-

Arsenal's Merino has earned striking role: Arteta

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

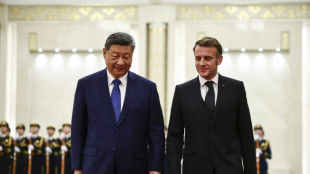

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Rains hamper Sri Lanka cleanup after deadly floods

-

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

Toshiba sets March date for vote on spin-off plan

Japanese conglomerate Toshiba said Monday it would hold an extraordinary meeting of shareholders on March 24 to vote on its plan to spin off its devices unit.

The ballot will not be legally binding but is intended to "confirm the views of our shareholders regarding moving forward", Toshiba said, with a binding resolution to be voted on sometime in 2023.

But the board will be hoping the vote produces solid enough support for its revised proposal, which also includes selling off "non-core" business including Toshiba Tec and other units.

CEO Satoshi Tsunukawa said he would be seeking a majority mandate from shareholders at the meeting, rather than a more stringent two-thirds majority.

Toshiba last November announced a proposal to spin off two new businesses, one dealing with infrastructure and the other devices.

But last week it revised the plan, saying spinning off a single unit would be less costly and time-consuming and make it easier to list the new firm.

Once a shining symbol of Japan's advanced technology and economic power, Toshiba more recently has faced a series of scandals and losses.

It had appeared to be staging a recovery early last year and rejoined the prestigious first section of the Tokyo Stock Exchange.

But it was plunged into uncertainty in June when shareholders voted to oust the board's chairman after revelations the firm sought government help to influence a boardroom ballot proposed by activist shareholders.

The vote also came on the heels of an unexpected buyout offer from a private equity fund associated with then-CEO Nobuaki Kurumatani, with allegations it was intended to blunt the influence of activist investors.

Reception to its initial plan to split into three firms was mixed, and while some analysts said the proposal could help maximise value, there was public opposition from several key shareholders.

The shareholder meeting was announced as Toshiba on Monday downgraded its annual operational profit forecast, citing the semiconductor shortage and rising costs.

The firm cut its operating profit expectations for the year to March to 155 billion yen ($1.34 billion) against an earlier forecast of 170 billion yen.

Annual sales are now seen at 3.34 trillion yen, compared with a previous 3.35 trillion yen forecast.

"We adjusted the annual outlooks to reflect the impact of rising cost of raw materials and transportation as well as the continuing semiconductor shortage," the company said.

It posted net profit of 55.1 billion yen for the three months to December, up from 40.1 billion yen from a year earlier.

For the nine months to December, the storied firm's net profit nearly tripled to 114.9 billion yen, against 43.6 billion yen in the same period the year before.

Mio Kato, an analyst at Lightstream Research who publishes on Smartkarma, said the third-quarter results "should not drive a big reaction in my view".

"Overall I don't think there will be any major change in investor perception," he told AFP, adding that the quarter was likely driven by "semiconductor supply chain and some incremental lockdown-related impact".

P.Hernandez--AT