-

S&P 500 surges to record after strong US economic report

S&P 500 surges to record after strong US economic report

-

UK police say no action against Bob Vylan duo over Israel army chant

-

Libya's top military chief killed in plane crash in Turkey

Libya's top military chief killed in plane crash in Turkey

-

Venezuela passes law to jail backers of US oil blockade

-

French parliament passes emergency budget extension

French parliament passes emergency budget extension

-

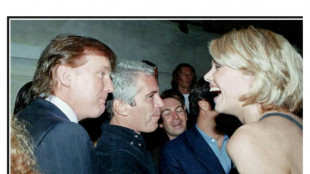

Trump in Epstein files: five takeaways from latest release

-

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

Wasteful Nigeria open AFCON campaign with narrow win over Tanzania

-

Ukraine retreats in east as Russian strikes kill three, hit energy

-

Macron meets French farmers in bid to defuse anger over trade deal

Macron meets French farmers in bid to defuse anger over trade deal

-

Ineos snap up Scotsman Onley

-

UK comedian Russell Brand faces new rape, assault charges: police

UK comedian Russell Brand faces new rape, assault charges: police

-

World is 'ready' for a woman at helm of UN: Chile's Bachelet tells AFP

-

Real Madrid's Endrick joins Lyon on loan

Real Madrid's Endrick joins Lyon on loan

-

Latest Epstein files renew scrutiny of Britain's ex-prince Andrew

-

US consumer confidence tumbles in December

US consumer confidence tumbles in December

-

Norwegian biathlete Sivert Guttorm Bakken found dead in hotel

-

UK comedian Russell Brand faces two new rape, assault charges: police

UK comedian Russell Brand faces two new rape, assault charges: police

-

Venezuela seeks to jail backers of US oil blockade

-

Norwegian biathlete Sivert Guttorm Bakken found dead

Norwegian biathlete Sivert Guttorm Bakken found dead

-

Wall Street stocks edge higher

-

Vietnam Communist Party endorses To Lam to stay in top job

Vietnam Communist Party endorses To Lam to stay in top job

-

US economic growth surges in 3rd quarter, highest rate in two years

-

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

Frank defends Van de Ven after Slot slams 'reckless' foul on Isak

-

Russian paramilitaries in CAR say take election threat 'extremely seriously'

-

Trump in the Epstein files: five takeaways from latest release

Trump in the Epstein files: five takeaways from latest release

-

UK govt to relax farmers inheritance tax after protests

-

Pakistani firm wins auction for state airline PIA

Pakistani firm wins auction for state airline PIA

-

Stocks slip on strong US growth data

-

DR Congo beat Benin to kick off Cup of Nations bid

DR Congo beat Benin to kick off Cup of Nations bid

-

New Epstein files dump contains multiple Trump references

-

Russian strike could collapse Chernobyl shelter: plant director

Russian strike could collapse Chernobyl shelter: plant director

-

Springbok captain Kolisi to rejoin Stormers

-

Italy fines Ryanair $300 mn for abuse of dominant position

Italy fines Ryanair $300 mn for abuse of dominant position

-

Mahrez eyes strong AFCON showing from Algeria

-

Killer in Croatia school attack gets maximum 50-year sentence

Killer in Croatia school attack gets maximum 50-year sentence

-

Thousands of new Epstein-linked documents released by US Justice Dept

-

Stocks steady as rate cut hopes bring Christmas cheer

Stocks steady as rate cut hopes bring Christmas cheer

-

Bangladesh summons Indian envoy as protest erupts in New Delhi

-

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

Liverpool's Isak faces two months out after 'reckless' tackle: Slot

-

Thailand-Cambodia border meeting in doubt over venue row

-

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

For director Josh Safdie, 'Marty Supreme' and Timothee Chalamet are one and the same

-

Kyiv's wartime Christmas showcases city's 'split' reality

-

Gazans fear renewed displacement after Israeli strikes

Gazans fear renewed displacement after Israeli strikes

-

Locals sound alarm as Bijagos Islands slowly swallowed by sea

-

Markets mostly rise as rate cut hopes bring Christmas cheer

Markets mostly rise as rate cut hopes bring Christmas cheer

-

Cambodia asks Thailand to move border talks to Malaysia

-

In Bulgaria, villagers fret about euro introduction

In Bulgaria, villagers fret about euro introduction

-

Key to probe England's 'stag-do' drinking on Ashes beach break

-

Delayed US data expected to show solid growth in 3rd quarter

Delayed US data expected to show solid growth in 3rd quarter

-

Thunder bounce back to down Grizzlies, Nuggets sink Jazz

Recession fears send stocks, oil prices plunging

Equities and oil prices tumbled Wednesday after a brief respite from last week's painful rout across world markets, with recession fears building as central banks hike interest rates to combat decades-high inflation.

Wall Street opened lower while European stock markets were down in afternoon trading and Asia closed in the red, a day after healthy gains.

Federal Reserve boss Jerome Powell's two-day testimony to Congress this week will be pored over for an idea about officials' plans for fighting runaway prices, which are being fanned by supply chain snarls, China's Covid lockdowns and the war in Ukraine.

Powell warned lawmakers on Wednesday that US economy faces an "uncertain" global environment and could face further inflation "surprises".

He once again stressed that the Fed is committed to bringing down inflation -- which has reached a 40-year high -- with higher interest rates, but said the world's largest economy "is very strong and well positioned to handle tighter monetary policy."

Most observers expect the Fed to aggressively hike US interest rates several more times this year having recently carried out the sharpest lift in almost 30 years.

"The 'R' word is likely to come up a lot today and the Chairman will have a tough time dodging it, especially with mid-terms in five months," said OANDA market analyst Craig Erlam, referring to recession.

"Naturally, he'll do his best to remain apolitical but I'm not sure investors will be able to ignore so much recession chat," he added.

Expectations of more rate hikes are handing support to the dollar, which pushed the yen briefly to a fresh 24-year low Wednesday.

The Bank of Japan is holding back from lifting interest rates, in sharp contrast to other major central banks.

"Swiftly rising interest rates act as a vacuum for economic growth, and this isn't lost on the market today," noted Sophie Lund-Yates, equity analyst at Hargreaves Lansdown.

"This is a darker day for global markets than has been seen in a while. Serious questions remain about the resilience of consumers, and it appears traders are bracing for a harsh hand where interest rates are concerned."

Oil prices were feeling the heat from recessionary fears, with both main contracts tanking more than six percent at one point.

Crude and gas prices have soared in recent months after major economies lifted pandemic lockdowns and following the invasion of Ukraine by major energy producer Russia.

Surging energy costs are fuelling global inflation, with official data Wednesday showing the British annual rate hitting a fresh 40-year high above nine percent.

In the United States, President Joe Biden will Wednesday ask Congress to suspend the federal gas tax for three months as skyrocketing prices cause widespread anger among Americans just months before crucial mid-term elections.

A senior administration official noted that US gas prices -- averaging near $5 per gallon -- had jumped almost $2 since Russian President Vladimir Putin began building up forces on the Ukrainian border earlier this year.

- Key figures at around 1330 GMT -

Brent North Sea crude: DOWN 6.0 percent at $107.83 per barrel

West Texas Intermediate: DOWN 6.5 percent at $102.36 per barrel

London - FTSE 100: DOWN 1.5 percent at 7,048.37 points

Frankfurt - DAX: DOWN 1.9 percent at 13,045.98

Paris - CAC 40: DOWN 1.6 percent at 5,867.49

EURO STOXX 50: DOWN 1.7 percent at 3,435.66

New York - Dow: DOWN 1.2 percent at 30,175.91

Tokyo - Nikkei 225: DOWN 0.4 at 26,149.55 (close)

Hong Kong - Hang Seng Index: DOWN 2.6 percent at 21,008.34 (close)

Shanghai - Composite: DOWN 1.2 percent at 3,267.20 (close)

Euro/dollar: UP at $1.0539 from $1.0535 late Tuesday

Pound/dollar: DOWN at $1.2257 from $1.2273

Euro/pound: UP at 85.99 pence from 85.80 pence

Dollar/yen: DOWN at 135.99 yen from 136.64 yen

burs-rl/lth

S.Jackson--AT