-

Stocks slip on strong US growth data

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

-

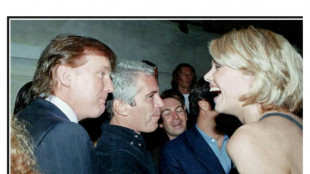

New Epstein files dump contains multiple Trump references

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

Diginex: Capital Discipline Is Becoming the Signal in ESG Infrastructure

-

Kele, Inc. Appoints Mark Sciortino as Chief Growth Officer

-

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

Primary Endpoint Successfully Achieved in Lexaria's Phase 1b Study GLP-1-H24-4

-

SMX Expands Precious Metals Strategy Through New Identity Infrastructure Partnerships

-

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

NuRAN Announces Closing of the Restructuring Transaction and Initial Tranche of Additional Debt Settlements

-

Dolphin Subsidiary Shore Fire Media's Podcast Clients Recognized as 2025's Best

-

Who Is the Best Plastic Surgery Marketing Company?

Who Is the Best Plastic Surgery Marketing Company?

-

Snaplii Simplifies Holiday Gifting with Smart Cash Gift Cards, Built-In Savings

-

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

QS Energy Positions AOT 3.0 for Full‑Pipeline, Global Deployment

-

Flushing Bank Expands Presence in Chinatown with Opening of New Branch

Altigen Technologies Reports Third Quarter Results for Fiscal Year 2025

NEWARK, CALIFORNIA / ACCESS Newswire / July 31, 2025 / Altigen Technologies (OTCQB:ATGN), a leading Silicon Valley-based Microsoft Cloud Communications Solutions provider, announced today its financial results for the third quarter ended June 30, 2025.

Key Financial Highlights (3Q 2025 versus 3Q 2024)

Net Revenue increased 7% to $3.52 million

Cloud services revenue decreased 1% to $1.69 million;

Service and Other revenue increased 25% to $1.56 million;

Gross margin increased to 63%, compared with 61%;

GAAP net income was $111 thousand, compared with $62 thousand.

"Our fiscal third quarter marked Altigen's fifth consecutive quarter of profitability," said Jeremiah Fleming, President and CEO of Altigen Technologies. "Compared to the same period last year, we delivered improvements across nearly every key financial metric, demonstrating that our digital transformation strategy is clearly taking hold."

Trended Financial Information (in thousands, except for EPS and percentages) | ||||||||||

Fiscal | Fiscal | Fiscal | Fiscal | Fiscal | ||||||

3Q25 | 2Q25 | 1Q25 | 4Q24 | 3Q24 | ||||||

Total Revenue | $ | 3,517 | $ | 3,500 | $ | 3,378 | $ | 3,736 | $ | 3,283 |

Cloud Services | 1,685 | 1,680 | 1,720 | 1,680 | 1,710 | |||||

Services and Other | 1,563 | 1,552 | 1,366 | 1,731 | 1,249 | |||||

Legacy Products (Recurring) | 269 | 268 | 292 | 325 | 324 | |||||

GAAP Operating (Loss) / Income | $ | 125 | $ | 283 | $ | 75 | $ | 209 | $ | 68 |

Operating Margin | 3.6 | % | 8.1 | % | 2.2 | % | 0.7 | % | 2.1 | % |

GAAP Net Income/(Loss) | $ | 111 | $ | 287 | $ | 87 | $ | 2,079 | $ | 62 |

Adjusted EBITDA (1) | 645 | 314 | 291 | 507 | 214 | |||||

Adjusted EBITDA excludes one-time litigation costs and other non-recurring or unusual charges that may arise from time to time that we do not consider to be directly related to core operating performance.

Conference Call

Altigen will be discussing its financial results and outlook on a conference call today at 1:00 p.m. Pacific Time (4:00 p.m. ET). The conference call can be accessed by dialing (888) 506-0062 (domestic) or (973) 528-0011 (international), conference ID #822684. To access the replay, dial (877) 481-4010 (domestic) or (919) 882-2331 (international), conference ID #52683. A web archive will be made available at www.altigen.com for 90 days following the call's conclusion.

About Altigen Technologies

Altigen Technologies (OTCQB:ATGN) is focused on driving digital transformation in today's modern workplace. Our Cloud Communications solutions and Technology Consulting services empower companies of all sizes to elevate customer engagement, increase employee productivity and improve operational efficiency. We're headquartered in Silicon Valley with operations strategically located in five countries spanning three continents. For more information, call 1-888-ALTIGEN or visit our website at www.altigen.com.

Safe Harbor Statement

This press release contains forward‐looking information. The statements are based on reasonable assumptions, beliefs and expectations of management and the Company provides no assurance that actual events will meet management's expectations. Furthermore, the forward-looking statements contained in this press release are based on the Company's views of future events and financial performances which are subject to known and unknown risks and uncertainties including, but not limited to, statements regarding the Company's operational improvements, performance enhancements, AI solution development, and expectations for sustainable growth. There can be no assurances that the Company will achieve the expected results, and actual results may be materially different than expectations and from those stated or implied in forward-looking statements.

Please refer to the Company's most recent Annual Report filed with the OTCQB over-the-counter market for a further discussion of risks and uncertainties. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. The Company does not undertake any obligation to update any forward-looking statements.

Contact:

Altigen Communications, Inc.

Investor Relations - [email protected]

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except shares and per share data)

June 30, | September 30, | |||

2025 | 2024 | |||

(unaudited) | ||||

ASSETS | ||||

Current assets: | ||||

Cash and cash equivalents | $ | 3,471 | $ | 2,575 |

Accounts receivable, net | 1,185 | 1,770 | ||

Other current assets | 155 | 185 | ||

Total current assets | 4,811 | 4,530 | ||

Property and equipment, net | - | - | ||

Operating lease right-of-use assets | 68 | 149 | ||

Goodwill | 2,725 | 2,725 | ||

Intangible assets, net | 1,177 | 1,242 | ||

Capitalized software development cost, net | 1,490 | 1,363 | ||

Deferred tax asset | 5,638 | 5,638 | ||

Other long-term assets | 15 | 2 | ||

Total assets | $ | 15,924 | $ | 15,649 |

LIABILITIES AND STOCKHOLDERS' EQUITY | ||||

Current liabilities: | ||||

Accounts payable | $ | 294 | $ | 98 |

Accrued compensation and benefits | 562 | 593 | ||

Accrued expenses | 143 | 446 | ||

Deferred consideration - current | 744 | 744 | ||

Operating lease liabilities - current | 47 | 104 | ||

Deferred revenue - current | 538 | 481 | ||

Total current liabilities | 2,328 | 2,466 | ||

Deferred consideration - long-term | - | - | ||

Operating lease liabilities - long-term | 32 | 49 | ||

Deferred revenue - long-term | 95 | 176 | ||

Total liabilities | 2,455 | 2,691 | ||

Stockholders' equity: | ||||

Common stock | 24 | 24 | ||

Treasury stock | -1,579 | -1,565 | ||

Additional paid-in capital | 73,233 | 73,193 | ||

Accumulated deficit | -58,209 | -58,694 | ||

Total stockholders' equity | 13,469 | 12,958 | ||

Total liabilities and stockholders' equity | $ | 15,924 | $ | 15,649 |

(1) The information in this column was derived from the Company's audited consolidated financial statements as of and for the year ended September 30, 2024.

ALTIGEN COMMUNICATIONS, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

Three Months Ended | Nine Months Ended | |||||||||||

June 30, | June 30, | |||||||||||

2025 | 2024 | 2025 | 2024 | |||||||||

Net revenue | $ | 3,517 | $ | 3,283 | $ | 10,395 | $ | 9,883 | ||||

Gross profit | 2,199 | 1,994 | 6,494 | 6,009 | ||||||||

Operating expenses: | ||||||||||||

Research and development | 411 | 945 | 1,095 | 3,383 | ||||||||

Selling, general & administrative | 1,663 | 980 | 4,924 | 3,141 | ||||||||

Operating income (loss) | 125 | 69 | 475 | (515 | ) | |||||||

Other expense | (7 | ) | (5 | ) | - | (23 | ) | |||||

Interest and other income | 15 | 16 | 41 | 37 | ||||||||

Net income (loss) before provision for income taxes | 133 | 80 | 516 | (501 | ) | |||||||

Income tax benefit (expense) (1) | (22 | ) | (18 | ) | (32 | ) | (18 | ) | ||||

Net income (loss) | $ | 111 | $ | 62 | $ | 484 | $ | (519 | ) | |||

Per share data: | ||||||||||||

Basic | $ | 0.00 | $ | 0.00 | $ | 0.01 | $ | (0.02 | ) | |||

Diluted | $ | 0.00 | $ | 0.00 | $ | 0.01 | $ | (0.02 | ) | |||

Weighted average shares outstanding: | ||||||||||||

Basic | 25,852 | 24,919 | 25,601 | 24,919 | ||||||||

Diluted | 25,952 | 26,026 | 25,952 | 24,919 | ||||||||

ALTIGEN COMMUNICATIONS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

Nine Months Ended | |||||

June 30, | |||||

2025 | 2024 | ||||

Cash flows from operating activities: | |||||

Net income (loss) | $ | 484 | $ | (519 | ) |

Adjustments to reconcile net income to net cash from operating activities: | |||||

Depreciation and amortization | - | 3 | |||

Deferred income tax expense | - | - | |||

Amortization of intangible assets | 150 | 137 | |||

Amortization of capitalized software | 168 | 311 | |||

Adjustment for non-cash operating lease expenses | 7 | ||||

Stock-based compensation | 41 | 42 | |||

Changes in operating assets and liabilities: | |||||

Accounts receivable and unbilled accounts receivable | 573 | (277 | ) | ||

Prepaid expenses and other current assets | 42 | (51 | ) | ||

Other long-term assets | (12 | ) | - | ||

Accounts payable | 196 | 43 | |||

Accrued expenses | (585 | ) | (47 | ) | |

Deferred revenue | 152 | 96 | |||

Net cash provided by (used in) operating activities | 1,216 | (262 | ) | ||

Cash flows from investing activities: | |||||

Purchase of intangible assets | (85 | ) | |||

Capitalized software development costs | (221 | ) | (377 | ) | |

Net cash provided by (used in) investing activities | (306 | ) | (377 | ) | |

Cash flows from financing activities: | |||||

Payment related to business acquisition | - | - | |||

Exercise of stock option | (14 | ) | 0 | ||

Net cash provided by (used in) financing activities | - | - | |||

Net increase (decrease) in cash and cash equivalents | 896 | (639 | ) | ||

Cash and cash equivalents, beginning of year | 2,575 | 2,641 | |||

Cash and cash equivalents, end of year | $ | 3,471 | $ | 2,002 | |

ALTIGEN COMMUNICATIONS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data)

Three Months Ended | Nine Months Ended | ||||||||||

June 30, | June 30, | ||||||||||

2025 | 2024 | 2025 | 2024 | ||||||||

Reconciliation of GAAP to Non-GAAP Gross Profit: | |||||||||||

GAAP gross profit | $ | 2,199 | $ | 1,994 | $ | 6,494 | $ | 6,009 | |||

Amortization of capitalized software | 87 | 70 | 158 | 279 | |||||||

Amortization of acquired customer relationships | 40 | 40 | 120 | 120 | |||||||

Non-GAAP gross profit | $ | 2,326 | $ | 2,104 | $ | 6,772 | $ | 6,408 | |||

Reconciliation of GAAP to Non-GAAP Expenses: | |||||||||||

GAAP operating expenses | $ | 2,074 | $ | 1,925 | $ | 3,937 | $ | 6,524 | |||

Depreciation and amortization | - | 1 | - | 3 | |||||||

Amortization of capitalized software | 0 | 9 | 11 | 32 | |||||||

Amortization of intangible assets | 10 | 6 | 30 | 18 | |||||||

Stock-based compensation | 9 | 14 | 41 | 42 | |||||||

Non-GAAP operating expenses | $ | 2,055 | $ | 1,895 | $ | 3,855 | $ | 6,429 | |||

Reconciliation of GAAP to Non-GAAP Net Income: | |||||||||||

GAAP net profit / (loss) | $ | 110 | $ | 62 | $ | 484 | $ | (519 | ) | ||

Depreciation and amortization | - | 1 | - | 3 | |||||||

Amortization of capitalized software | 87 | 79 | 169 | 311 | |||||||

Amortization of intangible assets | 50 | 46 | 150 | 138 | |||||||

Stock-based compensation | 9 | 14 | 41 | 42 | |||||||

Deferred tax asset valuation allowance | - | - | - | - | |||||||

Non-GAAP net income | $ | 256 | $ | 202 | $ | 844 | $ | (25 | ) | ||

Per share data: | |||||||||||

Basic | $ | 0.00 | $ | 0.01 | $ | 0.01 | $ | 0.00 | |||

Diluted | $ | 0.00 | $ | 0.01 | $ | 0.01 | $ | 0.00 | |||

Weighted average shares outstanding: | |||||||||||

Basic | 25,852 | 24,919 | 25,601 | 24,919 | |||||||

Diluted | 25,952 | 26,026 | 25,952 | 24,919 | |||||||

Non-GAAP Financial Measures

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of our core operating performance on a period-to-period basis. These non-GAAP financial measures exclude stock-based compensation expense, amortization of acquired intangible assets, depreciation and amortization expenses, acquisition-related costs, change in deferred tax asset valuation allowance, litigation costs and other non-recurring or unusual charges or benefits that may arise from time to time that we do not consider to be directly related to core operating performance. We use non-GAAP measures to evaluate the core operating performance of our business and to perform financial planning. Since we find these measures to be useful, we believe that investors benefit from seeing results reviewed by management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with our GAAP financials, provide useful information to investors by facilitating: (i) the comparability of our on-going operating results over the periods presented and (ii) the ability to identify trends in our underlying business.

SOURCE: Altigen Technologies

View the original press release on ACCESS Newswire

P.A.Mendoza--AT