-

AI gobbling up memory chips essential to gadget makers

AI gobbling up memory chips essential to gadget makers

-

'One Battle After Another' leads the charge for Golden Globes

-

Trump to meet top US oil execs after seizing Venezuela leader

Trump to meet top US oil execs after seizing Venezuela leader

-

Kyrgios to play doubles only at Australian Open

-

Swiss mining giant Glencore reveals merger talks with Rio Tinto

Swiss mining giant Glencore reveals merger talks with Rio Tinto

-

Firefighters warn of 'hectic' Australian bushfires

-

International Space Station crew to return early after astronaut medical issue

International Space Station crew to return early after astronaut medical issue

-

Arsenal in 'strong position' despite missed opportunity for Arteta

-

US House revolt advances Obamacare subsidy extension

US House revolt advances Obamacare subsidy extension

-

Swiss mining giant Glencore in merger talks with Rio Tinto

-

US snowboard star Kim dislocates shoulder ahead of Olympic three-peat bid

US snowboard star Kim dislocates shoulder ahead of Olympic three-peat bid

-

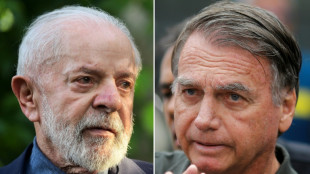

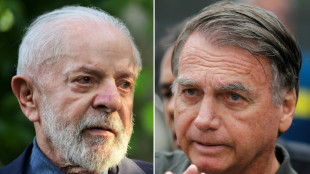

Brazil's Lula vetoes bill reducing Bolsonaro's sentence

-

AC Milan scrape a point with Genoa after late penalty howler

AC Milan scrape a point with Genoa after late penalty howler

-

Arsenal miss chance to stretch lead in Liverpool stalemate

-

Stocks mixed as traders await US jobs data, oil rebounds

Stocks mixed as traders await US jobs data, oil rebounds

-

After Minneapolis shooting, AI fabrications of victim and shooter

-

Trump says no pardon for Sean 'Diddy' Combs

Trump says no pardon for Sean 'Diddy' Combs

-

Real Madrid edge Atletico to set up Clasico Spanish Super Cup final

-

Venezuela begins 'large' prisoner release amid US pressure

Venezuela begins 'large' prisoner release amid US pressure

-

Real Madrid beat Atletico to set up Clasico Spanish Super Cup final

-

Heavy wind, rain, snow batters Europe

Heavy wind, rain, snow batters Europe

-

PSG beat Marseille on penalties to win French Champions Trophy

-

Macron says France to vote against EU-Mercosur deal

Macron says France to vote against EU-Mercosur deal

-

From sci-fi to sidewalk: exoskeletons go mainstream

-

Rare genius dogs learn vocabulary by eavesdropping: study

Rare genius dogs learn vocabulary by eavesdropping: study

-

EU orders Musk's Grok AI to keep data after nudes outcry

-

Venezuela announces release of 'large number' of prisoners

Venezuela announces release of 'large number' of prisoners

-

Rare gorilla twins born in conflict-hit DR Congo nature park

-

Dolphins fire head coach McDaniel after four seasons

Dolphins fire head coach McDaniel after four seasons

-

Three ships head to US with Venezuela oil as capacity concerns grow

-

Trump says US could run Venezuela and its oil for years

Trump says US could run Venezuela and its oil for years

-

Heavy wind, rain, snow to batter Europe

-

Morocco coach Regragui aims to shift pressure to Cameroon before AFCON clash

Morocco coach Regragui aims to shift pressure to Cameroon before AFCON clash

-

HRW warns right to protest 'under attack' in UK

-

French farmers rage against EU-Mercosur trade deal

French farmers rage against EU-Mercosur trade deal

-

Humanoid robots go for knockout in high-tech Vegas fight night

-

Brazil's Lula vetoes law reducing Bolsonaro's sentence

Brazil's Lula vetoes law reducing Bolsonaro's sentence

-

New protests, strikes hit Iran as security forces open fire

-

Macron accuses US of 'turning away' from allies, breaking rules

Macron accuses US of 'turning away' from allies, breaking rules

-

Joshua pays tribute to close friends killed in crash

-

Protesters, US law enforcement clash after immigration officer kills woman

Protesters, US law enforcement clash after immigration officer kills woman

-

French ex-spy chief cops suspended jail term for 15 mn euro shakedown

-

UN climate chief says Trump scores 'own goal' with treaty retreat

UN climate chief says Trump scores 'own goal' with treaty retreat

-

Syria bombs Kurdish areas in city of Aleppo

-

Confusion reigns over Venezuela's oil industry as US looms

Confusion reigns over Venezuela's oil industry as US looms

-

Stocks retrench as traders eye geopolitics, US jobs data

-

US trade gap shrinks to smallest since 2009 as imports fall

US trade gap shrinks to smallest since 2009 as imports fall

-

Russia releases French researcher in prisoner exchange

-

Spain signs agreement with Church to compensate abuse victims

Spain signs agreement with Church to compensate abuse victims

-

Macron accuses US of 'breaking free from international rules'

Emerging Growth Research Maintains Buy Rating on First Phosphate Corp. Following Successful C$9.6 Million Financing and CSE25 Index Inclusion

NEW YORK CITY, NEW YORK / ACCESS Newswire / January 7, 2026 / Emerging Growth Research today announced the release of its Flash Report on First Phosphate Corp. (CSE:PHOS)(OTC:FRSPF), maintaining a Buy rating with a 12-month price target of C$4.83, representing approximately 360% upside from the Company's closing price of C$1.05 on January 6, 2026.

The Flash Report highlights First Phosphate's successful completion of C$9.6 million in financing with limited dilution, receipt of C$0.7 million in offtake pre-payment, and inclusion in the CSE25 Index-three key developments that collectively de-risk the Company's investment case and reinforce visibility on upcoming positive catalysts.

Key Highlights from the Flash Report:

Successful Capital Raise with Limited Dilution: First Phosphate completed the fourth and final tranche of its private placement on December 22, 2025, raising a total of C$9.6 million through the issuance of 8.0 million flow-through shares and 2.6 million ordinary shares at C$0.90 per share, together with 2.6 million warrants with a strike price of C$1.25 expiring April 29, 2026. Over the past three years, PHOS has raised C$49.7 million across ten private placement deals, demonstrating management's consistent ability to secure capital while preserving shareholder value.

Additional Offtake Pre-Payment: First Phosphate received an additional C$0.7 million as a lump-sum pre-payment from its existing long-term phosphate concentrate offtake partner to further finance final resource definition at Bégin-Lamarche and advance the project toward feasibility study and production.

CSE25 Index Inclusion: On December 19, 2025, PHOS common shares were added to the CSE25 Index as part of the Canadian Securities Exchange's quarterly rebalancing. This inclusion significantly increases the Company's visibility among investors and should improve stock liquidity through additional demand from index-linked investment products.

Resource Definition Progress: First Phosphate is currently completing a 30,000-metre drill program at Bégin-Lamarche to finalize geological studies with the aim of converting indicated mineral resources into measured mineral resources. This drilling program is expected to be completed by April 2026, when the Company will decide to proceed with the feasibility study.

Use of Proceeds: The capital raised will support activities related to final definition of mineral resources at the flagship Bégin-Lamarche phosphate mining project, advancing it to feasibility study, and working capital needs.

Updated Valuation: Reflecting lower risk perception and improved visibility on positive catalysts, Emerging Growth Research lowered its discount rate by 50 basis points while increasing the share count by 15% to reflect the recent capital increase. The updated target price of C$4.83 (from C$4.93) maintains substantial upside potential, with PHOS trading at just 0.22x estimated net asset value.

According to Emerging Growth Research's analysis, these developments significantly de-risk First Phosphate's path toward becoming a vertically integrated mine-to-market LFP battery supply chain for North America. The Company's rare igneous phosphate resource at Bégin-Lamarche-one of only approximately 5% of global phosphate deposits with this geology-yields high-purity phosphate concentrate above 40% P₂O₅ with minimal impurities, positioning it advantageously for battery-grade purified phosphoric acid (PPA) production.

The firm's sum-of-the-parts analysis values the mine at a discount rate of 11.5% and the planned PPA plant at 13.5%, reflecting the Company's dual-revenue model that will generate cash flow from concentrate sales while advancing toward higher-margin battery-grade acid production. Management has indicated post-tax free cash flow from the mine alone should average approximately US$239 million per year at steady state, peaking near US$290 million, before layering in incremental PPA cash flows.

Key upcoming catalysts over the next 12 to 24 months include completion of the drilling program by April 2026, feasibility study advancement, permitting progress, additional multi-year offtakes, potential grant packages, and conversion of the Port Saguenay land option.

For a copy of the full Flash Report, please visit:

or

https://emerginggrowth.com/profile/frspf/ (on the right side of the page as you scroll down)

About First Phosphate Corp.

First Phosphate is a mineral development and cleantech company dedicated to building and onshoring a vertically integrated mine-to-market LFP battery supply chain for North America. Target markets include energy storage, data centers, robotics, mobility, and national security. First Phosphate's flagship Bégin-Lamarche Property in Saguenay-Lac-Saint-Jean, Québec is one of North America's rare igneous phosphate resources, yielding high-purity phosphate with minimal impurities.

For more information, please visit https://www.firstphosphate.com.

Contact:

Emerging Growth Research

[email protected]

www.EmergingGrowth.com

Forward-Looking Statements

This press release contains forward-looking statements concerning business operations and financial performance as well as plans, objectives, and expectations for First Phosphate Corp. that are subject to risks and uncertainties. All statements other than statements of historical fact are forward-looking statements. These include but are not limited to statements regarding completion of the drill program by April 2026, feasibility study timing, first production expectations, resource conversion, concentrate and PPA volume targets, mine net cash costs, free cash flow projections, offtake execution, permitting timelines, financing arrangements, and valuation projections. Actual results could differ materially due to competitive, regulatory, operational, technical, geological, market, or funding risks.

SOURCE: First Phosphate Corp.

View the original press release on ACCESS Newswire

D.Johnson--AT