-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

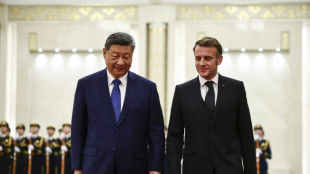

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Rains hamper Sri Lanka cleanup after deadly floods

-

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

-

Tech tracking to tackle human-wildlife conflict in Zimbabwe

Tech tracking to tackle human-wildlife conflict in Zimbabwe

-

Olympic swim star Thorpe to race gruelling Sydney-Hobart on top yacht

-

'Land without laws': Israeli settlers force Bedouins from West Bank community

'Land without laws': Israeli settlers force Bedouins from West Bank community

-

No yolk: police 'recover' Faberge egg swallowed by thief

I-ON Digital Corp. Deploys $200 Million in Assets Under Management (AUM), Backed By In Situ Gold Reserves, As I-ON's Treasury Solidifies Diversified Yield Strategies From Digital Asset Deployment

Resulting ION.au assets will be deployed into large-scale tokenization and stablecoin programs across I-ON's expanding open-finance network, underscoring accelerating institutional demand for its regulated, gold-backed digital asset platform.

CHICAGO, ILLINOIS / ACCESS Newswire / December 4, 2025 / I-ON Digital Corp. (OTCQB:IONI), a leading U.S. real-world-asset (RWA) infrastructure company specializing in regulated digital asset banking, tokenization, and gold-backed instruments, today announced it has secured multiple asset-deployment commitments totaling more than $200 million in in-situ gold reserves. These commitments advance I-ON's tokenization, treasury management, and advanced liquidity-deployment strategies across its expanding RWA-based ecosystem.

This substantial inflow-aggregated through a growing network of institutional reserve holders - will be digitized and managed through I-ON's regulated Treasury and Digital Asset Platform (DAP), then deployed across the Company's expanding liquidity network. This includes RAAC.io (Regnum Aurum Acquisition Corp.) and GoldfishGold.com, two rapidly scaling distribution gateways for RWAs, gold-backed digital assets, asset-collateralized stablecoins, and Open-Finance lending instruments. Together, these channels create a scalable pipeline for converting in-situ gold reserves into compliant, yield-generating digital financial products.

A MAJOR MILESTONE FOR REGULATED GOLD-BACKED DIGITAL ASSETS

The onboarding of $200 million in ION.au gold-backed digital asset deployment agreements - including both closely held ION.au and ION.au under management - represents one of the largest single tranches of in-situ gold commitments to enter a U.S.-regulated tokenization framework in 2025, positioning I-ON at the forefront of institutional-grade digital asset conversion.

The operational deployments are expected to transform, through material balance sheet and AUM growth, I-ON's suite of digitized financial instruments - including gold-backed tokens, stable-value structures, treasury-grade securities, and liquidity-pool assets - while remaining I-ON's legacy of deploying fully auditable, verifiable, and compliant digital assets within the Company's regulated digital banking architecture.

"This is a watershed moment not only for I-ON, but for the broader RWA tokenization market," said Carlos X. Montoya, Chairman & CEO of I-ON Digital. "The addition of $200 million in tokenized gold - driven by real institutional demand - validates the trust being placed in our model, our compliance infrastructure, and our partner ecosystem. It solidifies I-ON as one of the most credible and scaled gold-digitization platforms in the U.S."

POWERED BY A GROWING LIQUIDITY AND DISTRIBUTION ECOSYSTEM

Through RAAC.io, ION.au becomes programmable collateral that can be deployed across multiple products and venues, including:

- Instant settlement and collateralization in trading, lending, and payments

- Real-time proof-of-reserve visibility and 24/7 auditability

- Liquidity pools and hedged index baskets

- Tokenized capital markets products and yield-structured vehicles

Through GoldfishGold.com, ION.au reaches retail and institutional buyers via:

- Tokenized gold at market-leading spreads

- Integrated buy/sell networks

- Multi-asset vaulting and redemption programs

- Consumer-facing trading routes for I-ON-backed digital gold instruments

Together, these distribution points materially expand market access for I-ON's digitized gold products, enabling efficient deployment into trading markets, structured pools, and alternative liquidity channels.

ACCELERATING TOWARD NATIONAL EXCHANGE UPLISTING TARGETS

As recently announced, in conjunction with a I-ON Digital - Craft Capital Management NASDAQ up-listing engagement, this multi-faceted asset deployment arrives as I-ON continues to strengthen its capital markets readiness ahead of its planned 2026 national exchange uplisting, supported by recent:

- Digital asset banking advancements

- New tokenization partnerships

- Strategic engagements with capital advisors

- Expanded RWA infrastructure and institutional onboarding

"The momentum across our ecosystem is unmistakable," said Ken Park, Director & Chief Marketing Officer of I-ON Digital. "Our partners at RAAC.io and GoldfishGold.com continue to amplify market reach and accelerate capital inflows. This milestone reinforces the growing institutional appetite for regulated, high-integrity tokenized gold-and the unique position I-ON holds in delivering it."

ABOUT I-ON DIGITAL CORP.

I-ON Digital Corp. (OTCQB:IONI) is a U.S.-based digital asset infrastructure company focused on real-world-asset (RWA) tokenization, regulated gold-backed digital instruments, and digital asset banking services. I-ON's platform enables institutions to securely digitize, tokenize, manage, and distribute physical and in-situ assets through compliant, treasury-grade digital frameworks. The Company's extended ecosystem includes partnerships with RAAC.io, Instruxi Limited, Chainlink Labs, and other global RWA technology leaders. To learn more, visit https://iondigitalcorp.com

FOR FURTHER INFORMATION, PLEASE CONTACT:

Investor Relations

I-ON Digital Corp.

[email protected]

(866) 440-2278

https://iondigitalcorp.com

FORWARD-LOOKING STATEMENTS

Statements contained in this press release regarding matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the Company's capital markets activities, growth expectations, industry trends, potential uplisting, and future operational initiatives. These statements are based on current assumptions and are subject to risks and uncertainties that may cause actual results to differ materially. Factors that may cause such differences include, but are not limited to, regulatory developments, market adoption of digital asset products, capital market conditions, operational risks, and those described in the Company's filings with the U.S. Securities and Exchange Commission. The Company undertakes no obligation to update forward-looking statements except as required by law.

SOURCE: I-ON Digital Corp

View the original press release on ACCESS Newswire

R.Chavez--AT