-

Voter swings raise midterm alarm bells for Trump's Republicans

Voter swings raise midterm alarm bells for Trump's Republicans

-

Australia dodges call for arrest of visiting Israel president

-

Countries using internet blackouts to boost censorship: Proton

Countries using internet blackouts to boost censorship: Proton

-

Top US news anchor pleads with kidnappers for mom's life

-

Thailand's pilot PM on course to keep top job

Thailand's pilot PM on course to keep top job

-

The coming end of ISS, symbol of an era of global cooperation

-

New crew set to launch for ISS after medical evacuation

New crew set to launch for ISS after medical evacuation

-

Family affair: Thailand waning dynasty still election kingmaker

-

Japan's first woman PM tipped for thumping election win

Japan's first woman PM tipped for thumping election win

-

Stocks in retreat as traders reconsider tech investment

-

LA officials call for Olympic chief to resign over Epstein file emails

LA officials call for Olympic chief to resign over Epstein file emails

-

Ukraine, Russia, US to start second day of war talks

-

Fiji football legend returns home to captain first pro club

Fiji football legend returns home to captain first pro club

-

Trump attacks US electoral system with call to 'nationalize' voting

-

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

Barry Manilow cancels Las Vegas shows but 'doing great' post-surgery

-

US households become increasingly strained in diverging economy

-

Four dead men: the cold case that engulfed a Colombian cycling star

Four dead men: the cold case that engulfed a Colombian cycling star

-

Super Bowl stars stake claims for Olympic flag football

-

On a roll, Brazilian cinema seizes its moment

On a roll, Brazilian cinema seizes its moment

-

Rising euro, falling inflation in focus at ECB meeting

-

AI to track icebergs adrift at sea in boon for science

AI to track icebergs adrift at sea in boon for science

-

Indigenous Brazilians protest Amazon river dredging for grain exports

-

Google's annual revenue tops $400 bn for first time, AI investments rise

Google's annual revenue tops $400 bn for first time, AI investments rise

-

Last US-Russia nuclear treaty ends in 'grave moment' for world

-

Man City brush aside Newcastle to reach League Cup final

Man City brush aside Newcastle to reach League Cup final

-

Guardiola wants permission for Guehi to play in League Cup final

-

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

Boxer Khelif reveals 'hormone treatments' before Paris Olympics

-

'Bad Boy,' 'Little Pablo' and Mordisco: the men on a US-Colombia hitlist

-

BHP damages trial over Brazil mine disaster to open in 2027

BHP damages trial over Brazil mine disaster to open in 2027

-

Dallas deals Davis to Wizards in blockbuster NBA trade: report

-

Iran-US talks back on, as Trump warns supreme leader

Iran-US talks back on, as Trump warns supreme leader

-

Lens cruise into French Cup quarters, Endrick sends Lyon through

-

No.1 Scheffler excited for Koepka return from LIV Golf

No.1 Scheffler excited for Koepka return from LIV Golf

-

Curling quietly kicks off sports programme at 2026 Winter Olympics

-

Undav pokes Stuttgart past Kiel into German Cup semis

Undav pokes Stuttgart past Kiel into German Cup semis

-

Germany goalkeeper Ter Stegen to undergo surgery

-

Bezos-led Washington Post announces 'painful' job cuts

Bezos-led Washington Post announces 'painful' job cuts

-

Iran says US talks are on, as Trump warns supreme leader

-

Gaza health officials say strikes kill 24 after Israel says officer wounded

Gaza health officials say strikes kill 24 after Israel says officer wounded

-

Empress's crown dropped in Louvre heist to be fully restored: museum

-

UK PM says Mandelson 'lied' about Epstein relations

UK PM says Mandelson 'lied' about Epstein relations

-

Shai to miss NBA All-Star Game with abdominal strain

-

Trump suggests 'softer touch' needed on immigration

Trump suggests 'softer touch' needed on immigration

-

From 'flop' to Super Bowl favorite: Sam Darnold's second act

-

Man sentenced to life in prison for plotting to kill Trump in 2024

Man sentenced to life in prison for plotting to kill Trump in 2024

-

Native Americans on high alert over Minneapolis crackdown

-

Dallas deals Davis to Wizards in blockbuster NBA deal: report

Dallas deals Davis to Wizards in blockbuster NBA deal: report

-

Russia 'no longer bound' by nuclear arms limits as treaty with US ends

-

Panama hits back after China warns of 'heavy price' in ports row

Panama hits back after China warns of 'heavy price' in ports row

-

Strike kills guerrillas as US, Colombia agree to target narco bosses

University Bancorp 3Q2025 Net Income $4,371,716 $0.85 Per Share

ANN ARBOR, MI / ACCESS Newswire / October 31, 2025 / University Bancorp, Inc. (OTCQB:UNIB) announced that it had an unaudited net income attributable to University Bancorp, Inc. ("UNIB") common stock shareholders in 3Q2024 of $4,371,716 $0.85 per share on average shares outstanding of 5,169,518 for the third quarter, versus an unaudited net income of $2,744,480.07, $0.53 per share on average shares outstanding of 5,169,518 for 3Q2024.

For the 9 months ended September 30, 2025, net income was $5,535,896 $1.19 per share on average shares outstanding of 5,169,518 for the period, versus $7,913,973.04, $1.53 per share on average shares outstanding of 5,169,518 for the 9 months ended September 30, 2024.

For the 12 months ended September 30, 2025, net income was $8,640,829, $1.67 per share on average shares outstanding of 5,169,518 for the period.

Shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was $98,317,450 or $19.02 per share, based on shares outstanding at September 30, 2025 of 5,169,518.

President Stephen Lange Ranzini noted, "In late 2024, University Bank's shareholders' equity passed $100 million for the first time, and in October 2025, UNIB's shareholders' equity also passed $100 million for the first time. This milestone is a remarkable achievement, considering that our predecessor corporation, Newberry Bancorp, started with $1,500,000 shareholders' equity in July 1988, and UNIB brought just $400,000 of shareholders' equity to the merger of the two entities in early 1990."

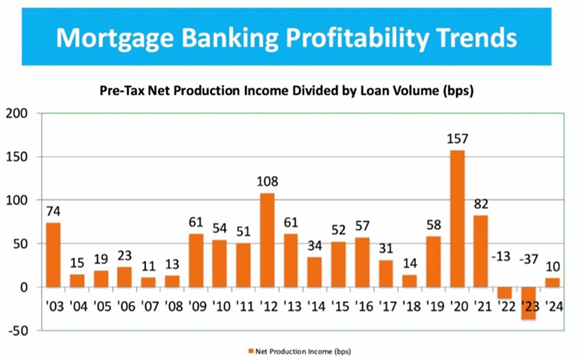

Return on Equity (ROE) at University Bancorp continues at acceptable levels, despite mortgage originations nationwide continuing to be at 30-year lows with respect to units originated, with the annualized ROE for the TTM ended September 30, 2025 being 9.4% on initial shareholders' equity of $91,925,253.43 at September 30, 2024. To provide some perspective on the mortgage origination industry's long-term cycles and where we are at in that cycle, here is a chart from the Mortgage Bankers Association:

Overall, our business development efforts continue at a rapid pace. For example, faith-based deposits have grown past $145 million, and on October 1st, we rolled out a new product that enables the automatic sweep of idle balances in brokerage firms into and out of our faith based deposit products. University Bank is now licensed for conventional mortgage lending, reverse mortgage lending and home equity lending in all 50 states. We have completed the rollout of our 1st Mortgage HELOC program in all 47 states where we intend to introduce the product, and are now working on rolling out a home equity lending program in 47 states, with the loans being sold to the secondary market and subserviced by our Midwest Loan Services division. In addition to product extensions and geographical expansion of our existing product suite, we are working on closing four small acquisitions, pending regulatory approvals, which will expand our core banking, insurance and wealth management businesses.

Earnings in 4Q2025 will be positively impacted by a sale of about $84 million of portfolio loans in two transactions, designed to keep University Bank's total assets under $1 billion as of year-end 2025, to avoid additional regulatory requirements and expenses that would kick in if our total assets were over $1 billion as of a year-end.

At 9/30/2025 cash & equity investment securities at UNIB, available to meet working capital needs and to support investment opportunities at UNIB were $26.0 million. UNIB also was recently approved for a $12.5 million line of credit on which we are in the process of working towards a legal closing.

A portion of UNIB's working capital, $18.3 million, has been invested in a portfolio of publicly traded financial services related investments. At 9/30/2025, two of these investments were large:

Currency Exchange International (Symbol CURN), a Canadian bank holding company that specializes in foreign exchange, of which we own 12.41%, 762,339 shares of common stock at an average price per share of $13.38. The firm is trading at about 6x EBIT adjusted for the now completed exit from their unprofitable Canadian business, however in our opinion it is worth 10x EBIT or $30 per share, and it is a growing business.

Pulsar Helium (Symbol PSRHF), of which we own 4.999% of the common stock, 7,505,265 shares at an average price per share of $0.45. Pulsar Helium probably has between $42 million to $210 million of Helium-3, an unique resource that is very useful for producing electricity from fusion reactors. While Helium-3 is available on the Moon, Pulsar has the only commercially viable deposit of Helium-3 known on Earth. The estimated range for Helium-4 in its reservoir is in our opinion probably $1 billion to $5 billion. The range for CO2 in its reservoir is probably $0.5 billion to $2.5 billion. All production costs and the cost of separating the gas produced from Pulsar's reservoir is expected to be offset by the sale of the CO2 to the food processing industry, or to a new use, cooling for AI Data Centers, a superior alternative to using large amounts of water, which is meeting with political resistance. There is a 20% mineral rights royalty payable on all production . Between shares outstanding and options / warrants that are in the money that are expected to be exercised shortly, the company has about 165 million shares outstanding. At the current share price of US$0.581 the market capitalization of the company, which currently has no debt and sufficient cash on hand to get to production in under two years with a project finance loan, is $96 million. The value of the company is probably between $600 million and $3 billion, or $3.64 to $18.18 per share. Of note, at 9/30/2025 our Pulsar Helium shares were marked to market at $0.32 per share, and they closed today at $0.581 per share.

Other Key statistics as of 9/30/2025:

TTM Revenue | $ | 135,074,269 |

10 Year Average ROE | 26.6 | % |

5 Year Average ROE | 15.1 | % |

Current Ratio, # | 397.4 | x |

Efficiency Ratio, %+ | 86.2 | % |

Total Consolidated Assets | $ | 1,158,646,487 |

TTM ROA% | 0.86 | % |

TCE/TA % | 9.07 | % |

NPAs/Assets % | 0.57 | % |

Texas Ratio % | 8.36 | % |

NIM % | 4.22 | % |

NCOs/Loans | 0.001 | % |

Trailing 12 Months P-E Ratiox | 10.1 | x |

Price to Book Value Ratiox | 89 | % |

Treasury Shares | 37,381 shares |

#Parent company only current assets divided by 12-month projected cash expenses.

+Calculated as: (non-interest expense/ (net interest income + non-interest income)).

xBased on last sale of $16.85 per share.

Excluding goodwill & other intangibles related to the acquisition of Midwest Loan Services and Ann Arbor Insurance Center, net tangible shareholders' equity attributable to University Bancorp, Inc. common stock shareholders was $97,724,240 or $18.90 per share at 9/30/2025. Please note that we view the current market values of our insurance agency and Midwest Loan Services as substantially in excess of their carrying value including this goodwill.

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/.

A detailed income statement, balance sheet and other financial information for UNIB and University Bank as of 9/30/2025 is available here: https://www.university-bank.com/wp-content/uploads/2025/10/UNIB-UBank-3Q2025-Detailed-Financials.pdf.

University Bank's FDIC Call Report, with substantial additional information including loan origination and loan investment composition and delinquency ratios and Tier 1 Capital ratios for 9/30/2025 is available here: https://cdr.ffiec.gov/public/ManageFacsimiles.aspx

About UNIB

When UNIB announced its 2024 financial results, we noted the following key accomplishments:

Revenue in 2024 grew 18.65%. Our 10-year average revenue growth was 18.70%;

Return on Equity (ROE) for 2024 was 12.5%. Our 10-year average ROE was 25.97%;

Shareholders' equity at University Bank exceeded $100 million for the first time ever.

Shareholders' equity at UNIB at 12/31/2024 was $93,590,773 (excluding minority interest of $11,961,541), or $18.10 per share, based on common shares outstanding at December 31, 2024 of 5,169,518.

Shareholders and investors are encouraged to refer to the financial information including the investor presentations, audited financial statements, strategic plan and prior press releases, available on our investor relations web page at: http://www.university-bank.com/bancorp/.

Ann Arbor-based University Bancorp is a Federal Reserve regulated financial holding company that owns:

100% of University Bank, a bank based in Ann Arbor, Michigan;

100% of Crescent Assurance, PCC, a captive insurance company licensed in Washington DC; and

100% of Hyrex Servicing, a master mortgage servicing firm, based in Ann Arbor, Michigan.

University Bank together with its Michigan-based subsidiaries, holds and manages a total of over $35 billion in financial assets for over 183,000 customers, and our 533 employees make us the 5th largest bank based in Michigan. University Bank is an FDIC-insured, locally owned and managed community bank, and meets the financial needs of its community through its creative and innovative services. Founded in 1890, University Bank® is the 15th oldest bank headquartered in Michigan. We are proud to have been selected as the "Community Bankers of the Year" by American Banker magazine and as the recipient of the American Bankers Association's Community Bank Award. University Bank is a Member FDIC. The members of University Bank's corporate family, ranked by their size of revenues are:

UIF, a faith-based banking firm based in Southfield, MI;

University Lending Group, a retail residential mortgage originator based in Clinton Township, MI;

Midwest Loan Services, a residential mortgage subservicer based in Houghton, MI;

Community Banking, based in Ann Arbor, MI, which provides traditional community banking services in the Ann Arbor area;

Ann Arbor Insurance Centre, an independent insurance agency based in Ann Arbor, MI.

Reverse Mortgage Lending, a reverse residential mortgage lender based in Southfield, MI; and

Mortgage Warehouse Lending, a mortgage warehouse lender based in Southfield, MI.

CAUTIONARY STATEMENT: This press release contains certain forward-looking statements that involve risks and uncertainties. Forward-looking statements include, but are not limited to, statements concerning future growth in assets, pre-tax income and net income, budgeted income levels, the sustainability of past results, mortgage origination levels and margins, valuations, and other expectations and/or goals. Such statements are subject to certain risks and uncertainties which could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including, but not limited to, economic, competitive, governmental and technological factors affecting our operations, markets, products, services, interest rates and fees for services. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to update any information or forward-looking statement.

Contact:

Stephen Lange Ranzini, President and CEO

Phone: 734-741-5858, Ext. 9226

Email: [email protected]

SOURCE: University Bancorp, Inc.

View the original press release on ACCESS Newswire

M.Robinson--AT