-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

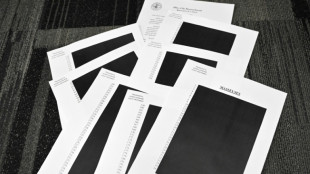

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

-

Amazon says blocked 1,800 North Koreans from applying for jobs

Amazon says blocked 1,800 North Koreans from applying for jobs

-

Trump says US needs Greenland 'for national security'

-

Purdy first 49er since Montana to throw five TDs as Colts beaten

Purdy first 49er since Montana to throw five TDs as Colts beaten

-

Australia captain Cummins out of rest of Ashes, Lyon to have surgery

-

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

North Korea's Kim tours hot tubs, BBQ joints at lavish new mountain resort

-

Asian markets rally again as rate cut hopes bring Christmas cheer

-

Australian state poised to approve sweeping new gun laws, protest ban

Australian state poised to approve sweeping new gun laws, protest ban

-

Trapped under Israeli bombardment, Gazans fear the 'new border'

-

Families want answers a year after South Korea's deadliest plane crash

Families want answers a year after South Korea's deadliest plane crash

-

Myanmar's long march of military rule

-

Disputed Myanmar election wins China's vote of confidence

Disputed Myanmar election wins China's vote of confidence

-

Myanmar junta stages election after five years of civil war

-

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

Ozempic Meals? Restaurants shrink portions to match bite-sized hunger

-

'Help me, I'm dying': inside Ecuador's TB-ridden gang-plagued prisons

-

Australia's Cummins, Lyon out of fourth Ashes Test

Australia's Cummins, Lyon out of fourth Ashes Test

-

US singer Barry Manilow reveals lung cancer diagnosis

-

'Call of Duty' co-creator Vince Zampella killed in car crash

'Call of Duty' co-creator Vince Zampella killed in car crash

-

Starring Georgia Announces Plans to Carry Out a Comprehensive Rehabilitation of the Tbilisi State Concert Hall

-

Universal EV Chargers Scales Driver-First DC Fast Charging in 2025, Commissioning 320 Live Ports Across Key U.S. Markets

Universal EV Chargers Scales Driver-First DC Fast Charging in 2025, Commissioning 320 Live Ports Across Key U.S. Markets

-

Nextech3D.ai Provides Shareholder Update on Krafty Labs Acquisition and Announces New CEO Investment

-

The Alkaline Water Company Announces Capital Structure Reset and Strategic Alignment Ahead of Regulation A Offering

The Alkaline Water Company Announces Capital Structure Reset and Strategic Alignment Ahead of Regulation A Offering

-

Peraso Appoints Wireless Veteran Cees Links to Board of Directors

-

Amazing Community Support Signals Huge Success for Today's "Toys for Joy" Giveaway Organized by Rapper Mistah F.A.B. and Oakland's Church of Ambrosia

Amazing Community Support Signals Huge Success for Today's "Toys for Joy" Giveaway Organized by Rapper Mistah F.A.B. and Oakland's Church of Ambrosia

-

Vero Technologies Celebrates Five Years Leading Asset Finance Innovation

-

DealFlow Discovery Conference Announces Keynote Fireside Chat and Book Signing with Venture Capital Pioneer Alan Patricof

DealFlow Discovery Conference Announces Keynote Fireside Chat and Book Signing with Venture Capital Pioneer Alan Patricof

-

PetVivo Holdings, Inc. Presenting at the 3rd Annual DealFlow Discovery Conference

-

Green Leaf Innovations, Inc. Announces FINRA Approval of Reverse Stock Split and Strategic Reduction of Authorized Share Capital

Green Leaf Innovations, Inc. Announces FINRA Approval of Reverse Stock Split and Strategic Reduction of Authorized Share Capital

-

Laser Photonics Reports Q3 2025 Revenue Growth of 28% Year-Over-Year

-

BeMetals Announces Settlement of All Outstanding Debt

BeMetals Announces Settlement of All Outstanding Debt

-

Who Does the Best Mommy Makeover in Bellevue?

US inflation high but stable in May as spending slows

A key US inflation measure showed price increases held steady in the 12 months ended in May, while consumer spending growth slowed sharply, a good sign in the battle against soaring prices.

Any sign of moderation will be a boon to President Joe Biden whose approval ratings have tumbled, as his administration has struggled to find effective tools to help American families feeling the pain of surging gasoline, food and housing prices.

The trend also offers comfort to the Federal Reserve, showing its aggressive interest rate strategy is starting to have an impact to quell the fastest surge in inflation in more than 40 years.

The personal consumption expenditures (PCE) price index rose 6.3 percent compared to May 2021, still high but the same pace as in the prior month, the Commerce Department reported Thursday.

The index jumped 0.6 percent compared to April, much faster than in the prior month, but slightly below what economists had projected.

But spending edged up just 0.2 percent, less than half the increase in April and part of a steady downward drift as consumers pull back amid surging prices.

Buoyed by a stockpile of savings, helped by massive government aid, consumers have been the lynchpin in the rapid US recovery from the pandemic downturn.

But strong demand clashed with global supply chain snarls and the world's largest economy has been battered for months by a cresting inflation wave, made more painful by the surge in energy prices sparked by the Russian invasion of Ukraine in late February.

Excluding volatile food and energy prices, "core" PCE rose 0.3 percent in the month, the same as in April, while the 12-month pace slowed slightly to 4.7 percent, the report said.

- Fed inflation battle -

Brian Deese, head of the White House National Economic Council, noted that the three-month annual average for core PCE fell to four percent from 5.2 percent.

"That is important moderation that we're seeing," he said on CNBC.

However, he said the headline continues to be driven by higher energy prices.

Energy prices jumped four percent in the month, after dropping in April, and are 35.8 percent higher than May 2021, the data showed.

The PCE price index is the Federal Reserve's preferred inflation gauge, as it reflects consumers' actual spending, including shifts to lower cost items, unlike the more well-known consumer price index, which jumped 8.6 percent in May.

PCE also gives less weight to things like rent, vehicles and airline fares, which have contributed to the blistering pace of the CPI rise.

The Fed early this month announced the biggest hike in the benchmark lending rate in nearly 30 years, a three-quarter point increase that was the third step in its counteroffensive against rising inflation, as it aims to cool demand.

Policymakers have signaled there is a good chance of another similar increase in late July, followed by more big steps in coming months.

That has raised concerns the Fed could push the economy into a recession -- a price Fed Chair Jerome Powell signaled the central bank is willing to pay to control inflation.

- Slower spending -

The signs of consumers pulling back will weigh on second quarter GDP growth, after the Commerce Department revised first-quarter consumer spending sharply lower, cutting it to 1.8 percent from 3.1 percent, as the economy contracted 1.6 percent.

Diane Swonk of Grant Thornton estimates that "consumers have drained about $600 billion of the excess $2.5 trillion in savings they amassed during the pandemic to deal with the bite of higher prices."

The key driver of the slower consumption growth in May was the sharp drop in spending on big-ticket manufactured items, that economists note reflects a pull back on vehicle sales.

Spending on services rose 0.7 percent in the month, the same as in April.

P.A.Mendoza--AT