-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

-

Gold, silver prices tumble as investors soothed by Trump's Fed pick

Gold, silver prices tumble as investors soothed by Trump's Fed pick

-

Trump attorney general orders arrest of ex-CNN anchor covering protests

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

Eurozone growth beats 2025 forecasts despite Trump woes

-

Israel to partially reopen Gaza's Rafah crossing on Sunday

-

Dutch PM-elect Jetten says not yet time to talk to Putin

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

-

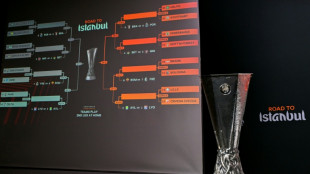

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

Alcaraz defends controversial timeout after beaten Zverev fumes

-

New Dutch government pledges ongoing Ukraine support

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

Chad, France eye economic cooperation as they reset strained ties

-

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

-

Everton winger Grealish set to miss rest of season in World Cup blow

Everton winger Grealish set to miss rest of season in World Cup blow

-

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

-

Arteta focuses on the positives despite Arsenal stumble

Arteta focuses on the positives despite Arsenal stumble

-

Fijian Drua sign France international back Vakatawa

-

Kevin Warsh, a former Fed 'hawk' now in tune with Trump

Kevin Warsh, a former Fed 'hawk' now in tune with Trump

-

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

-

Turkey leads Iran diplomatic push as Trump softens strike threat

Turkey leads Iran diplomatic push as Trump softens strike threat

-

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

-

'Superman' Li Ka-shing, Hong Kong billionaire behind Panama ports deal

'Superman' Li Ka-shing, Hong Kong billionaire behind Panama ports deal

-

Skiing great Lindsey Vonn crashes at Crans-Montana, one week before Olympics

| SCS | 0.12% | 16.14 | $ | |

| JRI | 0.27% | 12.99 | $ | |

| RBGPF | 1.65% | 83.78 | $ | |

| BCC | -1.24% | 79.185 | $ | |

| CMSC | -0.02% | 23.69 | $ | |

| RYCEF | -2.69% | 16 | $ | |

| RELX | -1.56% | 35.61 | $ | |

| NGG | -0.65% | 84.5 | $ | |

| BCE | -0.08% | 25.465 | $ | |

| RIO | -4.67% | 90.885 | $ | |

| GSK | 1.19% | 51.265 | $ | |

| AZN | 0.55% | 93.1 | $ | |

| CMSD | 0.04% | 24.07 | $ | |

| VOD | -0.58% | 14.625 | $ | |

| BTI | -0.11% | 60.145 | $ | |

| BP | -0.67% | 37.785 | $ |

Oil hits seven-year highs on recovery hopes, unrest

Oil prices hit their highest levels in more than seven years Tuesday, driven in part by hopes of a global economic recovery that would ramp up demand.

Stock markets however headed south, with US Treasury yields surging on expectations the Federal Reserve will have to unveil several interest rate hikes to tackle a worrying spike in inflation, leading the Dow to finish 1.5 percent lower on its first day back after a long holiday weekend.

European crude benchmark Brent North Sea reached $88.13 per barrel, while the US West Texas Intermediate contract hit $85.74 -- the highest levels since October 2014 -- before easing slightly in later trading.

Expectations of Fed tightening continued to support the dollar.

A drone attack on Monday in Abu Dhabi claimed by Yemen's Huthi rebels, which triggered a fuel tank blast that killed three people, also supported prices.

The group warned civilians and foreign firms in the United Arab Emirates to avoid "vital installations," raising concerns about supplies from the crude-rich region.

"The suspected drone attack in Abu Dhabi underscores the ongoing threat against civilian and energy infrastructure in the region amid heightened regional tensions," said Torbjorn Soltvedt at risk intelligence company Verisk Maplecroft.

"Reports of damage to fuel trucks and storage will concern oil market watchers, who are also keeping a close eye on the trajectory of ongoing nuclear talks between the US and Iran," he added.

OANDA analyst Craig Erlam said OPEC nations and other key producers were struggling to meet targets to lift output by 400,000 barrels a month, which added to the upward pressure.

"The evidence suggests it's not that straightforward and the group is missing the targets by a large margin after a period of underinvestment and outages," he noted.

"That should continue to be supportive for oil and increase talk of triple-figure prices."

Hopes for more monetary easing by major consumer China to reinforce its stuttering economy were also seen as a key support for the oil market.

- Eye on earnings -

Following an almost uninterrupted rally since the early days of the pandemic, stock markets are showing signs of levelling out as global finance chiefs shift from economy-boosting largesse to measures aimed at reining in inflation.

Those fears drove global bond yields up on Tuesday, with German bund yields coming close to touching zero percent, their highest level since 2019.

"The move higher also raises the prospect that the European Central Bank won't be able to hold its line of no rate rises this year," said CMC Markets analyst Michael Hewson.

Still, equities are expected to enjoy further gains in 2022 as countries reopen and people grow more confident about travel, assuming concerns ease over the Omicron coronavirus variant.

Analysts are also watching the corporate earnings season that is underway, with hopes that firms can match their stellar performances from last year.

Shares in video game publisher Activision Blizzard, maker of blockbuster titles including "Call of Duty", closed 25.9 percent higher after Microsoft announced a $69 billion buyout.

Shares in Microsoft slid 2.4 percent by the end of trading.

"This is a big step up with Microsoft getting in on the ground floor when it comes to creating as well as overseeing content on its own gaming platform," said Hewson.

Microsoft's Xbox console makes it a major player in the gaming industry, even if it trails far behind Sony's PlayStation.

- Key figures around 2150 GMT -

Brent North Sea crude: UP 1.2 percent at $87.51 per barrel

West Texas Intermediate: UP 1.9 percent at $85.43 per barrel

New York - DOW: DOWN 1.5 percent at 35,368.47 (close)

New York - S&P 500: DOWN 1.8 percent at 4,577.11 (close)

New York - Nasdaq: DOWN 2.6 percent at 14,506.90 (close)

London - FTSE 100: DOWN 0.6 percent at 7,563.55 (close)

Frankfurt - DAX: DOWN 1.0 percent at 15,772.56 (close)

Paris - CAC 40: DOWN 0.9 percent at 7,133.83 (close)

EURO STOXX 50: DOWN 1.0 percent at 4,257.82 (close)

Tokyo - Nikkei 225: DOWN 0.3 percent at 28,257.25 (close)

Hong Kong - Hang Seng Index: DOWN 0.4 percent at 24,112.78 (close)

Shanghai - Composite: UP 0.8 percent at 3,569.91 (close)

Euro/dollar: DOWN at $1.1325 from $1.1407 late Monday

Pound/dollar: DOWN at $1.3598 from $1.3652

Euro/pound: DOWN at 83.28 pence from 83.55 pence

Dollar/yen: UP at 114.60 yen from 114.58 yen

burs-imm/cs/sst

S.Jackson--AT