-

Spanish skater allowed to use Minions music at Olympics

Spanish skater allowed to use Minions music at Olympics

-

Fire 'under control' at bazaar in western Tehran

-

Howe trusts Tonali will not follow Isak lead out of Newcastle

Howe trusts Tonali will not follow Isak lead out of Newcastle

-

Vonn to provide injury update as Milan-Cortina Olympics near

-

France summons Musk for 'voluntary interview', raids X offices

France summons Musk for 'voluntary interview', raids X offices

-

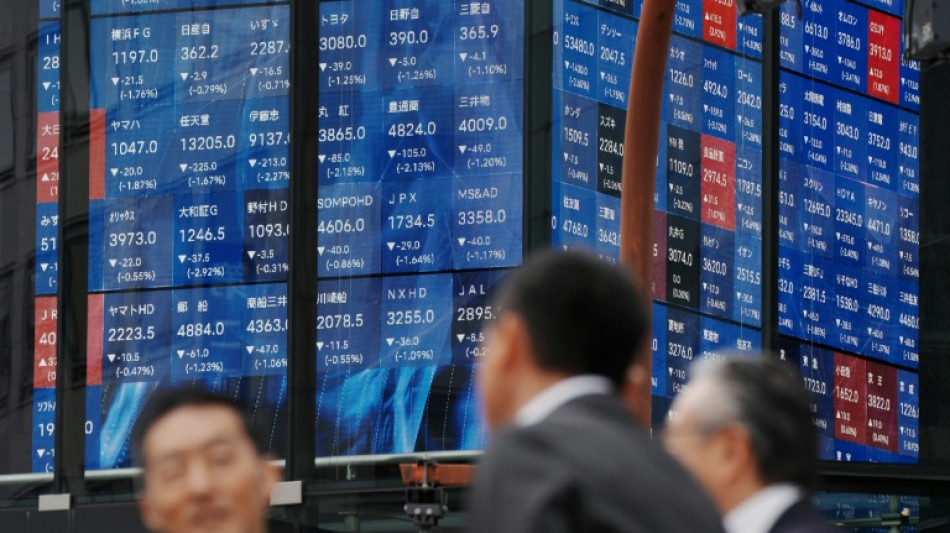

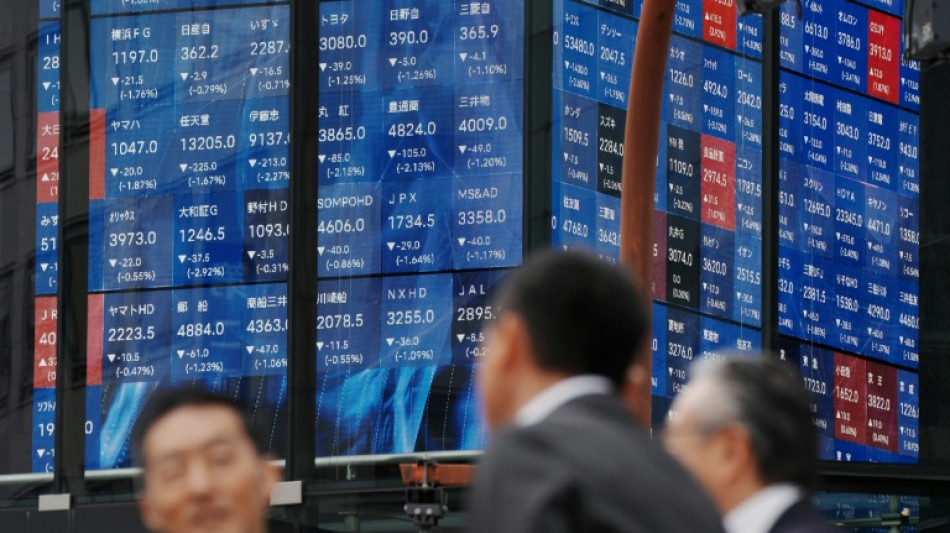

Stocks mostly climb as gold recovers

-

US judge to hear request for 'immediate takedown' of Epstein files

US judge to hear request for 'immediate takedown' of Epstein files

-

Russia resumes large-scale strikes on Ukraine in glacial temperatures

-

Fit-again France captain Dupont partners Jalibert against Ireland

Fit-again France captain Dupont partners Jalibert against Ireland

-

French summons Musk for 'voluntary interview' as authorities raid X offices

-

IOC chief Coventry calls for focus on sport, not politics

IOC chief Coventry calls for focus on sport, not politics

-

McNeil's partner hits out at 'brutal' football industry after Palace move collapses

-

Proud moment as Prendergast brothers picked to start for Ireland

Proud moment as Prendergast brothers picked to start for Ireland

-

Germany has highest share of older workers in EU

-

Teen swims four hours to save family lost at sea off Australia

Teen swims four hours to save family lost at sea off Australia

-

Ethiopia denies Trump claim mega-dam was financed by US

-

Norway crown princess's son pleads not guilty to rapes as trial opens

Norway crown princess's son pleads not guilty to rapes as trial opens

-

Russia resumes strikes on freezing Ukrainian capital ahead of talks

-

Malaysian court acquits French man on drug charges

Malaysian court acquits French man on drug charges

-

Switch 2 sales boost Nintendo profits, but chip shortage looms

-

China to ban hidden car door handles, setting new safety standards

China to ban hidden car door handles, setting new safety standards

-

Switch 2 sales boost Nintendo results but chip shortage looms

-

From rations to G20's doorstep: Poland savours economic 'miracle'

From rations to G20's doorstep: Poland savours economic 'miracle'

-

Russia resumes strikes on freezing Ukrainian capital

-

'Way too far': Latino Trump voters shocked by Minneapolis crackdown

'Way too far': Latino Trump voters shocked by Minneapolis crackdown

-

England and Brook seek redemption at T20 World Cup

-

Coach Gambhir under pressure as India aim for back-to-back T20 triumphs

Coach Gambhir under pressure as India aim for back-to-back T20 triumphs

-

'Helmets off': NFL stars open up as Super Bowl circus begins

-

Japan coach Jones says 'fair' World Cup schedule helps small teams

Japan coach Jones says 'fair' World Cup schedule helps small teams

-

Equities and precious metals rebound after Asia-wide rout

-

Do not write Ireland off as a rugby force, says ex-prop Ross

Do not write Ireland off as a rugby force, says ex-prop Ross

-

Winter Olympics 2026: AFP guide to Alpine Skiing races

-

Winter Olympics to showcase Italian venues and global tensions

Winter Olympics to showcase Italian venues and global tensions

-

Buoyant England eager to end Franco-Irish grip on Six Nations

-

China to ban hidden car door handles in industry shift

China to ban hidden car door handles in industry shift

-

Sengun leads Rockets past Pacers, Ball leads Hornets fightback

-

Waymo raises $16 bn to fuel global robotaxi expansion

Waymo raises $16 bn to fuel global robotaxi expansion

-

Netflix to livestream BTS comeback concert in K-pop mega event

-

Rural India powers global AI models

Rural India powers global AI models

-

US House to vote Tuesday to end shutdown

-

Equities, metals, oil rebound after Asia-wide rout

Equities, metals, oil rebound after Asia-wide rout

-

Bencic, Svitolina make history as mothers inside tennis top 10

-

Italy's spread-out Olympics face transport challenge

Italy's spread-out Olympics face transport challenge

-

Son of Norway crown princess stands trial for multiple rapes

-

Side hustle: Part-time refs take charge of Super Bowl

Side hustle: Part-time refs take charge of Super Bowl

-

Paying for a selfie: Rome starts charging for Trevi Fountain

-

Faced with Trump, Pope Leo opts for indirect diplomacy

Faced with Trump, Pope Leo opts for indirect diplomacy

-

NFL chief expects Bad Bunny to unite Super Bowl audience

-

Australia's Hazlewood to miss start of T20 World Cup

Australia's Hazlewood to miss start of T20 World Cup

-

Bill, Hillary Clinton to testify in US House Epstein probe

Stocks mostly climb as gold recovers

European stock markets mostly rose Tuesday after large gains across Asia, as gold and silver prices strongly rebounded in fresh volatile trading.

The dollar rose and oil prices steadied as investors weighed company earnings against geopolitical unrest.

The price of gold was up 5.5 percent at $4,917.43 an ounce. Last week it reached a record-high close to $5,600 before tumbling.

Silver surged almost ten percent to $87 on Tuesday, still well short of the record near $120 it hit last week.

"A sense of calm descended after the precious metal ructions, opening the door for investors to buy on the dip," noted Richard Hunter, head of markets at Interactive Investor.

Hopes for the US economy, boosted by forecast-beating manufacturing data, provided investors a much-needed catalyst for a rally Monday on Wall Street.

That fed through to Asia, where Tokyo closed with a gain of 3.9 percent on Tuesday.

Mumbai's Nifty index soared almost five percent as investors welcomed President Donald Trump's announcement of a US-India trade deal.

Trump also pledged to cut tariffs on the country's goods after Prime Minister Narendra Modi promised to stop buying Russian oil over the war in Ukraine.

In Europe, Frankfurt and Paris stock markets rose slightly and London dipped nearing the half-way stage.

Investors sat tight ahead of interest-rate decisions due Thursday from the European Central Bank and Bank of England.

The dollar firmed Tuesday, supported by US President Donald Trump recently tapping Kevin Warsh -- considered the most hawkish of his candidates -- to head the Federal Reserve.

On the corporate front, Elon Musk's SpaceX has taken over his artificial intelligence company xAI in a merger aimed at deploying space-based data centres.

According to Bloomberg, the combined company would have a valuation of $1.25 trillion.

All eyes will be on more earnings from major companies this week, with particular attention on the tech sector and planned investment in artificial intelligence.

Traders are keeping tabs also on Washington after Trump urged the House of Representatives to swiftly adopt a spending bill and end a fresh government shutdown.

"The latest US government shutdown looks to provide yet another bout of disruption to the economic calendar for traders and investors alike" with jobs data postponed this week, said Joshua Mahony, chief market analyst at Scope Markets.

- Key figures at around 1100 GMT -

London - FTSE 100: DOWN 0.2 percent at 10,319.73 points

Paris - CAC 40: UP 0.1 percent at 8,188.34

Frankfurt - DAX: UP 0.3 percent at 24,860.92

Tokyo - Nikkei 225: UP 3.9 percent at 54,720.66 (close)

Hong Kong - Hang Seng Index: UP 0.2 percent at 26,834.77 (close)

Shanghai - Composite: UP 1.3 percent at 4,067.74 (close)

New York - Dow: UP 1.1 percent at 49,407.66 (close)

Euro/dollar: DOWN at $1.1788 from $1.1793 on Monday

Pound/dollar: DOWN at $1.3656 from $1.3667

Dollar/yen: UP at 155.92 yen from 155.60 yen

Euro/pound: UP at 86.32 pence from 86.29 pence

Brent North Sea Crude: FLAT at $66.34 per barrel

West Texas Intermediate: UP 0.2 percent at $62.24 per barrel

burs-bcp/ajb/gv

O.Brown--AT