-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

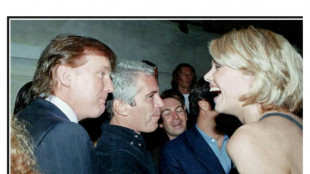

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

US Fed chair admits recession a 'possibility' after rate hikes

The US economy remains strong but a series of aggressive rate hikes meant to cool soaring inflation could eventually trigger a recession, Federal Reserve Chair Jerome Powell cautioned Wednesday.

Powell, whose testimony before senators was closely watched by investors and analysts, also said the world's largest economy faces an "uncertain" global environment and could see further inflation "surprises."

The Fed chair again stressed that the US central bank understands the hardship caused by rising prices and is committed to bringing down inflation, which has reached a 40-year high.

Last week, the Fed announced the sharpest interest rate increase in nearly 30 years and promised more action to combat the price surge, with gas and food costs skyrocketing and millions of Americans struggling to make ends meet.

But when peppered with questions about the prospect of a recession, Powell admitted it could not be ruled out.

"It's not our intended outcome at all, but it's certainly a possibility," he told the Senate Banking Committee.

"And frankly, the events of the last few months around the world have made it more difficult for us to achieve what we want, which is two percent inflation and still a strong labor market."

In his opening remarks, Powell insisted the US economy "is very strong and well positioned to handle tighter monetary policy."

"Inflation has obviously surprised to the upside over the past year, and further surprises could be in store," the Fed chief said in his semi-annual appearance before Congress.

Policymakers "will need to be nimble" given that the economy "often evolves in unexpected ways," he said.

The Fed is facing intense criticism that it was too slow to react to the changing economy, which benefited from a flood of federal government stimulus.

Last week's super-sized 0.75-percentage-point increase in the benchmark lending rate was the third since March, taking the policy rate up a total of 1.5 points. Powell at the time said more such increases were likely in July.

"I think it's going to be very challenging. We've never said it was going to be easy or straightforward," Powell said when asked about efforts to stave off recession.

- 'Essential' to curb inflation -

In addition to easing the financial strain on less-wealthy American families, the Fed chief said tamping down inflation was "essential... if we are to have a sustained period of strong labor market conditions that benefit all."

The US economy recovered quickly from the Covid-19 pandemic, helped by robust consumer spending, and has continued to create jobs at a strong pace, averaging 408,000 in the past three months.

Unemployment is near a 50-year low.

But the buoyant demand for homes, cars and other goods clashed with transportation and supply chain snarls in parts of the world where Covid-19 has remained a challenge.

That fueled inflation, which got dramatically worse after Russia invaded Ukraine in late February and Western nations imposed stiff sanctions on Moscow, sending food and fuel prices up at a blistering rate.

Powell said the fallout from the conflict "is creating additional upward pressure on inflation."

In addition, "Covid-19-related lockdowns in China are likely to exacerbate ongoing supply chain disruptions."

But he noted that the issue is not unique to the United States.

"Over the past year, inflation also increased rapidly in many foreign economies," he said.

In fact, many major central banks have joined the Fed in beginning to tighten monetary policy -- with the notable exception of the Bank of Japan.

Powell pointed to signs that rising rates are having an impact, as business investment slows and "activity in the housing sector looks to be softening, in part reflecting higher mortgage rates."

Average home loan rates jumped to 5.23 percent in May for a 30-year, fixed-rate mortgage, from 4.98 percent in April, according to Freddie Mac, while the median price for homes topped $400,000 for the first time.

"The tightening in financial conditions that we have seen in recent months should continue to temper growth and help bring demand into better balance with supply," Powell said.

R.Garcia--AT