward-looking terminology such as "scheduled", "anticipates", "expects" or "does not expect", "is expected", "scheduled", "targeted", or "believes", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". Forward-looking information in this news release includes, without limitation, statements regarding the Offering, the closing of the Offering, the anticipated closing date of the Offering, the intended use of proceeds from the Offering and the filing of the Offering Document. Forward-looking information is based on assumptions management believes to be reasonable at the time such statements are made. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information contained herein is made as of the date of this news release. Although the Corporation has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Corporation undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

SOURCE: Critical Elements Lithium Corp.

View the original press release on ACCESS Newswire

K.Hill--AT