-

Syria announces ceasefire with Kurdish fighters in Aleppo

Syria announces ceasefire with Kurdish fighters in Aleppo

-

Russia hits Ukraine with hypersonic missile after rejecting peacekeeping plan

-

Hundreds of thousands without power as Storm Goretti pummels Europe

Hundreds of thousands without power as Storm Goretti pummels Europe

-

Asian stocks mixed ahead of US jobs, Supreme Court ruling

-

Scores without power as Storm Goretti pummels Europe

Scores without power as Storm Goretti pummels Europe

-

Sabalenka gets revenge over Keys in repeat of Australian Open final

-

Fresh from China, South Korea president to visit Japan

Fresh from China, South Korea president to visit Japan

-

Injured Kimmich to miss icy Bundesliga return for Bayern

-

Rybakina has little hope of change to tennis schedule

Rybakina has little hope of change to tennis schedule

-

Osimhen, Nigeria seek harmony with Algeria up next at AFCON

-

US immigration agent's fatal shooting of woman leaves Minneapolis in shock

US immigration agent's fatal shooting of woman leaves Minneapolis in shock

-

After fire tragedy, small Swiss town mourns 'decimated generation'

-

Switzerland mourns Crans-Montana fire tragedy

Switzerland mourns Crans-Montana fire tragedy

-

Russia bombards Kyiv after rejecting peacekeeping plan

-

Crunch time for EU's long-stalled Mercosur trade deal

Crunch time for EU's long-stalled Mercosur trade deal

-

Wawrinka gets Melbourne wildcard but Kyrgios to play doubles only

-

Asian stocks rally ahead of US jobs, Supreme Court ruling

Asian stocks rally ahead of US jobs, Supreme Court ruling

-

'Sever the chain': scam tycoons in China's crosshairs

-

Bulls-Heat NBA game postponed over 'moisture' on court

Bulls-Heat NBA game postponed over 'moisture' on court

-

Arsenal's Martinelli 'deeply sorry' for shoving injured Bradley

-

Christ icon's procession draws thousands to streets of Philippine capital

Christ icon's procession draws thousands to streets of Philippine capital

-

Moleiro shining as Villarreal make up La Liga ground after cup failures

-

New Chelsea boss Rosenior faces FA Cup test

New Chelsea boss Rosenior faces FA Cup test

-

Vietnam shrugs off Trump tariffs as US exports surge

-

Syrian government announces ceasefire in Aleppo after deadly clashes

Syrian government announces ceasefire in Aleppo after deadly clashes

-

New Zealand's rare flightless parrot begins breeding again

-

Age no barrier for rampant Australia but future uncertain

Age no barrier for rampant Australia but future uncertain

-

Ex-delivery driver gives voice to China's precarious gig workers

-

Protesters, US law enforcers clash after immigration agent kills woman

Protesters, US law enforcers clash after immigration agent kills woman

-

AI gobbling up memory chips essential to gadget makers

-

'One Battle After Another' leads the charge for Golden Globes

'One Battle After Another' leads the charge for Golden Globes

-

Trump to meet top US oil execs after seizing Venezuela leader

-

Kyrgios to play doubles only at Australian Open

Kyrgios to play doubles only at Australian Open

-

Swiss mining giant Glencore reveals merger talks with Rio Tinto

-

Firefighters warn of 'hectic' Australian bushfires

Firefighters warn of 'hectic' Australian bushfires

-

International Space Station crew to return early after astronaut medical issue

-

Arsenal in 'strong position' despite missed opportunity for Arteta

Arsenal in 'strong position' despite missed opportunity for Arteta

-

US House revolt advances Obamacare subsidy extension

-

Swiss mining giant Glencore in merger talks with Rio Tinto

Swiss mining giant Glencore in merger talks with Rio Tinto

-

US snowboard star Kim dislocates shoulder ahead of Olympic three-peat bid

-

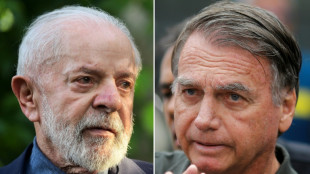

Brazil's Lula vetoes bill reducing Bolsonaro's sentence

Brazil's Lula vetoes bill reducing Bolsonaro's sentence

-

AC Milan scrape a point with Genoa after late penalty howler

-

Arsenal miss chance to stretch lead in Liverpool stalemate

Arsenal miss chance to stretch lead in Liverpool stalemate

-

Stocks mixed as traders await US jobs data, oil rebounds

-

After Minneapolis shooting, AI fabrications of victim and shooter

After Minneapolis shooting, AI fabrications of victim and shooter

-

Trump says no pardon for Sean 'Diddy' Combs

-

Real Madrid edge Atletico to set up Clasico Spanish Super Cup final

Real Madrid edge Atletico to set up Clasico Spanish Super Cup final

-

Venezuela begins 'large' prisoner release amid US pressure

-

Real Madrid beat Atletico to set up Clasico Spanish Super Cup final

Real Madrid beat Atletico to set up Clasico Spanish Super Cup final

-

Heavy wind, rain, snow batters Europe

Kee Ming Group Berhad Inks Underwriting Agreement With TA Securities Ahead Of ACE Market IPO

KUALA LUMPUR, MY / ACCESS Newswire / January 8, 2026 / Kee Ming Group Berhad ("Kee Ming" or the "Group"), a mechanical and electrical ("M&E") engineering solutions provider, has officially signed an underwriting agreement with TA Securities Holdings Berhad ("TA Securities") to underwrite a total of 24.38 million new shares in preparation for its upcoming initial public offering ("IPO") on the ACE Market of Bursa Malaysia Securities Berhad ("Bursa Securities").

Caption from L-R: Ms. Choy Sook Yan, Non-Independent Executive Director, Kee Ming Group Berhad; Ir. Liew Kar Hoe, Non-Independent Executive Director and Managing Director, Kee Ming Group Berhad; Mr. Tah Heong Beng, Executive Director, Operations, TA Securities Holdings Berhad; Mr. Ku Mun Fong, Head of Corporate Finance, TA Securities Holdings Berhad

With approximately 13 years of industry experience, Kee Ming has established itself as a trusted provider of comprehensive M&E engineering solutions, spanning electrical engineering services such as high-voltage ("HV"), medium-voltage ("MV"), low-voltage ("LV") and extra-low voltage ("ELV") installations, as well as mechanical engineering services including air-conditioning and mechanical ventilation ("ACMV"), and fire protection systems. In addition, the Group provides M&E engineering services for clean energy infrastructure, including solar photovoltaic ("PV") installations and electric vehicle ("EV") charging solutions, aligning with Malaysia's National Energy Transition Roadmap.

Kee Ming's IPO will involve the issuance of 66.63 million new ordinary shares, representing approximately 20.5% of the enlarged issued share capital of 325.00 million ordinary shares, alongside an offer for sale of 16.25 million existing shares, representing approximately 5.0% of the enlarged issued share capital. The allocation of IPO shares is structured as follows:

Public issue

Malaysian public:

16.25 million shares or 5.00% of the enlarged issued share capital will be made available for application by the Malaysian public.

Eligible persons:

8.13 million shares or 2.50% of the enlarged issued share capital will be allocated to eligible directors, employees, and other persons who have contributed to the success of the Group.

Private placement to identified Bumiputera investors approved by MITI:

40.63 million shares or 12.50% of the enlarged issued share capital are reserved for private placement to identified Bumiputera investors approved by MITI.

Private placement to selected investors:

1.63 million shares or 0.50% of the enlarged issued share capital are reserved for private placement to selected investors.

Offer for sale

Offer for sale of 16.25 million existing shares or 5.00% of the enlarged issued share capital by way of private placement to selected investors.

Ir. Liew Kar Hoe, Non-Independent Executive Director and Managing Director of Kee Ming Group Berhad, remarked, "The signing of this underwriting agreement represents another important milestone in Kee Ming's journey towards becoming a listed company. Our IPO will provide the financial resources to strengthen our financial position and enable us to undertake more projects or projects with higher value that supports Malaysia's industrial growth and clean energy transition."

As at 31 July 2025, Kee Ming's has a total of 50 ongoing projects with a total project value of RM218.6 million and a total outstanding order book of RM142.2 million. The positive outlook for the M&E engineering services market further supports the Group's growth trajectory with the market forecast to expand from RM10.86 billion in 2025 to RM16.82 billion in 2029, representing a CAGR of 11.9%. This growth is underpinned by robust infrastructure and building activities, the expansion of data centres, major government projects such as the Penang Light Rail Transit, Johor Singapore Rapid Transit System and the Johor-Singapore Special Economic Zone, as well as Malaysia's accelerating green energy transition, including solar PV and EV charging developments.

With its upcoming listing on the ACE Market of Bursa Securities, Kee Ming is set to reinforce its position as a M&E engineering solutions provider with involvement in the clean energy segment, and to capture growth opportunities driven by Malaysia's industrial expansion and the transition to sustainable energy solutions.

TA Securities Holdings Berhad is the Principal Adviser, Sponsor, Sole Placement Agent and Sole Underwriter for this IPO, while Eco Asia Capital Advisory Sdn. Bhd. serves as the Financial Adviser of the IPO.

###

ABOUT KEE MING GROUP BERHAD

Kee Ming is a M&E engineering solutions provider with approximately 13 years of experience, specialising in electrical engineering such as HV, MV, LV, and ELV installations, mechanical engineering services including ACMV and fire protection systems, as well as provision of M&E engineering services in clean energy segment including solar PV installations and EV charging solutions. Headquartered in Ipoh, Perak, with branch offices in Selangor and Penang, the Group serves industrial, commercial and residential markets across Malaysia, supported by strong technical expertise and proven project delivery capabilities.

For more information, visit https://keeming.com

Issued By: Swan Consultancy Sdn. Bhd. on behalf of Kee Ming Group Berhad

For more information, please contact:

Jazzmin Wan

Email: [email protected]

William Yeo

Email: [email protected]

SOURCE: Kee Ming Group Berhad

View the original press release on ACCESS Newswire

P.Smith--AT