-

'Unfair election': young voters absent from Myanmar polls

'Unfair election': young voters absent from Myanmar polls

-

Master Lock Comanche wins Sydney-Hobart ocean race for fifth time

-

Bulgaria adopts euro amid fear and uncertainty

Bulgaria adopts euro amid fear and uncertainty

-

Giannis triumphant in NBA return as Spurs win streak ends

-

Texans reach NFL playoffs and Ravens win to stay in hunt

Texans reach NFL playoffs and Ravens win to stay in hunt

-

How company bets on bitcoin can backfire

-

Touadera on path to third presidential term as Central African Republic votes

Touadera on path to third presidential term as Central African Republic votes

-

'Acoustic hazard': Noise complaints spark Vietnam pickleball wars

-

Iraqis cover soil with clay to curb sandstorms

Iraqis cover soil with clay to curb sandstorms

-

Australia's Head backs struggling opening partner Weatherald

-

'Make emitters responsible': Thailand's clean air activists

'Make emitters responsible': Thailand's clean air activists

-

Zelensky looks to close out Ukraine peace deal at Trump meet

-

MCG curator in 'state of shock' after Ashes Test carnage

MCG curator in 'state of shock' after Ashes Test carnage

-

Texans edge Chargers to reach NFL playoffs

-

Osimhen and Mane score as Nigeria win to qualify, Senegal draw

Osimhen and Mane score as Nigeria win to qualify, Senegal draw

-

Osimhen stars as Nigeria survive Tunisia rally to reach second round

-

How Myanmar's junta-run vote works, and why it might not

How Myanmar's junta-run vote works, and why it might not

-

Zelensky talks with allies en route to US as Russia pummels Ukraine

-

Watkins wants to sicken Arsenal-supporting family

Watkins wants to sicken Arsenal-supporting family

-

Arsenal hold off surging Man City, Villa as Wirtz ends drought

-

Late penalty miss denies Uganda AFCON win against Tanzania

Late penalty miss denies Uganda AFCON win against Tanzania

-

Watkins stretches Villa's winning streak at Chelsea

-

Zelensky stops in Canada en route to US as Russia pummels Ukraine

Zelensky stops in Canada en route to US as Russia pummels Ukraine

-

Arteta salutes injury-hit Arsenal's survival spirit

-

Wirtz scores first Liverpool goal as Anfield remembers Jota

Wirtz scores first Liverpool goal as Anfield remembers Jota

-

Mane rescues AFCON draw for Senegal against DR Congo

-

Arsenal hold off surging Man City, Wirtz breaks Liverpool duck

Arsenal hold off surging Man City, Wirtz breaks Liverpool duck

-

Arsenal ignore injury woes to retain top spot with win over Brighton

-

Sealed with a kiss: Guardiola revels in Cherki starring role

Sealed with a kiss: Guardiola revels in Cherki starring role

-

UK launches paid military gap-year scheme amid recruitment struggles

-

Jota's children join tributes as Liverpool, Wolves pay respects

Jota's children join tributes as Liverpool, Wolves pay respects

-

'Tired' Inoue beats Picasso by unanimous decision to end gruelling year

-

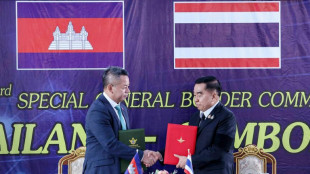

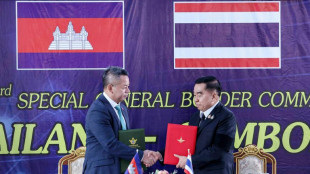

Thailand and Cambodia declare truce after weeks of clashes

Thailand and Cambodia declare truce after weeks of clashes

-

Netanyahu to meet Trump in US on Monday

-

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

US strikes targeted IS militants, Lakurawa jihadists, Nigeria says

-

Cherki stars in Man City win at Forest

-

Schwarz records maiden super-G success, Odermatt fourth

Schwarz records maiden super-G success, Odermatt fourth

-

Russia pummels Kyiv ahead of Zelensky's US visit

-

Smith laments lack of runs after first Ashes home Test loss for 15 years

Smith laments lack of runs after first Ashes home Test loss for 15 years

-

Russian barrage on Kyiv kills one, leaves hundreds of thousands without power

-

Stokes, Smith agree two-day Tests not a good look after MCG carnage

Stokes, Smith agree two-day Tests not a good look after MCG carnage

-

Stokes hails under-fire England's courage in 'really special' Test win

-

What they said as England win 4th Ashes Test - reaction

What they said as England win 4th Ashes Test - reaction

-

Hong Kongers bid farewell to 'king of umbrellas'

-

England snap 15-year losing streak to win chaotic 4th Ashes Test

England snap 15-year losing streak to win chaotic 4th Ashes Test

-

Thailand and Cambodia agree to 'immediate' ceasefire

-

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

Closing 10-0 run lifts Bulls over 76ers while Pistons fall

-

England 77-2 at tea, need 98 more to win chaotic 4th Ashes Test

-

Somalia, African nations denounce Israeli recognition of Somaliland

Somalia, African nations denounce Israeli recognition of Somaliland

-

England need 175 to win chaotic 4th Ashes Test

Stocks climb awaiting next moves in Trump trade war

European and Asian stock markets mostly gained Tuesday as investors continued to react positively to US President Donald Trump's pausing of an EU tariff threat.

London led the way in Europe, up one percent in midday deals, as trading resumed after Monday's UK public holiday.

The dollar gained solidly against main rivals, while Wall Street reopens later after US Memorial Day.

"US futures point to a higher open on indices, as optimism spreads after the holiday break," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

"Trump once again has pressed the pause button, this time on proposed 50 percent tariffs on imports from the European Union, which caused nervousness at the end of last week."

Trump on Sunday delayed 50-percent tariffs on the European Union until July 9 to give more time for negotiations.

The president had sent markets into a tailspin Friday when he threatened to hit EU goods with the huge tariff from June 1 as talks were "going nowhere".

EU trade commissioner Maros Sefcovic said Monday following calls with top US officials that the bloc remains "fully committed" to reaching a trade agreement with the United States.

A key survey Tuesday showed that consumer sentiment in Europe's biggest economy, Germany, inched up heading into June -- but erratic US trade policy and a glum domestic economic outlook kept the gauge at low levels.

The forward-looking indicator, published by pollsters GfK and the Nuremberg Institute for Market Decisions, came in at minus 19.9 points, a rise of 0.9 from the previous month.

It was the third-straight increase for the regular survey of about 2,000 people, which has been boosted by a new German government vowing to kickstart the country's economy following two years of recession.

It was revealed Tuesday that Germany had overtaken Japan as the world's top creditor, with the Asian nation losing top spot after a 34-year reign.

Japan's net external assets as of the end of last year stood at 533.05 trillion yen ($3.7 trillion), up almost 13 percent from a year earlier, according to finance ministry data.

For Japan, a weaker yen contributed to increases in both foreign assets and liabilities, but assets grew at a faster pace, driven in part by expanded business investment abroad, the data added.

Elsewhere on Tuesday, oil prices rose slightly on the eve of the latest OPEC+ meeting to decide on crude output levels from the cartel and its partners, notably Russia.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 1.0 percent at 8,807.27 points

Paris - CAC 40: UP 0.4 percent at 7,855.88

Frankfurt - DAX: UP 0.8 percent at 24,220.99

Tokyo - Nikkei 225: UP 0.5 percent at 37,724.11 (close)

Hong Kong - Hang Seng Index: UP 0.4 percent at 23,381.99 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,340.69 (close)

New York - Dow: Closed Monday for a holiday

Euro/dollar: DOWN at $1.1349 from $1.1382 on Monday

Pound/dollar: DOWN at $1.3540 from $1.3563

Dollar/yen: UP at 144.07 yen from 142.81 yen

Euro/pound: DOWN at 83.88 pence from 83.91 pence

Brent North Sea Crude: UP 0.3 percent at $64.30 per barrel

West Texas Intermediate: UP 0.3 percent at $61.69 per barrel

burs-bcp/ajb/lth

D.Lopez--AT