-

Asian stocks in retreat as traders eye Fed decision, tech earnings

Asian stocks in retreat as traders eye Fed decision, tech earnings

-

Australia bans under-16s from social media in world-first crackdown

-

US Fed appears set for third rate cut despite sharp divides

US Fed appears set for third rate cut despite sharp divides

-

Veggie 'burgers' at stake in EU negotiations

-

Haitians dance with joy over UNESCO musical listing

Haitians dance with joy over UNESCO musical listing

-

Suspense swirls if Nobel peace laureate will attend ceremony

-

UK public urged to keep eyes peeled for washed-up bananas

UK public urged to keep eyes peeled for washed-up bananas

-

South Korea chip giant SK hynix mulls US stock market listing

-

Captain Cummins back in Australia squad for third Ashes Test

Captain Cummins back in Australia squad for third Ashes Test

-

NFL Colts to bring 44-year-old QB Rivers out of retirement: reports

-

West Indies 92-2 after being asked to bat in second New Zealand Test

West Indies 92-2 after being asked to bat in second New Zealand Test

-

Ruckus in Brazil Congress over bid to reduce Bolsonaro jail term

-

ExxonMobil slows low-carbon investment push through 2030

ExxonMobil slows low-carbon investment push through 2030

-

Liverpool's Slot swerves further Salah talk after late Inter win

-

Maresca concerned as Atalanta fight back to beat Chelsea

Maresca concerned as Atalanta fight back to beat Chelsea

-

Liverpool edge Inter in Champions League as Chelsea lose in Italy

-

Spurs sink Slavia Prague to boost last-16 bid in front of Son

Spurs sink Slavia Prague to boost last-16 bid in front of Son

-

Arsenal ensure Women's Champions League play-off berth

-

Late penalty drama helps Liverpool defy Salah crisis at angry Inter

Late penalty drama helps Liverpool defy Salah crisis at angry Inter

-

Canada launches billion dollar plan to recruit top researchers

-

Liverpool defy Salah crisis by beating Inter Milan in Champions League

Liverpool defy Salah crisis by beating Inter Milan in Champions League

-

Honduran leader alleges vote tampering, US interference

-

De Ketelaere inspires Atalanta fightback to beat Chelsea

De Ketelaere inspires Atalanta fightback to beat Chelsea

-

Kounde double helps Barcelona claim Frankfurt comeback win

-

US Supreme Court weighs campaign finance case

US Supreme Court weighs campaign finance case

-

Zelensky says ready to hold Ukraine elections, with US help

-

Autistic Scottish artist Nnena Kalu smashes Turner Prize 'glass ceiling'

Autistic Scottish artist Nnena Kalu smashes Turner Prize 'glass ceiling'

-

Trump slams 'decaying' and 'weak' Europe

-

Injury-hit Arsenal in 'dangerous circle' but Arteta defends training methods

Injury-hit Arsenal in 'dangerous circle' but Arteta defends training methods

-

Thousands flee DR Congo fighting as M23 enters key city

-

Karl and Gnabry spark Bayern to comeback win over Sporting

Karl and Gnabry spark Bayern to comeback win over Sporting

-

Thousands flee DR Congo fighting as M23 closes on key city

-

Zelensky says ready to hold Ukraine elections

Zelensky says ready to hold Ukraine elections

-

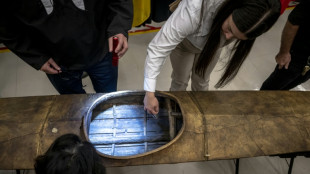

Indigenous artifacts returned by Vatican unveiled in Canada

-

Ivory Coast recall Zaha for AFCON title defence

Ivory Coast recall Zaha for AFCON title defence

-

Communist vs Catholic - Chile prepares to choose a new president

-

Trump's FIFA peace prize breached neutrality, claims rights group

Trump's FIFA peace prize breached neutrality, claims rights group

-

NHL 'optimistic' about Olympic rink but could pull out

-

Thousands reported to have fled DR Congo fighting as M23 closes on key city

Thousands reported to have fled DR Congo fighting as M23 closes on key city

-

Three face German court on Russia spying charges

-

Amy Winehouse's father sues star's friends for auctioning her clothes

Amy Winehouse's father sues star's friends for auctioning her clothes

-

Woltemade's 'British humour' helped him fit in at Newcastle - Howe

-

UK trial opens in dispute over Jimi Hendrix recordings

UK trial opens in dispute over Jimi Hendrix recordings

-

Pandya blitz helps India thrash South Africa in T20 opener

-

Zelensky says will send US revised plan to end Ukraine war

Zelensky says will send US revised plan to end Ukraine war

-

Nobel event cancellation raises questions over Machado's whereabouts

-

Miami's Messi wins second consecutive MLS MVP award

Miami's Messi wins second consecutive MLS MVP award

-

Trump slams 'decaying' Europe and pushes Ukraine on elections

-

TotalEnergies in deal for Namibia offshore oil field

TotalEnergies in deal for Namibia offshore oil field

-

Jesus added to Arsenal's Champions League squad

US Fed appears set for third rate cut despite sharp divides

The US Federal Reserve is expected to deliver a further interest rate cut Wednesday despite divisions among its ranks, with chief Jerome Powell's ability to secure support from fellow policymakers put to the test.

Financial markets expect a third straight 25 basis points reduction, bringing levels to a range between 3.50 percent and 3.75 percent. This would be the lowest in around three years.

But divides within the Fed have grown even as policymakers voted to slash rates twice in recent months to boost the weakening employment market.

"We look for at least two dissents in favor of no action and one in favor of a larger cut," said Michael Feroli, chief US economist at JP Morgan.

"There are almost equally compelling reasons to cut and to hold," he added in a recent note.

The Fed's rate-setting committee consists of 12 voting members -- including seven members of the board of governors, the New York Fed president and a rotation of reserve bank presidents -- who take a majority vote in deciding the path of rates.

Powell noted in October that inflation separate from President Donald Trump's tariffs is not too far from officials' two-percent target.

But the costs of goods have risen on the back of Trump's wide-ranging levies this year, and some officials are cautious that higher prices could become persistent.

The Fed pursues maximum employment and stable prices as it decides the path of interest rates, although the goals can sometimes be in conflict. Lower rates typically stimulate the economy while higher levels hold back activity and tamp down inflation.

- 'Risk management' -

Powell will likely be able to "persuade several hesitant policymakers to support a third consecutive 'risk management' rate cut," said EY-Parthenon chief economist Gregory Daco.

This comes as the most recent available figures confirmed a slowdown in the jobs market, while a government shutdown from October to mid-November delayed the publication of more updated federal data.

But Daco also expects Powell to signal "firmly that additional easing is unlikely before next spring," unless there is material weakening in the world's biggest economy.

This is because rates are close to "neutral," a level that neither stimulates nor restricts economic activity, analysts believe.

Feroli of JP Morgan observed that most Fed governors appear to favor lowering rates, while most reserve bank presidents seem inclined to keeping them unchanged.

But New York Fed President John Williams' remarks that there was room for another cut in the near-term tilts the balance.

"We believe he was speaking for the rest of the leadership," Feroli said, referring to Powell and Vice Chair Philip Jefferson. "This should weigh the votes firmly toward a cut."

Meanwhile Fed Governor Stephen Miran, who is on leave from his role heading the White House Council of Economic Advisers, is expected to push for a larger rate cut.

- Litmus test -

This week's gathering is the last before 2026, a year of key changes for the central bank -- including the accession of a new chief and tests of its independence as political pressure mounts.

In an interview with Politico published Tuesday, Trump signaled that he would judge Powell's successor on whether they immediately cut interest rates.

Asked if this was a "litmus test" for his handpicked candidate, Trump responded "yes."

Powell's term as Fed chair ends in May 2026, and Trump has hinted that he wants to nominate his chief economic adviser Kevin Hassett to the top post.

Hassett currently chairs the White House National Economic Council, and appears to be in lockstep with the president on key economic questions facing the Fed.

If appointed, however, Hassett could also face pressure from financial markets to diverge from the White House on interest rates -- particularly if inflation worsens.

Miran's term as governor also ends in January, creating an opening among the Fed's top officials. And Trump has sought to free up another seat in attempting to fire Fed Governor Lisa Cook earlier this year.

Cook challenged her ousting, and the Supreme Court barred the president from immediately removing her while awaiting oral arguments on the case in January.

Ch.Campbell--AT