-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

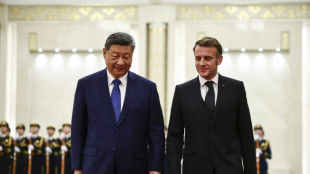

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Rains hamper Sri Lanka cleanup after deadly floods

-

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

-

Tech tracking to tackle human-wildlife conflict in Zimbabwe

Tech tracking to tackle human-wildlife conflict in Zimbabwe

-

Olympic swim star Thorpe to race gruelling Sydney-Hobart on top yacht

-

'Land without laws': Israeli settlers force Bedouins from West Bank community

'Land without laws': Israeli settlers force Bedouins from West Bank community

-

No yolk: police 'recover' Faberge egg swallowed by thief

Bonk, Inc. Completes 51% Revenue Interest Acquisition in $30M Asset Strategic Partner

Acquisition of 51% Revenue Stake Adds Significant Non-Dilutive Asset Value to Balance Sheet Based on Q3 Valuation Metrics

SCOTTSDALE, ARIZONA / ACCESS Newswire / December 3, 2025 / Following its announcement of a majority revenue interest acquisition in Bonk.fun, Bonk, Inc. (Nasdaq:BNKK) provided additional context regarding the financial impact of the transaction. Based on valuation metrics established in the Company's most recent quarterly filing, the expanded 51% revenue interest implies an asset value of approximately $30 million.

Proven Upside Potential While the current $30 million implied valuation is derived from recent Q3 reporting, the platform has demonstrated the ability to generate substantially higher cash flow during periods of heightened market activity. For example, in July 2025, Bonk.fun generated approximately $30 million in revenue.

Management notes that while digital asset markets are cyclical and revenue fluctuates with rising and falling market tides, this historical performance provides a clear benchmark for the significant economic value this 51% majority interest can unlock during favorable market cycles-offering upside far exceeding the current baseline valuation.

Non-Dilutive Growth Engine In its Q3 filing, Bonk, Inc. valued its initial 10% interest at approximately $3 million. This valuation metric implies a total value for the Bonk.fun asset of $30 million. By expanding its stake to 51% without a corresponding cash expenditure or equity issuance, Bonk, Inc. has executed a highly accretive, non-dilutive transaction that significantly strengthens the Company's balance sheet.

Revenue Generation "Our mandate is to identify and acquire undervalued, high-velocity assets that power the BONK ecosystem," stated Jordan Schur, President of Bonk, Inc. "Securing this majority revenue interest allows us to realize an implied asset value of approximately $30 million on our balance sheet without a single dollar of dilution. This is the kind of disciplined, accretive deal-making that will define Bonk, Inc. moving forward."

This move highlights Bonk, Inc.'s commitment to building a fortress balance sheet comprised of cash-flowing digital assets that support long-term shareholder value.

About Bonk, Inc. Bonk, Inc. (Nasdaq:BNKK) is a company evolving to bridge the gap between traditional public markets and the digital asset ecosystem. Through its subsidiary BONK Holdings LLC, the Company executes a strategy focused on acquiring revenue-generating assets within the DeFi space. The Company also operates a growing beverage division holding the patented Sure Shot and Yerbaé brands.

Investor Relations Contact: Phone: 888.257.8061 Email: [email protected]

Forward-Looking Statements: This press release contains forward-looking statements. Such statements are subject to risks and uncertainties, and actual results could differ materially. Factors that could cause or contribute to such differences include, but are not limited to, the performance of BONK digital assets, the operational success of the beverage division, market volatility, and other risks detailed in Bonk, Inc.'s filings with the Securities and Exchange Commission.

SOURCE: Bonk, Inc.

View the original press release on ACCESS Newswire

A.Moore--AT