-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

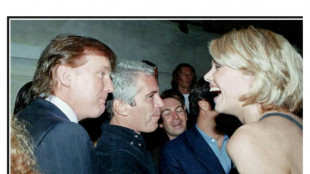

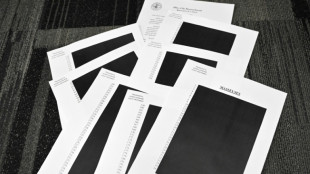

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Inflation-hit Turkey sticks to Erdogan's war on higher rates

Turkey's central bank on Thursday bucked global trends once again and kept its benchmark interest rate stable despite one of the highest levels of consumer price increases in the world.

The decision at a monthly policy meeting came two weeks after President Recep Tayyip Erdogan -- a lifelong opponent of high interest rates -- denied that Turkey had an "inflation problem".

Turkey's official annual rate of consumer price increases has edged above 70 percent and is on course to keep breaking records last set in the late 1990s.

Independent estimates by Turkish economists suggest the real figure could be substantially higher.

The inflationary spiral has decimated Turks' living standards and helped push Erdogan's public approval ratings to one of the lowest levels of his two-decade rule.

But Erdogan has vowed not to raise rates before a general election due in June 2023.

"We do not have an inflation problem. We have a cost-of-living problem," Erdogan said this month.

The central bank blamed higher prices on "temporary" global factors and kept its policy rate at 14 percent for the sixth month in a row.

Economists warn that Ankara's refusal to join most other countries in raising rates to fight the spike in food and energy prices caused by Russia's invasion of Ukraine could see the Turkish lira collapse.

"High inflation, falls in the lira and aggressive monetary tightening elsewhere are clearly not enough to persuade Turkey's central bank to lift interest rates," Capital Economics said in a research note.

"Disorderly falls in the lira are a major risk, which would probably be met with capital controls rather than rate hikes."

The lira has lost half its value against the dollar in the past year alone.

Those losses have accelerated in the past few weeks despite indirect market inteventions and other currency support measures that have depleted state reserves to their lowest point of Erdogan's rule.

- Disbelief -

Economists struggle to understand how Erdogan's government intends to combat consumer price increases in the runup to next year's vote.

Erdogan argues that high interest rates cause inflation -- the opposite of conventional economic beliefs that more expensive borrowing brings down prices by slowing down spending and dampening demand.

The pious Turkish leader also notes that charging interest violates Islamic rules against usury and that his policies will make Turkey into a global production engine that thrives on cheap exports.

But the lira's depreciation has made Turkey's dependence on energy and commodity imports much more expensive to maintain.

Turkish economists suspect the government may try to circumnavigate Erdogan's ban on interest rate hikes by trying to rein in spending in other ways.

"They may try to cool the economy by further tightening credit conditions," University of Economist and Technology's associate professor Atilim Murat.

"But we have seen in the past eight to 10 months that it is not possible to reduce inflation through these measure," he said.

Foreign economists are even more blunt.

OANDA trading platform analyst Craig Erlam said Erdogan was conducting a dangerous economic "experiment at arguably the worst moment in decades" because of soaring global inflation rates.

"This is like saying that I am going to drink a bottle of vodka because my doctor tells me I have liver disease, but I know better even though I have no medical qualifications," BlueBay Asset Management analyst Timothy Ash quipped in a note.

Y.Baker--AT