-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

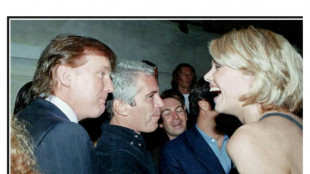

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Markets fluctuate, oil falls again as recession warnings build

Asian markets struggled Thursday to recover from the previous day's battering, while oil extended losses, after Federal Reserve boss Jerome Powell admitted the economy could tip into recession as the bank hikes interest rates to fight runaway inflation.

Soaring prices and central banks' battle to rein them in have sent a chill through global trading floors this year, while investors are also having to deal with the uncertainty wrought by the Ukraine war and patchy pandemic recovery.

Commentators have warned for some time that the world economy could be heading for another contraction owing to the sharp increase in borrowing costs and rampant inflation, which is at decades highs in several countries.

And on Wednesday the head of the most powerful central bank in the world told lawmakers that it was "certainly a possibility".

While saying the economy was strong enough for rates to rise, he added that "frankly, the events of the last few months around the world have made it more difficult for us to achieve what we want, which is two percent inflation and still a strong labour market."

He also warned: "Inflation has obviously surprised to the upside over the past year, and further surprises could be in store".

The Fed this month hiked rates by 75 basis points and is expected to do the same in July, with some observers predicting two more such moves after that.

After a day of swings, Wall Street ended in negative territory, though off big early lows.

Asia fluctuated after a big sell-off Wednesday, with optimism at a premium among investors and analysts saying it is unlikely to improve anytime soon.

Hong Kong, Sydney, Singapore and Wellington were slightly higher but Tokyo, Shanghai, Seoul, Taipei, Manila and Jakarta fell.

"Having listened to Powell's lengthy Senate testimony... it is clear that inflation is the domestic issue at the top of the political agenda," said SPI Asset Management's Stephen Innes.

"Powell consistently bobbed and weaved his way through commenting on anything of fiscal nature but was focused on deploying the tools within the Fed's power to address their dual mandate" of reining in inflation and keeping unemployment in check.

"So we should still position for more rate hike fallout to occur."

Powell's comments came as other top economists added to the recession talk, with former New York Fed President Bill Dudley saying it was "inevitable within the next 12 to 18 months".

And Deutsche Bank CEO Christian Sewing said there was a 50 percent chance of a contraction next year.

Elon Musk, JP Morgan boss Jamie Dimon and Nouriel Roubini are among several others to have made similar forecasts.

"We are still in an era where uncertainty is elevated and is expected to remain so for quite a while," said JoAnne Feeney, of Advisors Capital Management, on Bloomberg Television.

"It's risky right now in terms of the forward outlook for the global economy. Recession risk has clearly risen."

The prospect of a retreat in the global economy continued to drag oil prices down as traders fret over demand, with both main contracts down more than three percent, having tumbled on Wednesday.

Brent and WTI have dropped around 15 percent over the past week, even with sanctions on Russian crude exports and China's gradual reopening from lockdowns.

Adding to the selling was data Wednesday indicating a jump in US stockpiles.

"A slowdown in global growth is a risk to oil demand, which could help ease some of the tightness in the market," Warren Patterson, at ING Groep, said.

"Already, we have seen demand estimates revised lower."

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: FLAT at 26,146.71 (break)

Hong Kong - Hang Seng Index: UP 0.2 percent at 21,039.28

Shanghai - Composite: DOWN 0.1 percent at 3,263.02

West Texas Intermediate: DOWN 3.5 percent at $102.51 per barrel

Brent North Sea crude: DOWN 3.2 percent at $108.14 per barrel

Dollar/yen: DOWN at 135.74 yen from 136.22 yen late Wednesday

Pound/dollar: DOWN at $1.2241 from $1.2263

Euro/dollar: DOWN at $1.0561 from $1.0570

Euro/pound: UP at 86.27 pence from 86.17 pence

New York - Dow: DOWN 0.2 percent at 30,483.13 (close)

London - FTSE 100: DOWN 0.9 percent at 7,089.22 (close)

O.Ortiz--AT