-

Cash-starved French hospitals ask public to pitch in

Cash-starved French hospitals ask public to pitch in

-

US consumer inflation eases more than expected to lowest since May

-

Germany's Merz urges US to repair ties with Europe

Germany's Merz urges US to repair ties with Europe

-

Europe seeks new 'partnership' with US at security gathering

-

Fresh water leak adds to Louvre museum woes

Fresh water leak adds to Louvre museum woes

-

Floods wreak havoc in Morocco farmlands after severe drought

-

Russia, Ukraine to hold talks in Geneva on February 17-18

Russia, Ukraine to hold talks in Geneva on February 17-18

-

Ukraine's Heraskevych hopes 'truth will prevail' in Olympics appeal

-

Dumplings and work stress as Chinese rush home for Lunar New Year

Dumplings and work stress as Chinese rush home for Lunar New Year

-

Macron denounces 'antisemitic hydra' as he honours 2006 Jewish murder victim

-

India-Pakistan: Hottest ticket in cricket sparks T20 World Cup fever

India-Pakistan: Hottest ticket in cricket sparks T20 World Cup fever

-

Cross-country king Klaebo equals Winter Olympics record with eighth gold

-

Ukraine's Heraskevych appeals to CAS over Olympic ban as Malinin eyes second gold

Ukraine's Heraskevych appeals to CAS over Olympic ban as Malinin eyes second gold

-

Stocks mostly drop after Wall Street slide

-

Sophie Adenot, the second French woman to fly to space

Sophie Adenot, the second French woman to fly to space

-

Alleged rape victim of Norway princess's son says she took sleeping pills

-

Activist group Palestine Action wins legal challenge against UK ban

Activist group Palestine Action wins legal challenge against UK ban

-

Driven by Dhoni, Pakistan's X-factor tweaker Tariq targets India

-

Davidson set to make history as Ireland seek to rebound against Italy

Davidson set to make history as Ireland seek to rebound against Italy

-

Europe defends NATO, US ties at security gathering

-

China's fireworks heartland faces fizzling Lunar New Year sales

China's fireworks heartland faces fizzling Lunar New Year sales

-

Bangladesh's Yunus 'banker to the poor', pushing democratic reform

-

Cracknell given Six Nations debut as Wales make changes for France

Cracknell given Six Nations debut as Wales make changes for France

-

L'Oreal shares sink as sales miss forecasts

-

Bangladesh nationalists celebrate landslide win, Islamists cry foul

Bangladesh nationalists celebrate landslide win, Islamists cry foul

-

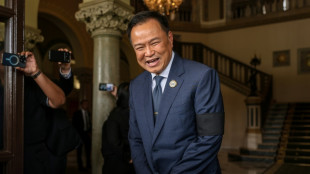

Thai PM agrees coalition with Thaksin-backed party

-

Zimbabwe pull off shock win over Australia at T20 World Cup

Zimbabwe pull off shock win over Australia at T20 World Cup

-

Merz, Macron to address first day of Munich security meet

-

Three dead, many without power after storm lashes France and Spain

Three dead, many without power after storm lashes France and Spain

-

Bennett half-century as Zimbabwe make 169-2 against Australia

-

Asian stocks track Wall St down as traders rethink tech bets

Asian stocks track Wall St down as traders rethink tech bets

-

'Weak by design' African Union gathers for summit

-

Nigerian conservative city turns to online matchmaking for love

Nigerian conservative city turns to online matchmaking for love

-

Serb-zero: the 'iceman' seeking solace in extreme cold

-

LeBron James nabs another NBA milestone with triple-double in Lakers win

LeBron James nabs another NBA milestone with triple-double in Lakers win

-

Hundreds of thousands without power after storm lashes France

-

US Congress impasse over migrant crackdown set to trigger partial shutdown

US Congress impasse over migrant crackdown set to trigger partial shutdown

-

AI's bitter rivalry heads to Washington

-

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

South Korea hails 'miracle' Choi after teen's landmark Olympic gold

-

England seek statement Six Nations win away to Scotland

-

Trent return can help Arbeloa's Real Madrid move forward

Trent return can help Arbeloa's Real Madrid move forward

-

Battling Bremen braced for Bayern onslaught

-

Bangladesh nationalists claim big election win, Islamists cry foul

Bangladesh nationalists claim big election win, Islamists cry foul

-

Tourists empty out of Cuba as US fuel blockade bites

-

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

Tearful Canadian mother mourns daughter before Carney visits town shaken by killings

-

Italy dream of cricket 'in Rome, Milan and Bologna' after historic win

-

Oscars museum dives into world of Miyazaki's 'Ponyo'

Oscars museum dives into world of Miyazaki's 'Ponyo'

-

Dieng powers Bucks over NBA champion Thunder

-

Japan seizes Chinese fishing vessel, arrests captain

Japan seizes Chinese fishing vessel, arrests captain

-

Bangladesh political heir Tarique Rahman poised for PM

Stocks mostly drop after Wall Street slide

European and Asian stock markets mostly fell Friday following another tech-led plunge on Wall Street as investors reassess their vast AI investments.

The dollar climbed as investors awaited US inflation data later in the day for clues on the outlook for Federal Reserve interest rates.

"The concerns that have revolved around AI disruption in the software segment have spread," noted Joshua Mahony, chief market analyst at Scope Markets.

A sense of calm had descended on trading floors early in the week after recent asset-wide volatility, helped by forecast-busting US jobs figures that eased worries about the world's top economy.

However, growing concern about the hundreds of billions spent on artificial intelligence infrastructure -- and the bundles more announced in the past few days -- have fanned speculation about when, if ever, companies will see a return.

The release of new tools this month that can perform crucial tasks in a range of fields, including legal, sales and marketing, has compounded those jitters -- hammering companies worried about competition.

Analysts said that has seen traders reassign their AI investments, with the main beneficiaries being chipmakers and other firms needed to build infrastructure.

"Developments in AI, particularly around the rollout of various AGI (artificial general intelligence) products, are only vaguely understood, which makes the ability to price future risk and certainty... something of a guess," said Pepperstone's Chris Weston.

Artificial general intelligence is the mooted next stage of AI, when computers could outperform humans across a wide variety of tasks.

Wall Street's Nasdaq lost more than two percent Thursday.

The weak sentiment carried over into Asia and Europe on Friday, with Tokyo and Chinese indices ending with losses of around 1.5 percent.

Europe's main stock held up better but were still down in midday deals.

At the same time, share prices of chipmakers continued to rally.

Attention turns to US inflation figures after a bumper American jobs report Wednesday saw traders dial down their expectations for a Federal Reserve rate cut next month.

Most now see the next reduction in July owing to signs the economy is faring a little better than initially feared.

Company earnings continued to roll in with mixed reaction.

L'Oreal shares fell four percent on the Paris stock market after the cosmetics giant posted sales that fell short of analyst expectations, stoking fears of weakness for its luxury brands and in the key Chinese market.

- Key figures at around 1130 GMT -

London - FTSE 100: DOWN 0.1 percent at 10,397.15 points

Paris - CAC 40: DOWN 0.4 percent at 8,305.45

Frankfurt - DAX: DOWN 0.2 percent at 24,811.00

Tokyo - Nikkei 225: DOWN 1.2 percent at 56,941.97 (close)

Hong Kong - Hang Seng Index: DOWN 1.7 percent at 26,567.12 (close)

Shanghai - Composite: DOWN 1.3 percent at 4,082.07 (close)

New York - Dow: DOWN 1.3 percent at 49,451.98 (close)

Euro/dollar: DOWN at $1.1858 from $1.1876 on Thursday

Pound/dollar: DOWN at $1.3611 from $1.3620

Dollar/yen: UP at 153.29 yen from 152.75 yen

Euro/pound: DOWN at 87.13 pence from 87.16 pence

Brent North Sea Crude: UP 0.2 percent at $67.63 per barrel

West Texas Intermediate: UP 0.1 percent at $62.91 per barrel

W.Morales--AT