-

Arsenal's Merino has earned striking role: Arteta

Arsenal's Merino has earned striking role: Arteta

-

Putin offers India 'uninterrupted' oil in summit talks with Modi

-

New Trump strategy vows shift from global role to regional

New Trump strategy vows shift from global role to regional

-

World Athletics ditches long jump take-off zone reform

-

French town offers 1,000-euro birth bonuses to save local clinic

French town offers 1,000-euro birth bonuses to save local clinic

-

After wins abroad, Syria leader must gain trust at home

-

Slot spots 'positive' signs at struggling Liverpool

Slot spots 'positive' signs at struggling Liverpool

-

Eyes of football world on 2026 World Cup draw with Trump centre stage

-

South Africa rugby coach Erasmus extends contract until 2031

South Africa rugby coach Erasmus extends contract until 2031

-

Ex-Manchester Utd star Lingard announces South Korea exit

-

Australia edge ominously within 106 runs of England in second Ashes Test

Australia edge ominously within 106 runs of England in second Ashes Test

-

Markets rise ahead of US data, expected Fed rate cut

-

McIlroy survives as Min Woo Lee surges into Australian Open hunt

McIlroy survives as Min Woo Lee surges into Australian Open hunt

-

German factory orders rise more than expected

-

India's Modi and Russia's Putin talk defence, trade and Ukraine

India's Modi and Russia's Putin talk defence, trade and Ukraine

-

Flooding kills two as Vietnam hit by dozens of landslides

-

Italy to open Europe's first marine sanctuary for dolphins

Italy to open Europe's first marine sanctuary for dolphins

-

Hong Kong university suspends student union after calls for fire justice

-

Asian markets rise ahead of US data, expected Fed rate cut

Asian markets rise ahead of US data, expected Fed rate cut

-

Nigerian nightlife finds a new extravagance: cabaret

-

Tanzania tourism suffers after election killings

Tanzania tourism suffers after election killings

-

Yo-de-lay-UNESCO? Swiss hope for yodel heritage listing

-

Weatherald fires up as Australia race to 130-1 in second Ashes Test

Weatherald fires up as Australia race to 130-1 in second Ashes Test

-

Georgia's street dogs stir affection, fear, national debate

-

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

Survivors pick up pieces in flood-hit Indonesia as more rain predicted

-

Gibbs runs for three TDs as Lions down Cowboys to boost NFL playoff bid

-

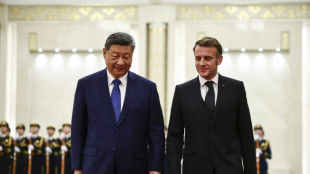

Pandas and ping-pong: Macron ending China visit on lighter note

Pandas and ping-pong: Macron ending China visit on lighter note

-

TikTok to comply with 'upsetting' Australian under-16 ban

-

Hope's resistance keeps West Indies alive in New Zealand Test

Hope's resistance keeps West Indies alive in New Zealand Test

-

Pentagon endorses Australia submarine pact

-

India rolls out red carpet for Russia's Putin

India rolls out red carpet for Russia's Putin

-

Softbank's Son says super AI could make humans like fish, win Nobel Prize

-

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

LeBron scoring streak ends as Hachimura, Reaves lift Lakers

-

England all out for 334 in second Ashes Test

-

Hong Kong university axes student union after calls for fire justice

Hong Kong university axes student union after calls for fire justice

-

'Annoying' Raphinha pulling Barca towards their best

-

Prolific Kane and Undav face off as Bayern head to Stuttgart

Prolific Kane and Undav face off as Bayern head to Stuttgart

-

Napoli's title defence continues with visit of rivals Juventus

-

Nice host Angers with storm clouds gathering over the Riviera

Nice host Angers with storm clouds gathering over the Riviera

-

OpenAI strikes deal on US$4.6 bn AI centre in Australia

-

Rains hamper Sri Lanka cleanup after deadly floods

Rains hamper Sri Lanka cleanup after deadly floods

-

In India's mining belt, women spark hope with solar lamps

-

After 15 years, Dutch anti-blackface group declares victory

After 15 years, Dutch anti-blackface group declares victory

-

Eyes of football world fixed on 2026 World Cup draw with Trump presiding

-

West Indies on the ropes in record run chase against New Zealand

West Indies on the ropes in record run chase against New Zealand

-

'Only a miracle can end this nightmare': Eritreans fear new Ethiopia war

-

Unchecked mining waste taints DR Congo communities

Unchecked mining waste taints DR Congo communities

-

McIntosh swims second-fastest 400m free ever in US Open triumph

-

Asian markets mixed ahead of US data, expected Fed rate cut

Asian markets mixed ahead of US data, expected Fed rate cut

-

French almond makers revive traditions to counter US dominance

Stocks struggle as data shows drop in US jobs

Equities struggled on Wednesday as data showed US businesses unexpectedly shed jobs last month.

The US private sector lost 32,000 jobs in November, according to payroll firm ADP, compared to a small gain expected by analysts.

The jobs numbers reinforced concerns over the health of the US economy, which has struggled with dislocations and price rises caused by tariffs introduced by President Donald Trump's administration.

"There's no way to portray that as good news, unless, of course, you're a stock trader who is focused more on the likelihood for Fed cuts than you are about what it says about the economy," said Steve Sosnick of Interactive Brokers.

After opening lower, all three of Wall Street's main indices had pushed into positive territory by mid-morning, with the jobs figures underpinning expectations that the US Federal Reserve will cut interest rates next week.

The tech-heavy Nasdaq Composite slid back into the red.

"The modest fall in the ADP payrolls measure in November... should be enough to persuade the FOMC to vote for another cut next week," said Stephen Brown at Capital Economics.

Money markets now put the chances of the Fed cutting interest rates on December 10 at nearly 90 percent.

Lower interest rates make it easier for companies and consumers to borrow money, so the prospect of Fed rate cuts tends to boost stocks.

Optimism over US rate cuts won an additional boost from reports that Trump's top economic adviser Kevin Hassett -- a proponent of more rate reductions -- is the frontrunner to take the helm at the Fed when Jerome Powell's tenure ends in May.

Investors are also looking ahead to the release on Friday of the Fed's preferred gauge of inflation -- the personal consumption expenditure (PCE) index.

Investors see the Fed cutting rates three times next year, which has been a factor weighing on the dollar.

The euro hit a seven-week high against the dollar, noted analyst Axel Rudolph at trading platform IG.

"The US central bank is expected to cut rates in December with a near 89 percent probability whereas the ECB isn't likely to do so for much of next year," he said.

Meanwhile the pound gained one percent against the dollar, also receiving a boost from data showing stronger than expected activity from the UK services sector.

Stronger sterling weighed on London's benchmark FTSE 100 stock index, which features major companies earning in dollars, and which ended the day down 0.1 percent.

A recovery in Bitcoin has also helped support equity markets.

"A continued bounce in bitcoin and other cryptocurrencies has stoked a renewed speculative bid," said Briefing.com analyst Patrick O'Hare.

Bitcoin is back above $90,000. It plunged below $83,000 last month after having set a record high of $126,251 in October.

Asian stock markets mostly rose Wednesday.

Elsewhere, the Indian rupee weakened past 90 per dollar for the first time, extending declines through the year as New Delhi struggles to strike a trade deal with the United States.

- Key figures at around 1630 GMT -

New York - Dow: UP 0.4 percent at 47,685.20 points

New York - S&P 500: UP 0.1 percent at 6,837.46

New York - Nasdaq Composite: DOWN less than 0.1 percent at 23,402.90

London - FTSE 100: DOWN 0.1 percent at 9,692.07 (close)

Paris - CAC 40: UP 0.2 percent at 8,087.42 (close)

Frankfurt - DAX: DOWN less than 0.1 percent at 23,693.71 (close)

Tokyo - Nikkei 225: UP 1.1 percent at 49,864.68 (close)

Hong Kong - Hang Seng Index: DOWN 1.3 percent at 25,760.73 (close)

Shanghai - Composite: DOWN 0.5 percent at 3,878.00 (close)

Euro/dollar: UP at $1.1664 from $1.1622 on Tuesday

Pound/dollar: UP at $1.3341 from $1.3209

Dollar/yen: DOWN at 155.03 yen from 155.86 yen

Euro/pound: DOWN at 87.43 pence from 88.00 pence

Brent North Sea Crude: UP 1.2 percent at $63.19 per barrel

West Texas Intermediate: UP 1.4 percent at $59.47 per barrel

burs-rl/rlp

A.Clark--AT