-

Australia four wickets from Ashes glory as England cling on

Australia four wickets from Ashes glory as England cling on

-

Beetles block mining of Europe's biggest rare earths deposit

-

French culture boss accused of mass drinks spiking to humiliate women

French culture boss accused of mass drinks spiking to humiliate women

-

NBA champions Thunder suffer rare loss to Timberwolves

-

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

Burning effigy, bamboo crafts at once-a-decade Hong Kong festival

-

Joshua knocks out Paul to win Netflix boxing bout

-

Dogged Hodge ton sees West Indies save follow-on against New Zealand

Dogged Hodge ton sees West Indies save follow-on against New Zealand

-

England dig in as they chase a record 435 to keep Ashes alive

-

Wembanyama 26-point bench cameo takes Spurs to Hawks win

Wembanyama 26-point bench cameo takes Spurs to Hawks win

-

Hodge edges towards century as West Indies 310-4, trail by 265

-

US Afghans in limbo after Washington soldier attack

US Afghans in limbo after Washington soldier attack

-

England lose Duckett in chase of record 435 to keep Ashes alive

-

Australia all out for 349, set England 435 to win 3rd Ashes Test

Australia all out for 349, set England 435 to win 3rd Ashes Test

-

US strikes over 70 IS targets in Syria after attack on troops

-

Australian lifeguards fall silent for Bondi Beach victims

Australian lifeguards fall silent for Bondi Beach victims

-

Trump's name added to Kennedy Center facade, a day after change

-

West Indies 206-2, trail by 369, after Duffy's double strike

West Indies 206-2, trail by 369, after Duffy's double strike

-

US strikes Islamic State group in Syria after deadly attack on troops

-

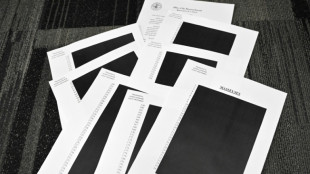

Epstein files opened: famous faces, many blacked-out pages

Epstein files opened: famous faces, many blacked-out pages

-

Ravens face 'special' Patriots clash as playoffs come into focus

-

Newly released Epstein files: what we know

Newly released Epstein files: what we know

-

Musk wins US court appeal of $56 bn Tesla pay package

-

US judge voids murder conviction in Jam Master Jay killing

US judge voids murder conviction in Jam Master Jay killing

-

Trump doesn't rule out war with Venezuela

-

Haller, Aouar out of AFCON, Zambia coach drama

Haller, Aouar out of AFCON, Zambia coach drama

-

Nasdaq rallies again while yen falls despite BOJ rate hike

-

Bologna win shoot-out with Inter to reach Italian Super Cup final

Bologna win shoot-out with Inter to reach Italian Super Cup final

-

Brandt and Beier send Dortmund second in Bundesliga

-

Trump administration begins release of Epstein files

Trump administration begins release of Epstein files

-

UN Security Council votes to extend DR Congo mission by one year

-

Family of Angels pitcher, club settle case over 2019 death

Family of Angels pitcher, club settle case over 2019 death

-

US university killer's mystery motive sought after suicide

-

Rubio says won't force deal on Ukraine as Europeans join Miami talks

Rubio says won't force deal on Ukraine as Europeans join Miami talks

-

Burkinabe teen behind viral French 'coup' video has no regrets

-

Brazil court rejects new Bolsonaro appeal against coup conviction

Brazil court rejects new Bolsonaro appeal against coup conviction

-

Three-time Grand Slam winner Wawrinka to retire in 2026

-

Man Utd can fight for Premier League title in next few years: Amorim

Man Utd can fight for Premier League title in next few years: Amorim

-

Pandya blitz powers India to T20 series win over South Africa

-

Misinformation complicated Brown University shooting probe: police

Misinformation complicated Brown University shooting probe: police

-

IMF approves $206 mn aid to Sri Lanka after Cyclone Ditwah

-

US halts green card lottery after MIT professor, Brown University killings

US halts green card lottery after MIT professor, Brown University killings

-

Stocks advance as markets cheer weak inflation

-

Emery says rising expectations driving red-hot Villa

Emery says rising expectations driving red-hot Villa

-

Three killed in Taipei metro attacks, suspect dead

-

Seven Colombian soldiers killed in guerrilla attack: army

Seven Colombian soldiers killed in guerrilla attack: army

-

Amorim takes aim at Man Utd youth stars over 'entitlement'

-

Mercosur meets in Brazil, EU eyes January 12 trade deal

Mercosur meets in Brazil, EU eyes January 12 trade deal

-

US Fed official says no urgency to cut rates, flags distorted data

-

Rome to charge visitors for access to Trevi Fountain

Rome to charge visitors for access to Trevi Fountain

-

Spurs 'not a quick fix' for under-fire Frank

Breaking Update - BOI Reporting is Back: New Filing Deadline Set for January 13, 2025

Recent regulatory changes have brought significant updates to the reporting obligations for companies filing beneficial ownership information with FinCEN. Following a federal Court of Appeals decision on December 23, 2024, reporting companies, except as indicated below, are once again required to file beneficial ownership information with FinCEN.

The Department of the Treasury recognizes that reporting companies may need additional time to comply, given the period when the preliminary injunction had been in effect. As such, the BOI reporting deadlines have been extended as follows:

Updated BOI Filing Deadlines:

Reporting companies created or registered before January 1, 2024: The deadline has been extended to January 13, 2025 (originally January 1, 2025) for filing initial BOI reports with FinCEN.

Reporting companies created or registered on or after September 4, 2024, that had a filing deadline between December 3, 2024, and December 23, 2024, now have an extended deadline of January 13, 2025.

Reporting companies created or registered between December 3, 2024, and December 23, 2024: These companies are granted an additional 21 days from the original filing deadline to file BOI reports.

Reporting companies created or registered on or After January 1, 2025: Must file BOI reports within 30 days of receiving actual or public notice of creation or registration.

Reporting Companies Qualifying for Disaster Relief: Deadlines may extend beyond January 13, 2025. Follow the later deadline that applies.

TaxBandits: The Solution for Timely and Stress-Free BOI Reporting

With BOI Reporting reinstated, businesses must begin preparing the necessary information to ensure the timely submission of their BOI reports. TaxBandits offers a comprehensive suite of features designed to facilitate accurate and on-time BOI filing for reporting companies, tax professionals, law firms, and service providers.

Key Features to Simplify BOI Reporting:

BOIR Protect: In partnership with Protection Plus, BOIR Protect provides peace of mind with a $1 Million BOI Filing Defense, covering potential errors or issues with filings for a full year.

Free Corrections or Updates: TaxBandits offers free corrections or updates for up to 7 days. Annual plan subscribers can file unlimited corrections or updates for one year.

Retransmit Rejected Returns for Free: When FinCEN rejects a BOI report, it can be re-transmitted without additional charges, ensuring prompt corrections and resubmission.

Easy Corrections: Update existing data and submit without needing to refile the entire report, saving time and ensuring accuracy.

Invite Beneficial Owners: Securely invite beneficial owners to complete their details via a secure URL, ensuring only authorized individuals can access and complete the necessary information.

AI-Based Data Extract: TaxBandit's AI-powered technology automatically extracts data from uploaded identification documents, eliminating the need for manual data entry and minimizing errors.

Schedule Filing: Prepare reports, schedule submission dates, and ensure automatic submission as planned. Reports can be edited multiple times before the scheduled date, minimizing the need for subsequent corrections or updates.

For CPAs and Service Providers:

TaxBandits' BOI reporting solution empowers tax professionals with features that drive efficiency. Compliance reminders, customizable engagement letters, and BanditConnect streamline reporting.

Secure Client Portal: BanditConnect provides a secure client portal for efficiently managing BOI filings. Businesses can customize the portal with their branding to enable seamless collaboration, secure data exchange, and an efficient review and approval process.

Team Management: The BanditCollab tool enables the invitation of unlimited team members, assignment of predefined roles, and delegation of BOI report filings. This ensures efficient workload management and timely completion of tasks.

Automated Reminders: Set up automated reminders for updates and upcoming deadlines from FinCEN, eliminating the need for manual follow-ups and ensuring timely action on all filings.

Custom Engagement Letter: Customize engagement letters with specific terms and conditions, auto-fill client details, request e-signatures, and update them at any time, ensuring a streamlined and efficient agreement process for BOI filing services.

Bulk Upload: Streamline BOI filings with the Bulk Upload feature! Use the standard CSV template to import data all at once, saving time and reducing manual effort.

Partnership Opportunities to Increase Revenue

TaxBandits provides an array of services tailored for large enterprises, accounting firms, and other businesses looking to expand their BOI reporting services.

Referral Program: Clients can participate in TaxBandits' referral program, obtain a referral link, incorporate it into their website or social media, and earn commissions for each completed filing.

API Integration: TaxBandits offers seamless API integration, enabling easy connection with existing business systems. This integration optimizes the BOI filing process by streamlining workflows and minimizing manual data entry, thus improving operational efficiency.

White-Label Solution: TaxBandits provides a white-label solution, allowing firms to brand the BOI filing platform fully as their own. This customization ensures businesses can offer a consistent and professional experience to their clients.

TaxBandits' BOI reporting solution empowers tax professionals with features that drive efficiency. Compliance reminders, customizable engagement letters, and BanditConnect streamline reporting. Watch the video to learn more about TaxBandits' BOIR filing solution and the original FinCEN requirements that have been reinstated:

About TaxBandits

TaxBandits is a SOC 2 Certified, IRS-authorized e-file provider specializing in various tax forms such as Form 941, Form 940, Form 1099, Form W-2, Form 1095-C, Form 1095-B, and Form W-9, etc., and BOI reporting. Serving businesses, service providers, or tax professionals of every shape and size, TaxBandits offers a complete solution that fulfills all filing needs.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN has been developing industry-leading software tools for e-filing and business management tools for over a decade.

The SPAN Enterprises Portfolio of products includes TaxBandits, ACAwise, ExpressExtension, 123PayStubs, and TruckLogics.

Please direct all media inquiries to Stephanie Glanville, Marketing Manager, at [email protected].

SOURCE: TaxBandits

N.Mitchell--AT