-

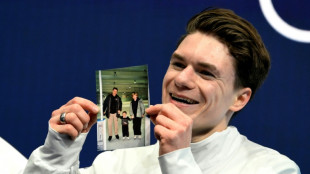

'I felt guided by them': US skater Naumov remembers parents at Olympics

'I felt guided by them': US skater Naumov remembers parents at Olympics

-

Till death do us bark: Brazilian state lets pets be buried with owners

-

Ukrainian athlete vows to wear banned helmet at Winter Olympics

Ukrainian athlete vows to wear banned helmet at Winter Olympics

-

'Confident' Pakistan ready for India blockbuster after USA win

-

Latam-GPT: a Latin American AI to combat US-centric bias

Latam-GPT: a Latin American AI to combat US-centric bias

-

Gauff dumped out of Qatar Open, Swiatek, Rybakina through

-

Paris officers accused of beating black producer to stand trial in November

Paris officers accused of beating black producer to stand trial in November

-

Istanbul bars rock bands accused of 'satanism'

-

Olympic bronze medal biathlete confesses affair on live TV

Olympic bronze medal biathlete confesses affair on live TV

-

US commerce chief admits Epstein Island lunch but denies closer ties

-

Mayor of Ecuador's biggest city arrested for money laundering

Mayor of Ecuador's biggest city arrested for money laundering

-

Farhan, spinners lead Pakistan to easy USA win in T20 World Cup

-

Stocks mixed as muted US retail sales spur caution

Stocks mixed as muted US retail sales spur caution

-

Macron wants more EU joint borrowing: Could it happen?

-

Shiffrin flops at Winter Olympics as helmet row simmers

Shiffrin flops at Winter Olympics as helmet row simmers

-

No excuses for Shiffrin after Olympic team combined flop

-

Starmer says UK govt 'united', pressing on amid Epstein fallout

Starmer says UK govt 'united', pressing on amid Epstein fallout

-

Pool on wheels brings swim lessons to rural France

-

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

Europe's Ariane 6 to launch Amazon constellation satellites into orbit

-

Could the digital euro get a green light in 2026?

-

Spain's Telefonica sells Chile unit in Latin America pullout

Spain's Telefonica sells Chile unit in Latin America pullout

-

'We've lost everything': Colombia floods kill 22

-

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

Farhan propels Pakistan to 190-9 against USA in T20 World Cup

-

US to scrap cornerstone of climate regulation this week

-

Nepal call for India, England, Australia to play in Kathmandu

Nepal call for India, England, Australia to play in Kathmandu

-

Stocks rise but lacklustre US retail sales spur caution

-

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

Olympic chiefs let Ukrainian athlete wear black armband at Olympics after helmet ban

-

French ice dancers poised for Winter Olympics gold amid turmoil

-

Norway's Ruud wins error-strewn Olympic freeski slopestyle

Norway's Ruud wins error-strewn Olympic freeski slopestyle

-

More Olympic pain for Shiffrin as Austria win team combined

-

Itoje returns to captain England for Scotland Six Nations clash

Itoje returns to captain England for Scotland Six Nations clash

-

Sahara celebrates desert cultures at Chad festival

-

US retail sales flat in December as consumers pull back

US retail sales flat in December as consumers pull back

-

Bumper potato harvests spell crisis for European farmers

-

Bangladesh's PM hopeful Rahman warns of 'huge' challenges ahead

Bangladesh's PM hopeful Rahman warns of 'huge' challenges ahead

-

Guardiola seeks solution to Man City's second half struggles

-

Shock on Senegalese campus after student dies during police clashes

Shock on Senegalese campus after student dies during police clashes

-

US vice president Vance on peace bid in Azerbaijan after Armenia visit

-

'Everything is destroyed': Ukrainian power plant in ruins after Russian strike

'Everything is destroyed': Ukrainian power plant in ruins after Russian strike

-

Shiffrin misses out on Olympic combined medal as Austria win

-

India look forward to Pakistan 'challenge' after T20 World Cup U-turn

India look forward to Pakistan 'challenge' after T20 World Cup U-turn

-

EU lawmakers back plans for digital euro

-

Starmer says UK govt 'united', presses on amid Epstein fallout

Starmer says UK govt 'united', presses on amid Epstein fallout

-

Olympic chiefs offer repairs after medals break

-

Moscow chokes Telegram as it pushes state-backed rival app

Moscow chokes Telegram as it pushes state-backed rival app

-

ArcelorMittal confirms long-stalled French steel plant revamp

-

New Zealand set new T20 World Cup record partnership to crush UAE

New Zealand set new T20 World Cup record partnership to crush UAE

-

Norway's Ruud wins Olympic freeski slopestyle gold after error-strewn event

-

USA's Johnson gets new gold medal after Olympic downhill award broke

USA's Johnson gets new gold medal after Olympic downhill award broke

-

Von Allmen aims for third gold in Olympic super-G

Insurance Agency Mergers and Acquisitions Drop Slightly

Deals for insurance firms in United States and Canada dip 8% in first half, OPTIS Partners reports

MINNEAPOLIS, MN / ACCESS Newswire / July 29, 2025 / There were 319 announced insurance agency mergers and acquisitions in the first half of 2025, down 8% from 345 in the same period in 2024, according to OPTIS Partners' M&A database. The pace picked up in the second quarter, with 168 deals, up 11% from a year ago.

American sellers accounted for 305 deals, while Canadian brokers accounted for 14 transactions.

"The M&A market is likely at a new normal. We expect about 750 to 800 deals annually going forward," said Steve Germundson, a partner at OPTIS Partners, an investment banking and financial consulting firm specializing in the insurance industry. "Larger firms will continue to look for bigger transactions to fuel needed growth, and the number of buyers will shrink as some of yesterday's active buyers become tomorrow's sellers."

BroadStreet Leads Buyers

Among buyers, BroadStreet Partners recorded the most transactions in the first half of 2025 with 39. Hub and Inszone followed with 27 and 18 deals, respectively, while Keystone Agency Partners and World Insurance Associates each announced 17 purchases.

The top 11 buyers (top 10 and ties) accounted for 187 deals or 59% of the total. All were private equity-backed firms except Leavitt Group (private), Arthur J. Gallagher (publicly traded), and Heffernan Insurance Brokers (privately held)

Private-equity firms dominate buyers

OPTIS Partners tracks buyers by four groups: private equity-backed/hybrid brokers, privately held brokers, publicly held brokers, and all others.

The private equity-backed/hybrid group of buyers (32 firms) continued to dominate deal activity in the first half, accounting for 73% of all transactions.

"Private-equity firms continue to invest," said OPTIS managing partner Timothy J. Cunningham. "Since the start of the pandemic, they've done about 70% of the total number of deals in each quarter. They've got the money and are willing to spend it for the right acquisition."

Privately held brokers completed 62 acquisitions in the first half of 2025 while publicly held brokers reported 19 deals.

P&C agencies are primary sellers

The OPTIS report covers four types of sellers: property-and-casualty insurance agencies, agencies offering both P&C and employee benefits, employee benefits agencies, and all other sellers (life/financial services, consulting, and other businesses associated with insurance distribution).

P&C sellers accounted for 209 transactions (65% of the total). Benefits agencies sales totaled 42 (13%), and there were 27 sales of P&C/benefits agencies (8%). All other sellers accounted for 43 sales (13 %).

The full report can be read at https://optisins.com/wp/2025/07/h1-2025-ma-report.

About OPTIS Partners

Focused exclusively on the insurance-distribution marketplace, Minneapolis-based OPTIS Partners (www.optisins.com) offers merger & acquisition representation for buyers and sellers, including due-diligence reviews. It provides appraisals of fair market value; financial-performance review, including trend analysis and internal controls; and ownership transition and perpetuation planning.

Contact:

Steve Germundson, OPTIS Partners, [email protected], 612-758-0598

Tim Cunningham, OPTIS Partners, [email protected], 312-543-5425

Dan Menzer, OPTIS Partners, [email protected], 630-520-0490

Henry Stimpson, Stimpson Communications, [email protected]

SOURCE: OPTIS Partners

View the original press release on ACCESS Newswire

A.Anderson--AT