-

Trump says US-UK relationship 'not like it used to be'

Trump says US-UK relationship 'not like it used to be'

-

Eight years on, trial begins in Argentina submarine implosion

-

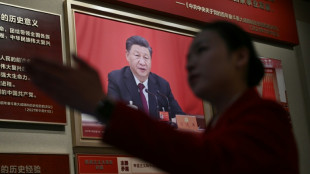

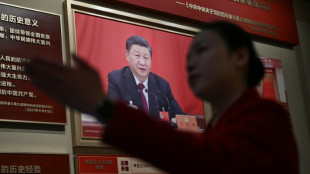

Beijing votes out three generals from political advisory body

Beijing votes out three generals from political advisory body

-

Oil extends gains and stocks dive as Iran conflict spreads

-

The French village where Ayatollah Khomeini fomented Iran's revolution

The French village where Ayatollah Khomeini fomented Iran's revolution

-

South Africa, India eye T20 World Cup rematch as semi-finals begin

-

Trump hosts Germany's Merz for talks eclipsed by Mideast war

Trump hosts Germany's Merz for talks eclipsed by Mideast war

-

Second-hand phones surf rising green consumer wave

-

Pakistanis at remote border describe scramble to leave Iran

Pakistanis at remote border describe scramble to leave Iran

-

China votes to oust three generals from political advisory body

-

Murray scores 45 as Nuggets hold off Jazz

Murray scores 45 as Nuggets hold off Jazz

-

Five things about the 2026 F1 season

-

Scrum-half Gibson-Park: Ireland's 'petit general'

Scrum-half Gibson-Park: Ireland's 'petit general'

-

Geopolitical storm leaves isolated Greenlanders hanging by a telecoms thread

-

Myong hat-trick as North Korea cruise at Women's Asian Cup

Myong hat-trick as North Korea cruise at Women's Asian Cup

-

AI disinformation turns Nepal polls into 'digital battleground'

-

New Israel, Iran attacks across region: Latest developments in Middle East war

New Israel, Iran attacks across region: Latest developments in Middle East war

-

China's overstretched healthcare looks to AI boom

-

Oil extends gains and stocks drop as Iran conflict spreads

Oil extends gains and stocks drop as Iran conflict spreads

-

Rituals of resilience: how Afghan women stay sane in their 'cage'

-

Strait of Hormuz impasse squeezes world shipping

Strait of Hormuz impasse squeezes world shipping

-

Fresh Israel, Iran attacks across region: Latest developments in Middle East war

-

Oscar-nominated Iranian doc offers different vision of leadership

Oscar-nominated Iranian doc offers different vision of leadership

-

Oscar-nominated docs take on hot-button US social issues

-

'I couldn't breathe': The dark side of Bolivia's silver boom

'I couldn't breathe': The dark side of Bolivia's silver boom

-

Trump warns of longer Iran war as Riyadh, Beirut hit

-

Underground party scene: Israelis celebrate Purim in air raid shelters

Underground party scene: Israelis celebrate Purim in air raid shelters

-

Flowers, music, and soldiers at funeral of drug lord

-

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

'Safety and wellbeing' will guide F1 Mideast planning: FIA chief

-

Trump to attend White House Correspondents' dinner

-

Will Iran's missiles drain US interceptor stocks?

Will Iran's missiles drain US interceptor stocks?

-

The Agentic Era Redefines Customer Intimacy as AI is Set to Become the Primary Brand Interface

-

MindMaze Therapeutics Provides Corporate Update and Publishes March 2026 Investor Presentation

MindMaze Therapeutics Provides Corporate Update and Publishes March 2026 Investor Presentation

-

InterContinental Hotels Group PLC Announces Transaction in Own Shares - March 03

-

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

New eBook Challenges the Popular Narrative That Manifestation Is Always Positive

-

Trump warns of longer Iran war as violence spreads

-

Energy infrastructure emerges as war target, lifting prices

Energy infrastructure emerges as war target, lifting prices

-

Trump warns of longer Iran war, Rubio points at Israel

-

US urges to 'depart now' from Middle East: Latest developments in Iran war

US urges to 'depart now' from Middle East: Latest developments in Iran war

-

Ecuador launches joint anti-drug operations with US

-

Getafe deal flat Real Madrid La Liga title race blow

Getafe deal flat Real Madrid La Liga title race blow

-

Rubio, Hezbollah and Qatar: Latest developments in Iran war

-

Rubio says Israel's strike plan triggered US attack on Iran

Rubio says Israel's strike plan triggered US attack on Iran

-

'Thank you, madam president': Melania Trump leads UN Security Council as Iran war rages

-

Bombing Iran, Trump has 'epic fury' but endgame undefined

Bombing Iran, Trump has 'epic fury' but endgame undefined

-

US slaps sanctions on Rwanda military over DR Congo 'violation'

-

US Congress to debate Trump's war powers

US Congress to debate Trump's war powers

-

US appeals court denies Trump bid to delay tariff refund lawsuits

-

Trump warns of longer Iran war

Trump warns of longer Iran war

-

Fire-damaged Six nations trophy to be replaced

Russian central bank says suing Euroclear over frozen assets

Russia's central bank on Friday said it was suing the Belgium-based Euroclear financial group, which holds Moscow's frozen international reserves, as the EU moves closer to using the funds to support Ukraine.

The European Commission is pushing to tap some 200 billion euros ($232 billion) of the Russian central bank's assets that the bloc immobilised after Moscow's 2022 assault on Ukraine, in order to provide Kyiv a financial lifeline.

The EU is determined to reach a final deal at a summit next week, but faces resistance from Belgium, which as the home of Euroclear fears retribution from Moscow.

On Friday, Russia's central bank said it was filing "a lawsuit against Euroclear in the Moscow Arbitration Court" due to what it called "the illegal actions" of the institution.

"The actions of Euroclear depository caused damage to the Bank of Russia due to the inability to manage funds and securities belonging to the Bank of Russia," the bank said in a statement.

It did not say if the lawsuit has already been filed nor elaborate on the nature of the damages.

It was also unclear what the implications of any Russian-based legal claim would be.

G7 countries have already used the interest earned on the frozen assets to fund a $50-billion loan for Ukraine.

Russia has long decried the freezing of the assets as illegal and said any further steps to directly use the money would be theft.

Euroclear declined to comment directly on the lawsuit announced Friday.

A spokesman for the clearing house noted however that Euroclear is "currently fighting more than 100 legal claims in Russia."

EU leaders have already pledged to keep Kyiv afloat next year, and officials are determined to reach an agreement on where the money should come from at their December 18-19 summit.

Under the complex scheme proposed by the EU, Euroclear would loan the money to the EU, which in turn loans it to Kyiv.

The funds would only be paid back by Ukraine if and when Russia compensates Kyiv for the destruction it has wrought.

On Thursday, the bloc's member states lifted a key hurdle by agreeing on a way to keep the funds frozen as long as required, without need for renewal every six months.

P.Smith--AT