-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

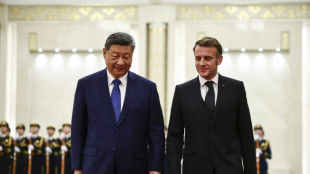

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Rains hamper Sri Lanka cleanup after deadly floods

-

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

-

Tech tracking to tackle human-wildlife conflict in Zimbabwe

Tech tracking to tackle human-wildlife conflict in Zimbabwe

-

Olympic swim star Thorpe to race gruelling Sydney-Hobart on top yacht

-

'Land without laws': Israeli settlers force Bedouins from West Bank community

'Land without laws': Israeli settlers force Bedouins from West Bank community

-

No yolk: police 'recover' Faberge egg swallowed by thief

The OLB Group Announces Completion of PCI DSS 4.0 Certification for SecurePay Payment Gateway

NEW YORK, NY / ACCESS Newswire / December 3, 2025 / (NASDAQ:OLB) - The OLB Group, Inc. ("OLB" or the "Company"), a diversified FinTech company, today announced that its SecurePay payment gateway has successfully achieved Payment Card Industry Data Security Standard (PCI DSS) Version 4.0 certification, the latest and most comprehensive security standard established by the Payment Card Industry Security Standards Council (PCI SSC).

A New Era in Payment Security

PCI DSS 4.0 represents the most significant update to payment security standards in over a decade, introducing enhanced requirements designed to address evolving cyber threats and strengthen the protection of cardholder data across the global payments ecosystem. SecurePay's achievement of this certification demonstrates OLB's commitment to maintaining the highest levels of security for its merchant partners and their customers.

"Achieving PCI DSS 4.0 certification for SecurePay is a significant milestone that reinforces our position as a trusted leader in payment processing," said Ronny Yakov, Chief Executive Officer of The OLB Group. "This certification validates our ongoing investment in security infrastructure and our dedication to providing merchants with a payment gateway that meets the most stringent industry standards."

Key Enhancements Under PCI DSS 4.0

The updated certification encompasses critical security enhancements mandated by the major card brands, including Visa, Mastercard, American Express, Discover, and JCB International. Notable requirements addressed in PCI DSS 4.0 include:

Enhanced Authentication Controls - Implementation of strengthened multi-factor authentication (MFA) requirements for all access to the cardholder data environment, reflecting updated mandates from Visa and Mastercard for payment service providers.

Advanced Encryption Standards - Deployment of upgraded cryptographic protocols to protect cardholder data both in transit and at rest, meeting heightened requirements established by all major card networks.

Continuous Security Monitoring - Integration of automated security monitoring and threat detection capabilities, aligning with American Express and Discover's enhanced requirements for real-time vulnerability management.

Targeted Risk Analysis - Implementation of customized security controls based on entity-specific risk assessments, a new flexible approach under PCI DSS 4.0 that allows organizations to tailor security measures to their unique operating environment.

Expanded Scope for E-Commerce - Enhanced protections for payment page scripts and third-party integrations, addressing emerging threats in card-not-present transactions as prioritized by all participating card brands.

Card Brand Compliance

SecurePay's PCI DSS 4.0 certification ensures full compliance with the security programs of all major card networks:

Visa Global Registry of Service Providers

Mastercard Site Data Protection (SDP) Program

American Express Data Security Operating Policy (DSOP)

Discover Information Security Compliance (DISC) Program

JCB Data Security Program

"The transition to PCI DSS 4.0 represents a fundamental shift in how the payment industry approaches security, Our successful certification demonstrates that SecurePay is positioned to meet not only today's security challenges but also the evolving requirements that the card brands will continue to implement through 2025 and beyond."

Strategic Implications

The PCI DSS 4.0 certification strengthens SecurePay's competitive positioning in the payment gateway market and provides OLB's merchant partners with assurance that their transactions are processed through a platform meeting the highest available security standards. This achievement supports the Company's strategic initiatives to expand its payment processing capabilities and attract enterprise-level merchants requiring best-in-class security compliance.

About PCI DSS 4.0

PCI DSS 4.0, released by the PCI Security Standards Council in March 2022, became mandatory for all entities processing, storing, or transmitting cardholder data as of March 31, 2024, with additional future-dated requirements taking effect through March 31, 2025. The standard introduces 64 new requirements focused on emerging threats, enhanced authentication, improved encryption, and greater flexibility in how organizations achieve security objectives.

About OLB Group, Inc.

The OLB Group, Inc. is a diversified Fintech eCommerce merchant services provider and Bitcoin mining enterprise. The Company's eCommerce platform delivers cloud-based merchant services for a comprehensive digital commerce solution to merchants in all 50 states. In addition, through its ownership of the MOOLA Cloud and Black 011 platform, OLB Group can provide its services to an additional network of 31,600 convenient stores and bodegas in the United States.

Forward-Looking Statements

This press release includes information that constitutes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are based on the Company's current beliefs, assumptions, and expectations regarding future events, which in turn are based on information currently available to the Company. Such forward-looking statements include statements regarding the proposed spinoff of DMint described herein and are characterized by future or conditional words such as "may," "will," "expect," "intend," "anticipate," "believe," "estimate" and "continue" or similar words. You should read statements that contain these words carefully because they discuss future expectations and plans, which contain projections of future results of operations or financial condition or state other forward-looking information.

By their nature, forward-looking statements address matters that are subject to risks and uncertainties. A variety of factors could cause actual events and results to differ materially from those expressed in or contemplated by the forward-looking statements, including the risk that the licensee understands and complies with various banking laws and regulations that may impact the licensee's ability to process transactions. For example, federal money laundering statutes and Bank Secrecy Act regulations discourage financial institutions from working with operators of certain industries - particularly industries with heightened cash reporting obligations and restrictions - as a result of which, banks may refuse to process certain payments and/or require onerous reporting obligations by payment processors to avoid compliance risk. These and other risk factors affecting the Company are discussed in detail in the Company's periodic filings with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether because of the latest information, future events or otherwise, except to the extent required by applicable laws

Investor Relations Contact:

The OLB Group, Inc.

[email protected]

(212) 278-0900 Ext 333

SOURCE: The OLB Group, Inc.

View the original press release on ACCESS Newswire

T.Perez--AT