-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

Reigning world champs Tinch, Hocker among Millrose winners

Reigning world champs Tinch, Hocker among Millrose winners

-

Venezuelan activist ends '1,675 days' of suffering in prison

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Guirassy double helps Dortmund move six points behind Bayern

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

Nigeria's president pays tribute to Fela Kuti after Grammys Award

-

Inter eight clear after win at Cremonese marred by fans' flare flinging

-

England underline World Cup

credentials with series win over Sri Lanka

England underline World Cup

credentials with series win over Sri Lanka

-

Guirassy brace helps Dortmund move six behind Bayern

-

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

Man City held by Solanke stunner, Sesko delivers 'best feeling' for Man Utd

-

'Send Help' debuts atop N.America box office

-

Ukraine war talks delayed to Wednesday, says Zelensky

Ukraine war talks delayed to Wednesday, says Zelensky

-

Iguanas fall from trees in Florida as icy weather bites southern US

-

Carrick revels in 'best feeling' after Man Utd leave it late

Carrick revels in 'best feeling' after Man Utd leave it late

-

Olympic chiefs admit 'still work to do' on main ice hockey venue

-

Pope says Winter Olympics 'rekindle hope' for world peace

Pope says Winter Olympics 'rekindle hope' for world peace

-

Last-gasp Demirovic strike sends Stuttgart fourth

-

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

Sesko strikes to rescue Man Utd, Villa beaten by Brentford

-

'At least 200' feared dead in DR Congo landslide: government

-

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

Coventry says 'sad' about ICE, Wasserman 'distractions' before Olympics

-

In-form Lyon make it 10 wins in a row

-

Man Utd strike late as Carrick extends perfect start in Fulham thriller

Man Utd strike late as Carrick extends perfect start in Fulham thriller

-

Van der Poel romps to record eighth cyclo-cross world title

-

Mbappe penalty earns Real Madrid late win over nine-man Rayo

Mbappe penalty earns Real Madrid late win over nine-man Rayo

-

Resurgent Pakistan seal T20 sweep of Australia

-

Fiji top sevens standings after comeback win in Singapore

Fiji top sevens standings after comeback win in Singapore

-

Alcaraz sweeps past Djokovic to win 'dream' Australian Open

-

Death toll from Swiss New Year bar fire rises to 41

Death toll from Swiss New Year bar fire rises to 41

-

Alcaraz says Nadal inspired him to 'special' Australian Open title

-

Pakistan seeks out perpetrators after deadly separatist attacks

Pakistan seeks out perpetrators after deadly separatist attacks

-

Ukraine war talks delayed to Wednesday, Zelensky says

Formation Metals Announces $6,000,000 Private Placement is Fully Allocated

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Highlights:

Formation has planned a 20,000 metre total multi-phase drill program at its flagship N2 Gold Project in Quebec, host to a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

Phase 1, consisting of a fully funded 10,000 metres, commenced on September 25, 2025. Phase 1 will target the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces of which only ~35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.

The Company has working capital of ~C$5.0M with zero debt prior to the financing, putting it in a very strong financial position to execute its exploration programs. Inclusive of provincial tax credits from the Quebec government, Formation's exploration budget for 2025-2026 is set at ~$5.7M. The financings, if fully subscribed, would increase Formation's working capital to ~$10.5M.

NOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Highlights:

Formation has planned a 20,000 metre total multi-phase drill program at its flagship N2 Gold Project in Quebec, host to a global historic resource of ~870,000 ounces comprised of 18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4.

Phase 1, consisting of a fully funded 10,000 metres, commenced on September 25, 2025. Phase 1 will target the "A" zone, a shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces of which only ~35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres2, which was expanded by Agnico Eagle Mines in 2008 in the most recent drilling at the Property.

The Company has working capital of ~C$5.0M with zero debt prior to the financing, putting it in a very strong financial position to execute its exploration programs. Inclusive of provincial tax credits from the Quebec government, Formation's exploration budget for 2025-2026 is set at ~$5.7M. The financings, if fully subscribed, would increase Formation's working capital to ~$10.5M.

VANCOUVER, BC / ACCESS Newswire / October 1, 2025 / Formation Metals Inc. ("Formation" or the "Company") (CSE:FOMO)(FSE:VF1)(OTCQB:FOMTF), a North American mineral acquisition and exploration company, is pleased to announce that its previously announced offering of up to 10,810,810 units (each, a "LIFE Unit") of the Company at $0.37 per LIFE Unit for gross proceeds of up to $4,000,000 and 4,878,049 flow-through units of the Company ("FT Units") at a price of $0.41 per FT Unit for gross proceeds of up to $2,000,000 (the "FT Private Placement" and, together with the LIFE Offering, the "Offerings") is fully allocated. For more information about the offering, please see the company's press release dated September 30, 2025, a copy of which is available under the company's profile at SEDAR+.

Deepak Varshney, CEO of the Company, commented: "We are very pleased with the strong response to our financing, which has been fully allocated. We believe that the support from new potential investors is a strong endorsement of our projects and strategy. We look forward to completing the closing in the coming week and putting this capital to work to advance our exploration and development plans."

Completion of the offering remains subject to a number of customary closing conditions, including receipt of approval of the Canadian Securities Exchange and execution of subscription agreements.

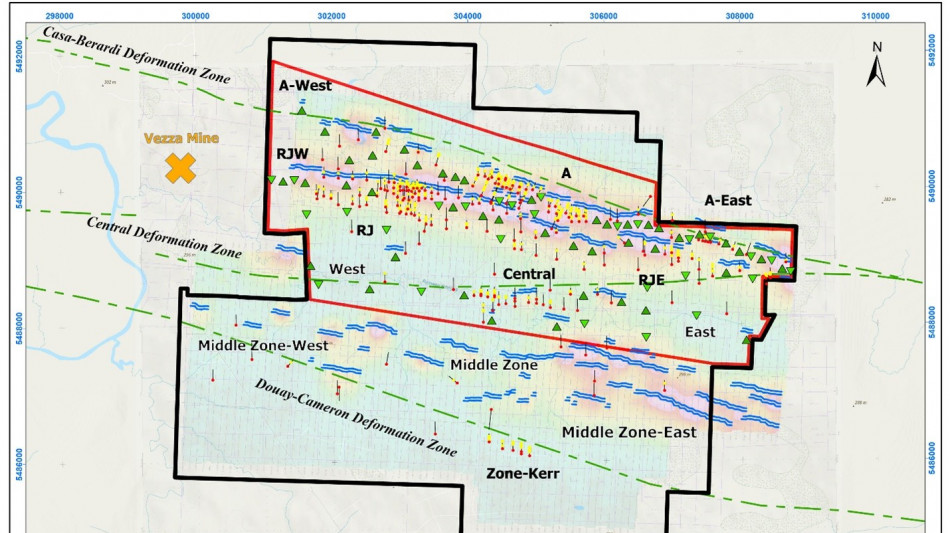

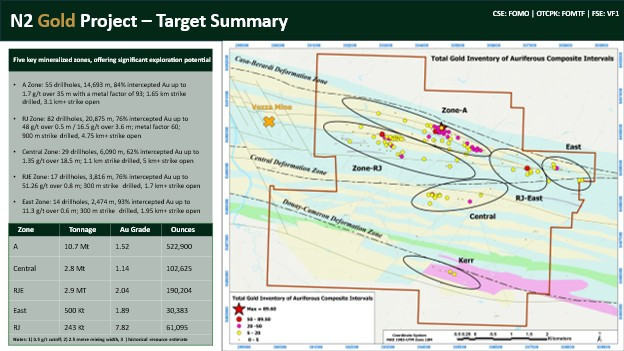

Project Summary

Comprising 87 claims totaling ~4,400 ha within the Abitibi sub province of Northwestern Quebec, Formation's flagship N2 Gold Project is an advanced gold project with a global historic resource of 877,000 ounces. There are six primary auriferous mineralized zones in total, each open for expansion along strike and at depth. Compilation and geophysical work by Balmoral Resources Ltd. (now Wallbridge Mining) from 2010 to 2018 generated numerous targets that have not yet been investigated with diamond drilling.

The drill program is designed to focus on discovery drilling at new high-potential targets along the mineralization strikes at the "A", "RJ" and "Central" zones in the northern part of the Property in order to discover new auriferous trends and unlock new zones of gold mineralization. The program will also focus on high-priority infilling and expansion targets in these zones to significantly enhance the auriferous zones identified to-date (Figure 1).

Historical highlights from the top two priority zones include:

A Zone: A shallow, highly continuous, low-variability historic gold deposit with ~522,900 ounces identified at a grade of 1.52 g/t Au. ~15,000 metres have been drilled historically across 1.65 km of strike, with over 3.1 km of strike remaining to be tested. 84% of historical drillholes intercepted auriferous intervals including up 1.7 g/t over

35 m.RJ Zone: a high-grade historic gold deposit with ~61,100 ounces identified at a grade of 7.82 g/t Au, with high-grade intercepts from historical drill holes as high as 51 g/t Au over 0.8 metres and 16.5 g/t Au over 3.5 metres2. This zone was the target of the most recently drilling at the Property by Agnico-Eagle Mines in 2008, when the price of gold was ~US$800/oz. Only ~900 metres of strike has been drilled, with 4.75+ km of strike remaining to be tested.

The Company also believes that N2 has significant base metal potential, where it recently completed a revaluation process which revealed significant copper and zinc intercepts within historic drillholes known to have significant gold grades (>1 g/t Au). Assay results range from 200 to 4,750 ppm and 203 ppm to 6,700 ppm, for copper and zinc, respectively, indicating strong potential for elevated base metal (Cu-Zn) concentrations across the property, specifically at the A and RJ zones. Property wide geology at N2 features volcanic and sedimentary rocks formed in regional anticlinal and synclinal flexures. Three principal deformation structures (Figure 1), oriented along the known NW-SE to WNW-ESE structural trends typical of VMS deposits in the Matagami region, function as critical geologic controls for mineralization on the property.

For the 2025 exploration season, Formation plans to concentrate its efforts on the northern part of N2, targeting gold deposit expansion and discovery along identified zones and fault systems associated with the main deformation features (specifically WNW-ESE trend), with IP surveys and drilling planned to model mineralized zones that will hopefully contribute to an updated NI-43 101 compliant resource. Formation will also look to further review historic base metal assays from older drill core and undertake additional work in 2025 to assess the property's copper and zinc potential.

Qualified person

The technical content of this news release has been reviewed and approved by Mr. Babak Vakili Azar, P.Geo., an independent contractor and a qualified person as defined by National Instrument 43-101. Historical reports provided by the optionor were reviewed by the qualified person. The information provided has not been verified and is being treated as historic.

About Formation Metals Inc.

Formation Metals Inc. is a North American mineral acquisition and exploration company focused on the development of quality properties that are drill-ready with high-upside and expansion potential. Formation's flagship asset is the N2 Gold Project, an advanced gold project with a global historic resource of ~870,000 ounces (18 Mt grading 1.4 g/t Au (~809,000 oz Au) across four zones (A, East, RJ-East, and Central)2,3 and 243 Kt grading 7.82 g/t Au (~61,000 oz Au) across the RJ zone2,4) and six mineralized zones, each open for expansion along strike and at depth including the "A" zone, of which only ~35% of strike has been drilled (>3.1 km open), and the "RJ" zone, host to historical high-grade intercepts as high as 51 g/t Au over 0.8 metres.

FORMATION METALS INC.

Deepak Varshney, CEO and Director

For more information, please call 778-899-1780, email [email protected] or visit www.formationmetalsinc.com.

Neither the Canadian Securities Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Notes and References:

Readers are cautioned that the geology of nearby properties is not necessarily indicative of the geology of the Property.

The above referenced resource estimates do not have a category, are considered historical in nature, and are based on prior data prepared by a previous property owner, and do not conform to current CIM categories.

While the Company considers the estimates to be reliable, a qualified person has not done sufficient work to classify the historical estimates as current resources in accordance with current CIM categories and the Company is not treating the historical estimates as a current resource. A 0.5 g/t Au cut-off was used in the preparation of the historical estimates with a minimum 2.5 metre mining width.

Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the historical estimates can be classified as current resources. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. The Company is not aware of any more recent estimates prepared for the N2 Property.

Needham, B. (1994), 1993 Diamond Drill Report, Northway Joint Venture, Northway Property; Cypress Canada Inc.; 492 pages.

Guy K. (1991), Exploration Summary May 1, 1990 to May 1, 1991 Vezza Joint Venture Northway Property; Total Energold; 227 pages.

Forward-looking statements:

This news release includes "forward-looking statements" under applicable Canadian securities legislation, including statements respecting: the Company's plans for the Property and the expected timing and scope of the 2025 drilling program at the Property; the Company's goal of delivering a near-surface multi-million-ounce deposit the Property; the Company's anticipated timeline with respect to the Application for Autorisation de Travaux d'exploration à Impacts (ATI) to the Ministère des Ressources naturelles et des Forets (MERN); the Company's view that the Property has the potential for over three million ounces of gold; the 7,500-metre drilling program marking the beginning of the Company's pursuit of that goal; and statements respecting the Offerings, the timing thereof andthe expected use of proceeds therefrom. Such forward-looking information reflects management's current beliefs and is based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Readers are cautioned that such forward-looking statements are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

No Offer or Solicitation to Purchase Securities in the United States

This press release does not constitute or form a part of any offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein have not been and will not be registered under the Securities Act of 1933, as amended (the "Securities Act"), or with any securities regulatory authority of any state or other jurisdiction in the United States, and may not be offered or sold, directly or indirectly, within the United States or to, or for the account or benefit of, U.S. persons, as such term is defined in Regulation S under the Securities Act ("Regulation S"), except pursuant to an exemption from or in a transaction not subject to the registration requirements of the Securities Act.

Not for distribution to United States newswire services or for dissemination in the United States. This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available. This news release shall not constitute an offer to sell or the solicitation of an offer to buy in the United States or to, or for the account or benefit of, persons in the United States or U.S. Persons nor shall there by any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

SOURCE: Formation Metals

View the original press release on ACCESS Newswire

W.Morales--AT