-

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

Cunningham leads Pistons past Celtics, Nuggets outlast Rockets

-

10-year-old girl, Holocaust survivors among Bondi Beach dead

-

Steelers edge towards NFL playoffs as Dolphins eliminated

Steelers edge towards NFL playoffs as Dolphins eliminated

-

Australian PM says 'Islamic State ideology' drove Bondi Beach gunmen

-

Canada plow-maker can't clear path through Trump tariffs

Canada plow-maker can't clear path through Trump tariffs

-

Bank of Japan expected to hike rates to 30-year high

-

Cunningham leads Pistons past Celtics

Cunningham leads Pistons past Celtics

-

Stokes tells England to 'show a bit of dog' in must-win Adelaide Test

-

EU to unveil plan to tackle housing crisis

EU to unveil plan to tackle housing crisis

-

EU set to scrap 2035 combustion-engine ban in car industry boost

-

Australian PM visits Bondi Beach hero in hospital

Australian PM visits Bondi Beach hero in hospital

-

'Easiest scam in the world': Musicians sound alarm over AI impersonators

-

'Waiting to die': the dirty business of recycling in Vietnam

'Waiting to die': the dirty business of recycling in Vietnam

-

Asian markets retreat ahead of US jobs as tech worries weigh

-

Security beefed up for Ashes Adelaide Test after Bondi shooting

Security beefed up for Ashes Adelaide Test after Bondi shooting

-

Famed Jerusalem stone still sells despite West Bank economic woes

-

Trump sues BBC for $10 billion over documentary speech edit

Trump sues BBC for $10 billion over documentary speech edit

-

Chile follows Latin American neighbors in lurching right

-

Will OpenAI be the next tech giant or next Netscape?

Will OpenAI be the next tech giant or next Netscape?

-

Khawaja left out as Australia's Cummins, Lyon back for 3rd Ashes Test

-

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

Australia PM says 'Islamic State ideology' drove Bondi Beach shooters

-

Scheffler wins fourth straight PGA Tour Player of the Year

-

Security beefed up for Ashes Test after Bondi shooting

Security beefed up for Ashes Test after Bondi shooting

-

Wembanyama blocking Knicks path in NBA Cup final

-

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

Amorim seeks clinical Man Utd after 'crazy' Bournemouth clash

-

Man Utd blow lead three times in 4-4 Bournemouth thriller

-

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

Stokes calls on England to 'show a bit of dog' in must-win Adelaide Test

-

Trump 'considering' push to reclassify marijuana as less dangerous

-

Chiefs coach Reid backing Mahomes recovery after knee injury

Chiefs coach Reid backing Mahomes recovery after knee injury

-

Trump says Ukraine deal close, Europe proposes peace force

-

French minister urges angry farmers to trust cow culls, vaccines

French minister urges angry farmers to trust cow culls, vaccines

-

Angelina Jolie reveals mastectomy scars in Time France magazine

-

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

Paris Olympics, Paralympics 'net cost' drops to 2.8bn euros: think tank

-

Chile president-elect dials down right-wing rhetoric, vows unity

-

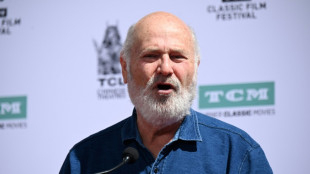

Five Rob Reiner films that rocked, romanced and riveted

Five Rob Reiner films that rocked, romanced and riveted

-

Rob Reiner: Hollywood giant and political activist

-

Observers say Honduran election fair, but urge faster count

Observers say Honduran election fair, but urge faster count

-

Europe proposes Ukraine peace force as Zelensky hails 'real progress' with US

-

Trump condemned for saying critical filmmaker brought on own murder

Trump condemned for saying critical filmmaker brought on own murder

-

US military to use Trinidad airports, on Venezuela's doorstep

-

Daughter warns China not to make Jimmy Lai a 'martyr'

Daughter warns China not to make Jimmy Lai a 'martyr'

-

UK defence chief says 'whole nation' must meet global threats

-

Rob Reiner's death: what we know

Rob Reiner's death: what we know

-

Zelensky hails 'real progress' in Berlin talks with Trump envoys

-

Toulouse handed two-point deduction for salary cap breach

Toulouse handed two-point deduction for salary cap breach

-

Son arrested for murder of movie director Rob Reiner and wife

-

Stock market optimism returns after tech selloff but Wall Street wobbles

Stock market optimism returns after tech selloff but Wall Street wobbles

-

Clarke warns Scotland fans over sky-high World Cup prices

-

In Israel, Sydney attack casts shadow over Hanukkah

In Israel, Sydney attack casts shadow over Hanukkah

-

Son arrested after Rob Reiner and wife found dead: US media

The IRS E-Filing Deadline for Forms 1099, 1098, and 1095 Approaches: TaxBandits Simplifies Last-Minute Filing

Employers, businesses, and tax professionals can now e-file 1099, 1098, and 1095 forms with TaxBandits to meet the IRS e-filing deadline. Filing on time ensures compliance and helps avoid costly penalties.

ROCK HILL, SC / ACCESS Newswire / March 28, 2025 / The IRS e-filing deadline for Forms 1099, 1098, and 1095 is March 31, 2025. Employers, businesses, and tax professionals must submit these forms on time to avoid significant penalties from the IRS.

TaxBandits offers an easy-to-use and secure platform to help businesses and tax professionals meet the filing deadline confidently and accurately.

Key IRS Forms Due by March 31, 2025

Compliance with IRS regulations requires businesses, employers, tax professionals, and insurers to e-file many tax forms by March 31, 2025. This includes:

1099-Series of Forms: This includes several 1099-series forms, such as 1099-MISC, 1099-INT, 1099-DIV, 1099-K, 1099-B, 1099-S, 1099-A, 1099-PATR, 1099-SA, 1099-OID, 1099-LTC, and 1099-QA, which report different types of income and transactions.

ACA Reporting Forms: ACA Forms 1095-B and 1095-C must be filed by applicable large employers and insurance providers to ensure compliance with the Affordable Care Act (ACA).

Other Required Forms: Other necessary filings include the 1098-series forms (1098, 1098-T, 1098-E, 1098-F), Forms 3921, 3922, and 8027.

Penalties for Missing the Deadline

Failure to meet the IRS e-filing deadline for Forms 1099, 1098, and 1095 can result in substantial penalties:

Form 1099 Penalties: Businesses face fines ranging from $60 to $660 per form, depending on how late the forms are filed. These penalties increase significantly if the forms are filed more than 30 days after the deadline.

ACA Form 1095 Penalties: For failing to file or providing incorrect information on ACA Forms 1095-C and 1095-B, businesses may incur penalties of $330 per return. The total penalty for a calendar year can reach up to $3,987,000 for large employers.

These penalties highlight the critical need to meet the e-filing deadline.

TaxBandits Offers Stress-Free Last-Minute Filing

TaxBandits offers a user-friendly platform for e-filing 1099, 1098, and ACA 1095 forms. Businesses can rely on TaxBandits' tailored solutions to easily meet the deadline.

Here's how TaxBandits simplifies last-minute filing:

Federal and State E-Filing: Clients can e-file forms effortlessly with both federal and state. TaxBandits also supports state-only ACA reporting.

Effortless Bulk Data Upload: TaxBandits enables seamless bulk data imports for tax forms through a standard CSV template or custom spreadsheet files. In addition, clients can use TaxBandits Excel templates to import ACA data.

Seamless Recipient Copy Distribution: Clients can deliver recipient copies via postal mail, online access, or both, ensuring secure and timely delivery.

Error-Free Filing with Built-In Checks: Built-in validation ensures accuracy by detecting and resolving errors before submission.

AI Assistance & World-Class Customer Support: BanditAI, the AI assistant, offers real-time guidance, while the support team is available via phone, email, and live chat.

Advanced Security Measures: As a SOC 2-certified company, TaxBandits prioritizes data security with top protection against breaches.

Exclusive Features for Tax Professionals

TaxBandits offers flexible solutions for CPAs, accounting firms, and enterprises. With a Pro Account, tax professionals can streamline workflows with time-saving features.

Secure Client Portal: Tax pros can enable their clients to review forms, communicate securely, and manage documents in a customized portal.

Team Management: TaxBandits provides the option to invite team members, assign roles such as preparer, approver, and transmitter, and delegate filings.

Detailed Reports: Obtain valuable insights from reports on filings, clients, and team performance to support informed decision-making.

Businesses, tax professionals, and service providers can easily e-file 1099-MISC, 1099-INT, 1099-DIV, 1099-K, 1098, ACA 1095, and many more tax forms at TaxBandits.com.

About TaxBandits

The 1099 and W-2 experts! TaxBandits is a SOC 2 Certified, IRS-authorized e-file provider of 1099 Form, Form W2, Form 940, Form 941, 1095-B, 1095-C, and W-9, serving businesses, service providers, and tax professionals of every shape and size.

TaxBandits provides another advantage for high-volume filers and software providers. The TaxBandits API enables seamless preparation and e-filing of 1099, W-2, 941, 940, and ACA 1095 forms.

About SPAN Enterprises

Headquartered in Rock Hill, South Carolina, SPAN has been developing industry-leading software tools for e-filing and business management tools for over a decade.

The SPAN Enterprises portfolio of products includes TaxBandits, ACAwise, ExpressExtension, 123PayStubs, TruckLogics, and WealthRabbit.

Please direct all media inquiries to Caleb Flachman, Marketing Manager, at [email protected].

SOURCE: TaxBandits

View the original press release on ACCESS Newswire

B.Torres--AT