-

Bondi victims honoured as Sydney-Hobart race sets sail

Bondi victims honoured as Sydney-Hobart race sets sail

-

North Korea's Kim orders factories to make more missiles in 2026

-

Palladino's Atalanta on the up as Serie A leaders Inter visit

Palladino's Atalanta on the up as Serie A leaders Inter visit

-

Hooked on the claw: how crane games conquered Japan's arcades

-

Shanghai's elderly waltz back to the past at lunchtime dance halls

Shanghai's elderly waltz back to the past at lunchtime dance halls

-

Japan govt approves record 122 trillion yen budget

-

US launches Christmas Day strikes on IS targets in Nigeria

US launches Christmas Day strikes on IS targets in Nigeria

-

Australia reeling on 72-4 at lunch as England strike in 4th Ashes Test

-

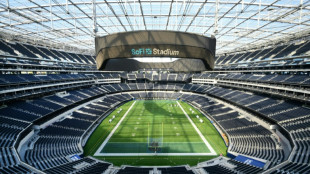

Too hot to handle? Searing heat looming over 2026 World Cup

Too hot to handle? Searing heat looming over 2026 World Cup

-

Packers clinch NFL playoff spot as Lions lose to Vikings

-

Guinea's presidential candidates hold final rallies before Sunday's vote

Guinea's presidential candidates hold final rallies before Sunday's vote

-

Villa face Chelsea test as Premier League title race heats up

-

Spurs extend domination of NBA-best Thunder

Spurs extend domination of NBA-best Thunder

-

Malaysia's Najib to face verdict in mega 1MDB graft trial

-

Russia makes 'proposal' to France over jailed researcher

Russia makes 'proposal' to France over jailed researcher

-

King Charles calls for 'reconciliation' in Christmas speech

-

Brazil's jailed ex-president Bolsonaro undergoes 'successful' surgery

Brazil's jailed ex-president Bolsonaro undergoes 'successful' surgery

-

UK tech campaigner sues Trump administration over US sanctions

-

New Anglican leader says immigration debate dividing UK

New Anglican leader says immigration debate dividing UK

-

Russia says made 'proposal' to France over jailed researcher

-

Bangladesh PM hopeful Rahman returns from exile ahead of polls

Bangladesh PM hopeful Rahman returns from exile ahead of polls

-

Police suspect suicide bomber behind Nigeria's deadly mosque blast

-

AFCON organisers allowing fans in for free to fill empty stands: source

AFCON organisers allowing fans in for free to fill empty stands: source

-

Mali coach Saintfiet hits out at European clubs, FIFA over AFCON changes

-

Pope urges Russia, Ukraine dialogue in Christmas blessing

Pope urges Russia, Ukraine dialogue in Christmas blessing

-

Last Christians gather in ruins of Turkey's quake-hit Antakya

-

Pope Leo condemns 'open wounds' of war in first Christmas homily

Pope Leo condemns 'open wounds' of war in first Christmas homily

-

Mogadishu votes in first local elections in decades under tight security

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh

Prime minister hopeful Tarique Rahman arrives in Bangladesh

-

'Starting anew': Indonesians in disaster-struck Sumatra hold Christmas mass

-

Cambodian PM's wife attends funerals of soldiers killed in Thai border clashes

Cambodian PM's wife attends funerals of soldiers killed in Thai border clashes

-

Prime minister hopeful Tarique Rahman arrives in Bangladesh: party

-

Pacific archipelago Palau agrees to take migrants from US

Pacific archipelago Palau agrees to take migrants from US

-

Pope Leo expected to call for peace during first Christmas blessing

-

Australia opts for all-pace attack in fourth Ashes Test

Australia opts for all-pace attack in fourth Ashes Test

-

'We hold onto one another and keep fighting,' says wife of jailed Istanbul mayor

-

North Korea's Kim visits nuclear subs as Putin hails 'invincible' bond

North Korea's Kim visits nuclear subs as Putin hails 'invincible' bond

-

Trump takes Christmas Eve shot at 'radical left scum'

-

3 Factors That Affect the Cost of Dentures in San Antonio, TX

3 Factors That Affect the Cost of Dentures in San Antonio, TX

-

Leo XIV celebrates first Christmas as pope

-

Diallo and Mahrez strike at AFCON as Ivory Coast, Algeria win

Diallo and Mahrez strike at AFCON as Ivory Coast, Algeria win

-

'At your service!' Nasry Asfura becomes Honduran president-elect

-

Trump-backed Nasry Asfura declared winner of Honduras presidency

Trump-backed Nasry Asfura declared winner of Honduras presidency

-

Diallo strikes to give AFCON holders Ivory Coast winning start

-

Dow, S&P 500 end at records amid talk of Santa rally

Dow, S&P 500 end at records amid talk of Santa rally

-

Spurs captain Romero facing increased ban after Liverpool red card

-

Bolivian miners protest elimination of fuel subsidies

Bolivian miners protest elimination of fuel subsidies

-

A lack of respect? African football bows to pressure with AFCON change

-

Trump says comedian Colbert should be 'put to sleep'

Trump says comedian Colbert should be 'put to sleep'

-

Mahrez leads Algeria to AFCON cruise against Sudan

Stock markets extend recovery, dollar at multi-year highs

Stock markets powered higher Thursday, extending a recovery on bargain hunting after sharp losses at the start of the week.

In foreign exchange, the dollar traded around 20-year peaks versus the yen and at the highest level in more than five years against the euro as the Federal Reserve aggressively hikes US interest rates.

Trading is volatile across major assets as investors remain on high alert over a range of crises including the Ukraine war, surging inflation, higher interest rates and Chinese Covid lockdowns.

National Australia Bank's Rodrigo Catril said "risk assets in general still need to navigate the consequences from what looks to be an increasingly more aggressive policy tightening by many central banks".

He added that "China's zero-Covid policy remains in place and the prospect of a protracted Russia-Ukraine conflict does not bode well for the energy prices and energy supply for Europe in particular."

The ongoing earnings season has meanwhile seen a mixed bag of results that have weighed on tech firms, though there was some cheer from a forecast-beating reading by Facebook parent Meta on Wednesday, which analysts said could provide some relief to the sector.

Investors took heart also from a report by China's state broadcaster CCTV that said officials had promised more policies on boosting the nation's employment.

Unemployment in China -- the world's second biggest economy after the United States -- has recently jumped on fresh Covid lockdowns in major cities including Shanghai.

It comes at a time of surging inflation that is causing central banks around the globe to hike interest rates.

Sweden's central bank on Thursday became the latest to lift rates, from zero to 0.25 percent.

The Federal Reserve is next week expected to lift US interest rates by half a point and signal further big increases through the year.

So far the European Central Bank has refused to tighten borrowing costs and on Thursday ECB vice-president Luis de Guindos said a surge in eurozone consumer prices is "very close" to reaching its peak.

Soaring prices are impacting consumers and businesses.

Unilever on Thursday announced a jump in revenue after the British consumer goods giant passed on higher costs to customers.

In other corporate news, shares in Standard Chartered soared 16 percent in London after the bank that is focused on Asia and emerging markets globally lifted its annual profits outlook after an upbeat first quarter.

- Key figures at 1100 GMT -

London - FTSE 100: UP 1.0 percent at 7,495.80 points

Paris - CAC 40: UP 1.3 percent at 6,531.51

Frankfurt - DAX: UP 1.2 percent at 13,964.11

EURO STOXX 50: UP 1.3 percent at 3,783.29

Tokyo - Nikkei 225: UP 1.8 percent at 26,847.90 (close)

Hong Kong - Hang Seng Index: UP 1.7 percent at 20,276.17 (close)

Shanghai - Composite: UP 0.6 percent at 2,975.48 (close)

New York - Dow: UP 0.2 percent at 33,301.93 (close)

Euro/dollar: DOWN at $1.0501 from $1.0556 late Wednesday

Pound/dollar: DOWN at $1.2472 from $1.2543

Euro/pound: UP at 84.18 pence from 84.14 pence

Dollar/yen: UP at 130.46 yen from 128.43 yen

Brent North Sea crude: DOWN 0.1 percent at $105.20 per barrel

West Texas Intermediate: UP 0.2 percent at $102.22 per barrel

B.Torres--AT