-

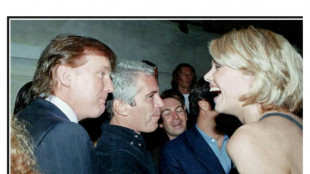

Trump in Epstein files: five takeaways from latest release

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

Paragon Technologies News Release

To the Shareholders of Paragon Technologies:

EASTON, PA / ACCESS Newswire / August 8, 2025 / It has been a busy few weeks since the conclusion of the annual meeting as we are hard at work restoring Paragon Technologies, Inc. (OTCID:PGNT) ('Paragon' or the 'Company') and I realize many of you have lots of questions. The purpose of this letter is to provide a brief overview of where our Company sits today given the events that have transpired over the past months.

Thanks to an overwhelming show of support, our slate was elected with a supermajority of the vote - a strong mandate for change, and for stewardship that reflects the values of ownership, discipline, and integrity.

Now that the campaign is behind us, Paragon is back again focused on doing the simple things that made the Company an enormous success for over a decade: delivering value to our clients, operating efficiently with a disciplined approach to expenditure, avoiding waste and bureaucracy, behaving with candor, being faithful stewards, and acting opportunistically.

For the past nine months, former directors Samuel Weiser, Tim Eriksen, Howard Brownstein and David Lontini, a group of directors who had no real economic interest in Paragon, were focused solely on perpetuating themselves in control and wasting millions of dollars of Paragon's capital to achieve that goal. We have now learned what we suspected all along: mindless tactics led to mindless waste. Based on an internal review, we have learned the following and feel our shareholders should be aware of these findings so shareholders are clearly aware of the substantial financial impact they will have on our upcoming financial results:

Approximately $3.7 million spent on their entrenchment schemes.

Another $1.2-$1.4 million in estimated remaining liabilities related to the prior Board decisions including passage of the poison pill, manipulating the Company's bylaws, and the pursuit of a costly and selfish proxy contest against significant shareholder support - rather than engage in a resolution, they wasted shareholder money. But these are the choices often made when management has no real economic stake in a business.

The liquidation of over $1 million of Paragon's marketable securities in April and May when markets were volatile, selling securities during market lows resulting in meaningful realized losses for Paragon. Today those securities would have appreciated meaningfully.

The quick sale of real estate assets without proper board approval on hastily negotiated terms that likely left $100,000 - $200,000 on the table.

Mismanagement of SI Systems, leading to a significant increase in operating costs without achieving any meaningful revenue gains.

Prior to my removal as CEO, all three of Paragon's subsidiaries were profitable and Paragon's assets included nearly $5 million in cash and marketable securities, net of expenses associated with our previous corporate campaign. Today that figure sits just above $1 million. Some of the wasted resources may be recouped, but the timing and likelihood of any recoupment is uncertain at this time.

Certainly, these expenditures will have a significant financial impact on Paragon and its financial results for the remainder of the year as we clear out the debris left behind. However, this episode also reveals Paragon's underlying strength and resiliency - resiliency that was painstakingly built over years of stewardship by management that was economically aligned with stockholders. We will do it again.

Protecting the downside is the core of our philosophy at Paragon. By prioritizing protecting stockholder capital, we are prioritizing our commitment to enhancing all stakeholder value. Our customers and other partners can rest assured Paragon will continue to be committed to providing them with value in our products and we will serve you with the utmost reliability, quality, and service.

And that brings us to the future-where our energy is now fully focused. Our mood and outlook are positive. The right leaders are back at the Company, and we have quickly acted and are seeing some results. SEDC just posted its highest monthly sales of the year in July, exceeding $13 million. We are already hard at work executing on the plan we laid out to shareholders: re-engaging with our partners, setting the initial steps for the expansion of our distribution and automation businesses and cutting unnecessary costs. We are focusing on long-term value while also prioritizing the need to minimize future financial loss in the short term.

To the vast majority of shareholders who stood with us through this process, we thank you. We can never promise perfection, but you can once again rely on us to communicate candidly, conduct our business affairs with prudence and integrity, and make decisions through the lens of owners - a recipe that has produced a decade of tremendous achievement for Paragon. At Paragon, our vision has always been to build something that lasts - and nothing will shake our confidence in doing just that. We have some rebuilding to do and that will take time, but the Company again has management 100% economically aligned with stockholders. We will act boldly and opportunistically, but most of all carefully.

The 2025 annual letter to shareholders is forthcoming (that streak will not be broken!) and I look forward to providing a more detailed overview of Paragon towards the end of the third quarter.

Sincerely

Sham Gad

CEO

Paragon Technologies, Inc.

CONTACT:

[email protected]

SOURCE: Paragon Technologies Inc.

View the original press release on ACCESS Newswire

A.Williams--AT