-

Australia's Liberals elect net zero opponent as new leader

Australia's Liberals elect net zero opponent as new leader

-

Arsenal must block out noise in 'rollercoaster' title race: Rice

-

Suns forward Brooks banned one game for technical fouls

Suns forward Brooks banned one game for technical fouls

-

N. Korea warns of 'terrible response' if more drone incursions from South

-

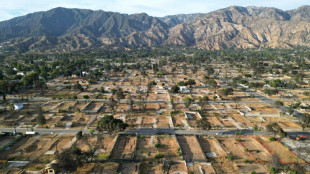

LA fires: California probes late warnings in Black neighborhoods

LA fires: California probes late warnings in Black neighborhoods

-

Atletico rout Barca in Copa del Rey semi-final first leg

-

Arsenal held by Brentford to offer Man City Premier League title hope

Arsenal held by Brentford to offer Man City Premier League title hope

-

US snowboard star Kim 'proud' as teenager Choi dethrones her at Olympics

-

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

Chloe Kim misses Olympic milestone, Ukrainian disqualfied over helmet

-

Tech shares pull back ahead of US inflation data

-

'Beer Man' Castellanos released by MLB Phillies

'Beer Man' Castellanos released by MLB Phillies

-

Canada PM to join mourners in remote town after mass shooting

-

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

Teenager Choi wrecks Kim's Olympic snowboard hat-trick bid

-

Inter await Juve as top guns go toe-to-toe in Serie A

-

Swiatek, Rybakina dumped out of Qatar Open

Swiatek, Rybakina dumped out of Qatar Open

-

Europe's most powerful rocket carries 32 satellites for Amazon Leo network into space

-

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

Neighbor of Canada mass shooter grieves after 'heartbreaking' attack

-

French Olympic ice dance champions laud 'greatest gift'

-

Strange 'inside-out' planetary system baffles astronomers

Strange 'inside-out' planetary system baffles astronomers

-

Teenager Choi denies Kim Olympic snowboard hat-trick

-

Swiss bar owners face wrath of bereaved families

Swiss bar owners face wrath of bereaved families

-

EU vows reforms to confront China, US -- but split on joint debt

-

Rubio heads to Munich to heap pressure on Europeans

Rubio heads to Munich to heap pressure on Europeans

-

Less glamour, more content, says Wim Wenders of Berlin Film Fest

-

What is going on with Iran-US talks?

What is going on with Iran-US talks?

-

Wales 'means everything' for prop Francis despite champagne, oysters in France

-

Giannis out and Spurs' Fox added to NBA All-Star Game

Giannis out and Spurs' Fox added to NBA All-Star Game

-

The secret to an elephant's grace? Whiskers

-

Chance glimpse of star collapse offers new insight into black hole formation

Chance glimpse of star collapse offers new insight into black hole formation

-

UN climate chief says 'new world disorder' threatens cooperation

-

Player feels 'sadness' after denied Augusta round with grandsons: report

Player feels 'sadness' after denied Augusta round with grandsons: report

-

Trump dismantles legal basis for US climate rules

-

Former Arsenal player Partey faces two more rape charges

Former Arsenal player Partey faces two more rape charges

-

Scotland coach Townsend adamant focus on England rather than his job

-

Canada PM to visit town in mourning after mass shooting

Canada PM to visit town in mourning after mass shooting

-

US lawmaker moves to shield oil companies from climate cases

-

Ukraine says Russia behind fake posts targeting Winter Olympics team

Ukraine says Russia behind fake posts targeting Winter Olympics team

-

Thousands of Venezuelans stage march for end to repression

-

Verstappen slams new cars as 'Formula E on steroids'

Verstappen slams new cars as 'Formula E on steroids'

-

Iranian state TV's broadcast of women without hijab angers critics

-

Top pick Flagg, France's Sarr to miss NBA Rising Stars

Top pick Flagg, France's Sarr to miss NBA Rising Stars

-

Sakkari fights back to outlast top-seed Swiatek in Qatar

-

India tune-up for Pakistan showdown with 93-run rout of Namibia

India tune-up for Pakistan showdown with 93-run rout of Namibia

-

Lollobrigida skates to second Olympic gold of Milan-Cortina Games

-

Comeback queen Brignone stars, Ukrainian banned over helmet

Comeback queen Brignone stars, Ukrainian banned over helmet

-

Stocks diverge as all eyes on corporate earnings

-

'Naive optimist' opens Berlin Film Festival with Afghan romantic comedy

'Naive optimist' opens Berlin Film Festival with Afghan romantic comedy

-

'Avatar' and 'Assassin's Creed' shore up troubled Ubisoft

-

'Virgin' frescoes emerge from Pompeii suburb

'Virgin' frescoes emerge from Pompeii suburb

-

Ukrainian's disqualification from Winter Olympics gives Coventry first test

Tech shares pull back ahead of US inflation data

Wall Street stocks tumbled Thursday following another pullback in tech shares as markets look ahead to a key inflation reading.

Apple, Amazon and Facebook parent Meta were among the large tech companies losing more than two percent in a session that began benignly but ended deep in the red, with the Nasdaq off more than two percent.

"We continue to have selling in tech," said Art Hogan of B. Riley Wealth Management. "There are concerns over what AI might disrupt."

Markets have digested mixed US economic data this week, with poor retail sales and existing-home sales offsetting strong US employment data. Investors looking forward to Friday's release of consumer price inflation (CPI) data for January for further clues on potential rate cuts.

"Caught between payrolls and CPI, US markets have found themselves unable to maintain momentum," said Chris Beauchamp, chief market analyst at IG trading platform, referring to the jobs report and inflation data.

In Europe, Paris ended with a gain after striking a fresh record high. London's blue-chip FTSE 100 index did the same but ended the day lower, as data showed the British economy managing only tepid growth in the final quarter of last year.

"The strength seen in Europe...comes from improved earnings data from some of the big hitters," said Joshua Mahony, chief market analyst at Scope Markets.

Shares in German industrial giant Siemens jumped 5.8 percent as it raised its outlook for the year after a strong first quarter boosted by spending on artificial intelligence.

In Paris, RayBan maker EssilorLuxottica shares rose 3.8 percent as its fourth-quarter earnings beat market expectations. Hermes climbed 2.8 percent after reporting 2025 sales growth despite the impact of US tariffs and a weaker dollar.

But French pharma giant Sanofi sank 4.2 percent after the surprise ouster of its chief executive Paul Hudson, suggesting growing concerns about the company's pipeline for new products. He will be replaced by Belen Garijo, currently chief of Germany's Merck KGaA.

Asian markets were subdued after the lackluster US close on Wednesday, where tech firms came in for further selling amid concerns of the scale of massive AI investments and their eventual impact on various industries.

- Key figures at around 2130 GMT -

New York - Dow: DOWN 1.3 percent at 49,451.98 (close)

New York - S&P 500: DOWN 1.6 percent at 6,832.76 (close)

New York - Nasdaq: DOWN 2.0 percent at 22,597.15 (close)

London - FTSE 100: DOWN 0.7 at 10,402.44 (close)

Paris - CAC 40: UP 0.3 percent at 8,340.56 (close)

Frankfurt - DAX: FLAT at 24,852.69 (close)

Tokyo - Nikkei 225: FLAT at 57,639.84 (close)

Hong Kong - Hang Seng Index: DOWN 0.9 percent at 27,032.54 (close)

Shanghai - Composite: UP 0.1 percent at 4,134.02 (close)

Euro/dollar: UP at $1.1876 from $1.1872 on Wednesday

Pound/dollar: DOWN at $1.3620 from $1.3628

Dollar/yen: UP at 152.75 yen from 153.26 yen

Euro/pound: UP at 87.16 pence from 87.11 pence

Brent North Sea Crude: DOWN 2.7 percent at $67.52 per barrel

West Texas Intermediate: DOWN 2.8 percent at $62.84 per barrel

burs-jmb/sla

A.Clark--AT