-

Recalled Ndiaye takes Senegal past 10-man Mali into AFCON semis

Recalled Ndiaye takes Senegal past 10-man Mali into AFCON semis

-

'Devastated' Switzerland grieves New Year inferno victims

-

Man pleads guilty to sending 'abhorrent messages' to England women's footballer Carter

Man pleads guilty to sending 'abhorrent messages' to England women's footballer Carter

-

PGA Tour unveils fall slate with Japan, Mexico, Bermuda stops

-

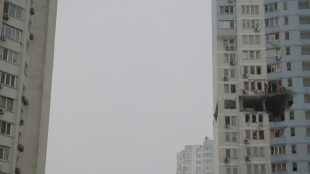

'Unhappy' Putin sends message to West with Ukraine strike on EU border

'Unhappy' Putin sends message to West with Ukraine strike on EU border

-

Fletcher defends United academy after Amorim criticism

-

Stocks shrug off mixed US jobs data to advance

Stocks shrug off mixed US jobs data to advance

-

Kyiv mayor calls for temporary evacuation over heating outages

-

Families wait in anguish for prisoners' release in Venezuela

Families wait in anguish for prisoners' release in Venezuela

-

Littler signs reported record £20 million darts deal

-

'Devastated' Switzerland grieves deadly New Year fire

'Devastated' Switzerland grieves deadly New Year fire

-

Syria threatens to bomb Kurdish district in Aleppo as fighters refuse to evacuate

-

Britain's Princess Catherine 'deeply grateful' after year in cancer remission

Britain's Princess Catherine 'deeply grateful' after year in cancer remission

-

Russia joins Chinese, Iran warships for drills off South Africa

-

40 white roses: shaken mourners remember Swiss fire victims

40 white roses: shaken mourners remember Swiss fire victims

-

German trial starts of 'White Tiger' online predator

-

Stocks rise despite mixed US jobs data

Stocks rise despite mixed US jobs data

-

'Palestine 36' director says film is about 'refusal to disappear'

-

US December hiring misses expectations, capping weak 2025

US December hiring misses expectations, capping weak 2025

-

Switzerland 'devastated' by fire tragedy: president

-

Semenyo says he wants to 'rewrite history again' after joining Man City

Semenyo says he wants to 'rewrite history again' after joining Man City

-

Rosenior not scared of challenge at 'world class' Chelsea

-

Polish farmers march against Mercosur trade deal

Polish farmers march against Mercosur trade deal

-

Swiatek wins in 58 minutes as Poland reach United Cup semis

-

Grok limits AI image editing to paid users after nudes backlash

Grok limits AI image editing to paid users after nudes backlash

-

Ski great Hirscher pulls out of Olympics, ends season

-

Kyiv mayor calls for temporary evacuation after Russian strikes

Kyiv mayor calls for temporary evacuation after Russian strikes

-

'War is back in vogue,' Pope Leo says

-

Storms pummel northern Europe causing travel mayhem and power cuts

Storms pummel northern Europe causing travel mayhem and power cuts

-

France has right to say 'no' to US, Paris says

-

TikTok drives 'bizarre' rush to Prague library's book tower

TikTok drives 'bizarre' rush to Prague library's book tower

-

EU countries override France to greenlight Mercosur trade deal

-

Russia joins Chinese, Iran warships for drills off S.Africa

Russia joins Chinese, Iran warships for drills off S.Africa

-

Stocks rise ahead of US jobs data and key tariffs ruling

-

'All are in the streets': Iranians defiant as protests grow

'All are in the streets': Iranians defiant as protests grow

-

Kurdish fighters refuse to leave Syria's Aleppo after truce

-

Grok turns off AI image generation for non-payers after nudes backlash

Grok turns off AI image generation for non-payers after nudes backlash

-

Germany factory output jumps but exports disappoint

-

Defiant Khamenei insists 'won't back down' in face of Iran protests

Defiant Khamenei insists 'won't back down' in face of Iran protests

-

Russian strikes cut heat to Kyiv, mayor calls for temporary evacuation

-

Switzerland holds day of mourning after deadly New Year fire

Switzerland holds day of mourning after deadly New Year fire

-

Trump says US oil pledged $100 bn for Venezuela ahead of White House meeting

-

Hundreds of thousands without power as storms pummel Europe

Hundreds of thousands without power as storms pummel Europe

-

Man City win race to sign forward Semenyo

-

Experts say oceans soaked up record heat levels in 2025

Experts say oceans soaked up record heat levels in 2025

-

'Would be fun': Alcaraz, Sinner tease prospect of teaming up in doubles

-

Man City win race to sign Semenyo

Man City win race to sign Semenyo

-

Chinese AI unicorn MiniMax soars 109 percent in Hong Kong debut

-

Iran rocked by night of protests despite internet blackout: videos

Iran rocked by night of protests despite internet blackout: videos

-

Stocks mixed ahead of US jobs, Supreme Court ruling

Stocks mixed as traders await US jobs data, oil rebounds

Global stocks were mixed Thursday while oil prices bounced higher as markets looked ahead to key US employment data expected to influence monetary policy.

The geopolitical outlook remained a major uncertainty for traders after the United States toppled Venezuela's president, and as China targeted Japanese imports following Tokyo voicing support for Taiwan.

US defense stocks saw some sharp gains after President Donald Trump called for a 50-percent hike of the US defense budget next year.

But US indices overall were indecisive, with the Dow advancing, the Nasdaq retreating and the S&P 500 ending flat.

Investors were awaiting the release of US data on non-farm payrolls Friday, a crucial guide for Federal Reserve decision-makers. They meet at the end of the month amid debate on whether they will cut interest rates for a fourth successive time.

"With a March rate cut essentially priced in as a coin-toss, tomorrow's jobs report does provide the basis for a potential market-moving event if we see any particularly strong deviation from expectations," said Joshua Mahony, chief market analyst at Scope Markets.

Analysts expect the US economy added 55,000 jobs in December, while unemployment dipped to 4.5 percent from 4.6 percent in November.

Equity markets in Asia struggled Thursday, with Hong Kong, Shanghai and Tokyo all closing lower.

Tokyo stocks were weighed down after China announced an anti-dumping probe into imports from Japan of a key chemical used to make semiconductors.

The move comes with the two Asian giants at loggerheads since Japanese Prime Minister Sanae Takaichi suggested in November that Japan may react militarily in any attack on Taiwan.

Seoul edged higher to another record close, though tech giant Samsung fell back after saying it expected its fourth-quarter profit to reach a record $13.8 billion.

Oil prices rebounded after suffering a second steep fall in a row Wednesday on Trump's comments that Venezuela would turn over millions of barrels to the United States following its ouster of President Nicolas Maduro.

Traders will also be keeping an eye on a US Supreme Court ruling, which could come as soon as Friday, on the legality of many of Trump's punishing tariffs.

- Key figures at around 2115 GMT -

New York - Dow: UP 0.6 percent at 49,266.11 (close)

New York - S&P 500: FLAT at 6,921.46 (close)

New York - Nasdaq: DOWN 0.4 percent at 23,480.02 (close)

London - FTSE 100: FLAT at 10,044.69 (close)

Paris - CAC 40: UP 0.1 percent at 8,243.47 (close)

Frankfurt - DAX: FLAT at 25,127.46 (close)

Tokyo - Nikkei 225: DOWN 1.6 percent at 51,117.26 (close)

Hong Kong - Hang Seng Index: DOWN 1.2 percent at 26,149.31 (close)

Shanghai - Composite: DOWN 0.1 percent at 4,082.98 (close)

Euro/dollar: DOWN at $1.1661 from $1.1675 on Wednesday

Pound/dollar: DOWN at $1.3437 from $1.3458

Dollar/yen: UP at 156.95 yen from 156.76 yen

Euro/pound: DOWN at 86.70 from 86.74 pence

Brent North Sea Crude: UP 3.4 percent at $61.99 per barrel

West Texas Intermediate: UP 3.2 percent at $57.76 per barrel

burs-jmb/jgc

O.Gutierrez--AT