-

Oil-rich UAE turns to AI to grease economy

Oil-rich UAE turns to AI to grease economy

-

West Indies 175-4 after Tickner takes three in second New Zealand Test

-

Nepal faces economic fallout of September protest

Nepal faces economic fallout of September protest

-

Asian stocks in retreat as traders eye Fed decision, tech earnings

-

Australia bans under-16s from social media in world-first crackdown

Australia bans under-16s from social media in world-first crackdown

-

US Fed appears set for third rate cut despite sharp divides

-

Veggie 'burgers' at stake in EU negotiations

Veggie 'burgers' at stake in EU negotiations

-

Haitians dance with joy over UNESCO musical listing

-

Suspense swirls if Nobel peace laureate will attend ceremony

Suspense swirls if Nobel peace laureate will attend ceremony

-

UK public urged to keep eyes peeled for washed-up bananas

-

South Korea chip giant SK hynix mulls US stock market listing

South Korea chip giant SK hynix mulls US stock market listing

-

Captain Cummins back in Australia squad for third Ashes Test

-

NFL Colts to bring 44-year-old QB Rivers out of retirement: reports

NFL Colts to bring 44-year-old QB Rivers out of retirement: reports

-

West Indies 92-2 after being asked to bat in second New Zealand Test

-

Ruckus in Brazil Congress over bid to reduce Bolsonaro jail term

Ruckus in Brazil Congress over bid to reduce Bolsonaro jail term

-

ExxonMobil slows low-carbon investment push through 2030

-

Liverpool's Slot swerves further Salah talk after late Inter win

Liverpool's Slot swerves further Salah talk after late Inter win

-

Maresca concerned as Atalanta fight back to beat Chelsea

-

Liverpool edge Inter in Champions League as Chelsea lose in Italy

Liverpool edge Inter in Champions League as Chelsea lose in Italy

-

Spurs sink Slavia Prague to boost last-16 bid in front of Son

-

Arsenal ensure Women's Champions League play-off berth

Arsenal ensure Women's Champions League play-off berth

-

Late penalty drama helps Liverpool defy Salah crisis at angry Inter

-

Canada launches billion dollar plan to recruit top researchers

Canada launches billion dollar plan to recruit top researchers

-

Liverpool defy Salah crisis by beating Inter Milan in Champions League

-

Honduran leader alleges vote tampering, US interference

Honduran leader alleges vote tampering, US interference

-

De Ketelaere inspires Atalanta fightback to beat Chelsea

-

Kounde double helps Barcelona claim Frankfurt comeback win

Kounde double helps Barcelona claim Frankfurt comeback win

-

US Supreme Court weighs campaign finance case

-

Zelensky says ready to hold Ukraine elections, with US help

Zelensky says ready to hold Ukraine elections, with US help

-

Autistic Scottish artist Nnena Kalu smashes Turner Prize 'glass ceiling'

-

Trump slams 'decaying' and 'weak' Europe

Trump slams 'decaying' and 'weak' Europe

-

Injury-hit Arsenal in 'dangerous circle' but Arteta defends training methods

-

Thousands flee DR Congo fighting as M23 enters key city

Thousands flee DR Congo fighting as M23 enters key city

-

Karl and Gnabry spark Bayern to comeback win over Sporting

-

Thousands flee DR Congo fighting as M23 closes on key city

Thousands flee DR Congo fighting as M23 closes on key city

-

Zelensky says ready to hold Ukraine elections

-

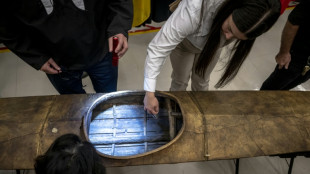

Indigenous artifacts returned by Vatican unveiled in Canada

Indigenous artifacts returned by Vatican unveiled in Canada

-

Ivory Coast recall Zaha for AFCON title defence

-

Communist vs Catholic - Chile prepares to choose a new president

Communist vs Catholic - Chile prepares to choose a new president

-

Trump's FIFA peace prize breached neutrality, claims rights group

-

NHL 'optimistic' about Olympic rink but could pull out

NHL 'optimistic' about Olympic rink but could pull out

-

Thousands reported to have fled DR Congo fighting as M23 closes on key city

-

Three face German court on Russia spying charges

Three face German court on Russia spying charges

-

Amy Winehouse's father sues star's friends for auctioning her clothes

-

Woltemade's 'British humour' helped him fit in at Newcastle - Howe

Woltemade's 'British humour' helped him fit in at Newcastle - Howe

-

UK trial opens in dispute over Jimi Hendrix recordings

-

Pandya blitz helps India thrash South Africa in T20 opener

Pandya blitz helps India thrash South Africa in T20 opener

-

Zelensky says will send US revised plan to end Ukraine war

-

Nobel event cancellation raises questions over Machado's whereabouts

Nobel event cancellation raises questions over Machado's whereabouts

-

Miami's Messi wins second consecutive MLS MVP award

Asian stocks in retreat as traders eye Fed decision, tech earnings

Asian markets retreated Wednesday following a tepid day on Wall Street as investors bided their time ahead of a highly anticipated Federal Reserve policy announcement later in the day.

Earnings from tech giants Oracle and Broadcom this week are also in view amid lingering worries about an AI-fuelled bubble that caused some panic on trading floors last month.

With US central bankers expected to cut interest rates for the third straight session later Wednesday, the main focus is on their post-meeting statement, boss Jerome Powell's news conference and the "dot plot" forecast for 2026 policy.

After November's tech-led swoon, markets have enjoyed a healthy run in recent weeks as weak jobs figures reinforced expectations for another step lower in borrowing costs.

But that has cooled heading into the Fed gathering amid speculation it will announce a "hawkish cut" that plays down the chances of a fourth successive reduction.

Data on Tuesday showing an uptick in job openings -- against estimates for a drop -- further tempered expectations for a string of cuts next year, with markets now pricing in two more over the next 12 months, compared with three previously seen.

Pepperstone's Chris Weston said the figures "catalysed a repricing of US forward Fed rate expectations".

After a weak day in New York, where the S&P 500 and Dow dropped, Asia fared no better.

Tokyo, Hong Kong, Shanghai, Sydney, Singapore, Wellington, Jakarta and Manila all fell, though Taipei edged up and Seoul was flat.

Still, there is some hope that the Fed will turn more dovish next year with President Donald Trump's top economic aide Kevin Hassett -- the frontrunner to succeed Powell in May -- saying he sees plenty of room to substantially lower rates

"While he has indicated that he would respond to the data and that he would not bow to political pressure to decide whether to cut interest rates, if he becomes the next chair, it is clear that on the current backdrop he is comfortable with more easing" than many board members, wrote National Australia Bank's Taylor Nugent.

Aside from the Fed saga, investors are also keenly awaiting earnings from software giant Oracle and chipmaker Broadcom, which will be used to judge the outlook for the tech sector in the wake of huge investments in artificial intelligence.

Markets have been pumped higher for the past two years by the surge into all things AI, though there has been some concern of late that the hundreds of billions splashed out might not see returns as early as hoped.

"Oracle may not have a substantial weight in the S&P 500 or NAS100 to move the index on its own," said Pepperstone's Weston. "But what they detail on its capex intentions and future funding plans could resonate across the AI space."

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 0.4 percent at 50,448.28 (break)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 25,393.52

Shanghai - Composite: DOWN 0.5 percent at 3,888.30

Dollar/yen: DOWN at 156.65 yen from 156.90 yen on Tuesday

Euro/dollar: DOWN at $1.1625 from $1.1630

Pound/dollar: DOWN at $1.3298 from $1.3300

Euro/pound: DOWN at 87.41 pence from 87.43 pence

West Texas Intermediate: UP 0.3 percent at $58.43 per barrel

Brent North Sea Crude: UP 0.3 percent at $62.12 per barrel

New York - Dow: DOWN 0.4 percent at 47,560.29 (close)

London - FTSE 100: FLAT at 9,642.01 (close)

E.Rodriguez--AT